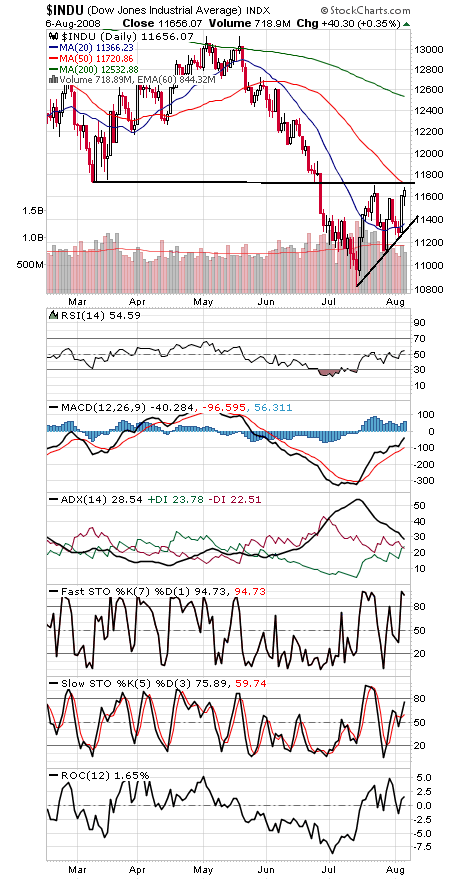

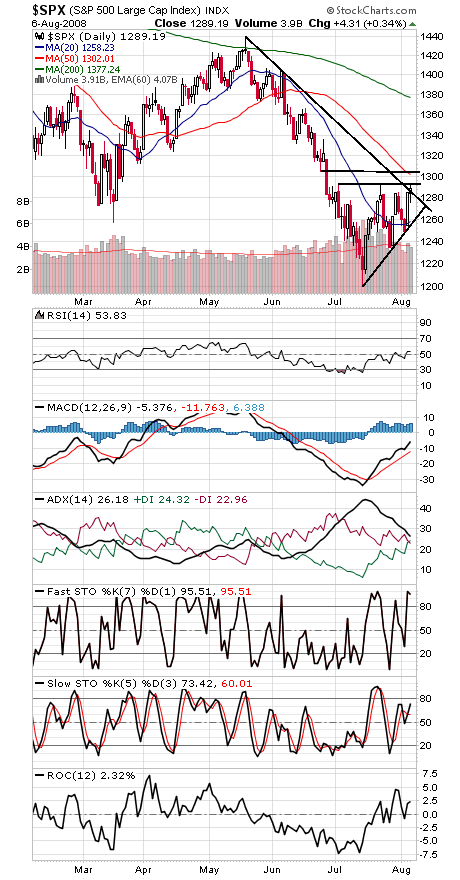

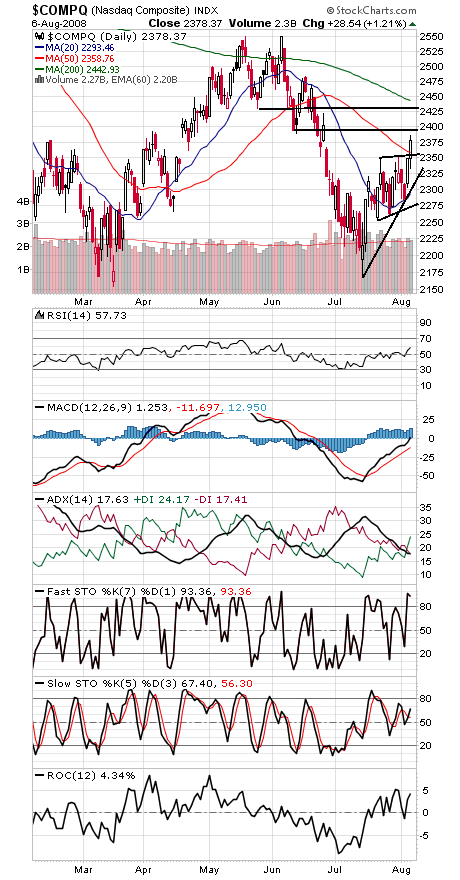

We’ve had plenty of elements for a major market low, such as extreme bearish sentiment and oversold conditions, but we continue to lack one piece that would cement a bottom: a day or two of 80-90% upside volume.

Until we get that kind of forceful buying, the market will remain vulnerable, but that doesn’t mean this rally can’t carry a long way.

The indexes are all facing major tests right now that could determine how far this rally can run.

The Dow (first chart below) is right below the very major resistance level of 11,720-11,750. Support is 11,500-11,530 and 11,350-11,400.

The S&P (second chart) did a nice job of clearing its May downtrend line today, but next up is major resistance from 1292-1304. Support is 1283, 1276 and 1260.

The Nasdaq (third chart) faces tough resistance from 2388-2401. Support is 2350-2355, 2333 and 2315.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.