“Sell in May and go away” certainly seems to be working this year, and with the stock market in the weakest part of the year in what has also been the weakest year of the four-year presidential election cycle, we’ve been expecting some kind of sell-off between now and October.

As excessive bullish sentiment was one reason behind our cautious outlook at the start of this correction, let’s examine the sentiment data we have now.

Certainly the VIX and put-call indicators are showing some fear, but the weekly Investors Intelligence survey wasn’t showing enough as of its publication yesterday morning. At 43.8 to 24.7 bulls to bears, it’s improved from 56 to 19 on May 5, but it’s a long way from the 34 to 26 reading at the low of the January-February correction. Obviously today should improve sentiment further, but sentiment has so far remained stubbornly bullish for a significant correction.

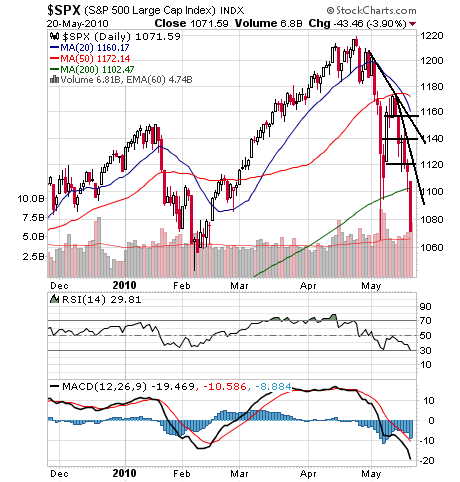

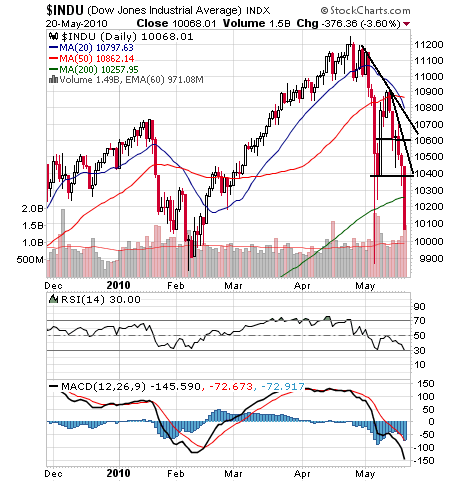

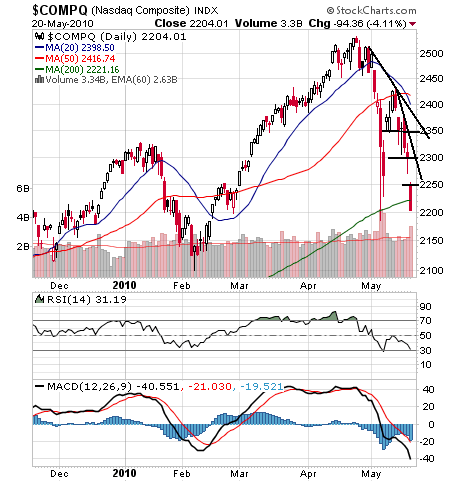

Onto the charts. A lot of support has been broken, but the indexes are coming up on some obvious major support levels.

On the S&P (first chart below), support could be found at the May 7 low at 1058 and the February low at 1044.5 (with the September-November lows of 1020-1030 below that).

The Dow (second chart) could find support at 10,000, the May 7 low at 9869, the February low at 9835, and the October low at 9679.

For the Nasdaq (third chart), possible support levels include the May 7 low at 2185, the February low at 2100 and the November low at 2024.

To the upside, a move back above the 200-day averages in those charts would be a bare beginning on undoing some significant technical damage.

But the most important thing the stock market can do this year is establish an enduring low, something it wasn’t able to do during the last four-year cycle for the first time since 1930. A strong bottom that holds for at least a few years might even be a good longer-term sign for the economy.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association. He is a co-author of the book “Dow Theory Unplugged” from W&A Publishing.