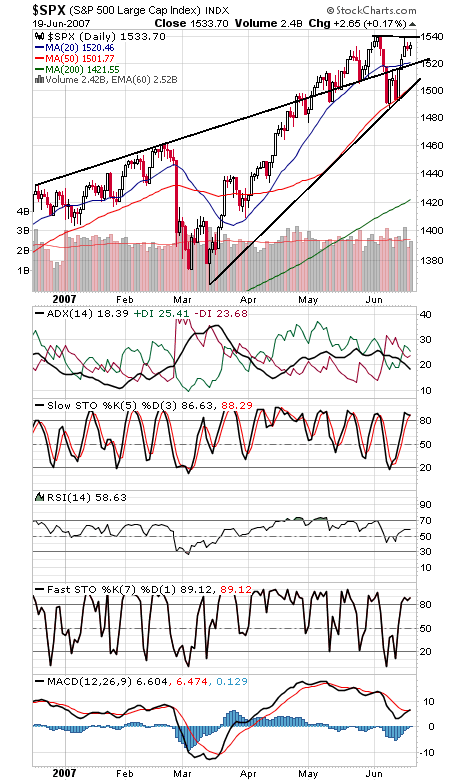

The biggest problem for the market here might be the sudden lack of blockbuster mergers and big takeover premiums that have been behind the big market gains of the last year or so. Those mergers convinced investors that there was still value in stocks — and the lack of big deals the last couple of weeks could cause traders to rethink valuations here. On the other hand, a blockbuster deal in the next week or so could be just what the market needs to snap out of its funk and propel the S&P (first chart below) through its all-time intraday high of 1552.87 set seven years ago.

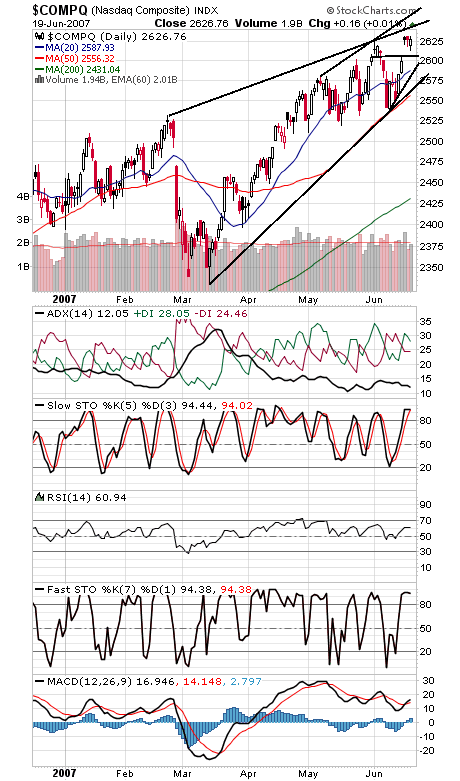

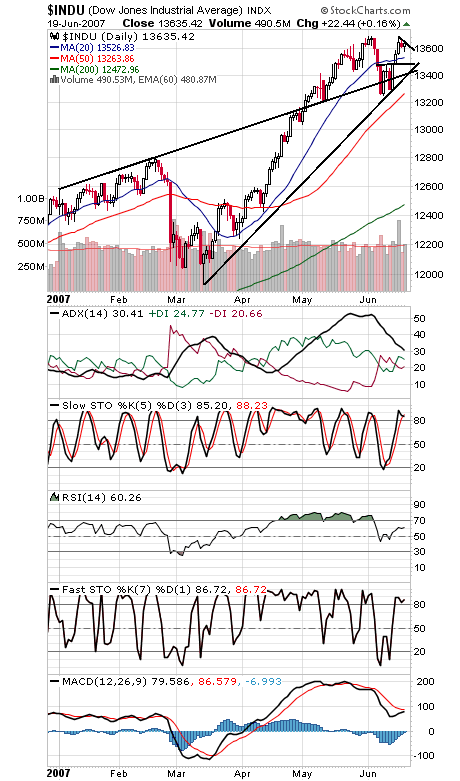

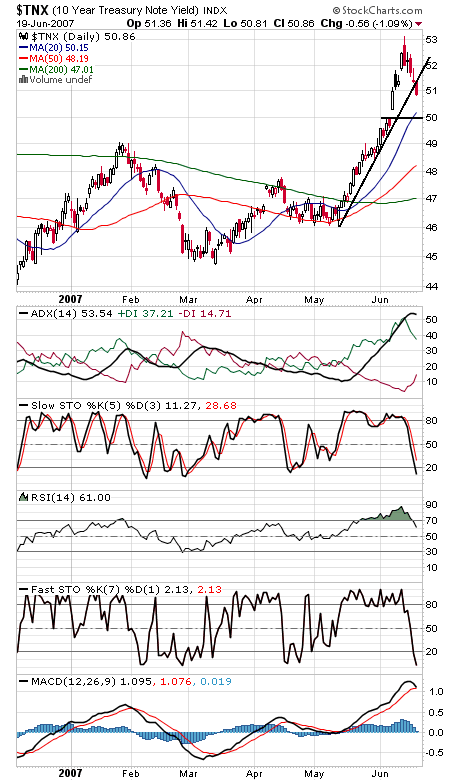

On the plus side, stocks are consolidating at the highs after last week’s run-up, which suggests that the next move may yet be up. First resistance on the S&P is 1540, and support is 1527, 1523-1525 and 1520. The Nasdaq (second chart) faces resistance at 2631, 2640 and 2650, and support is 2620, 2612 and 2600-2605. 13,692-13,700 remains tough resistance for the Dow (third chart), and 13,530 and 13,480 are support. The 10-year yield (fourth chart) broke its sharp uptrend today; now we’ll see how it handles the 5% barrier.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association