It remains to be seen if today was nothing more than a tantrum by a market that didn’t get its way, but the technical damage was nonetheless significant.

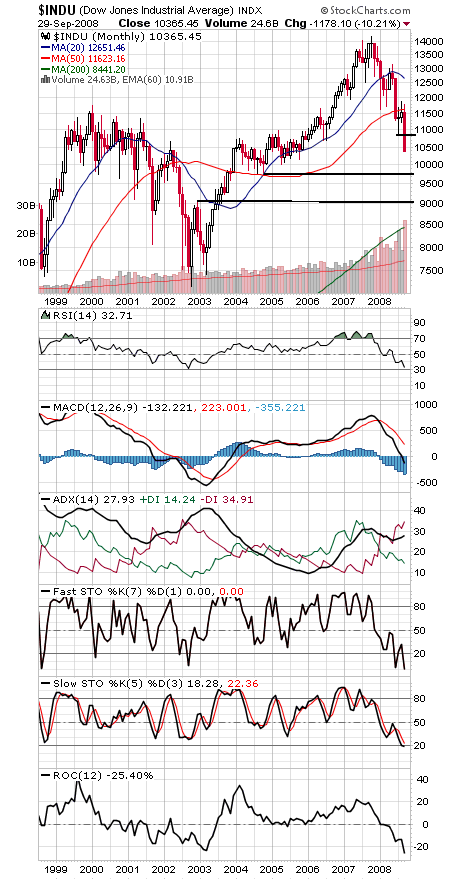

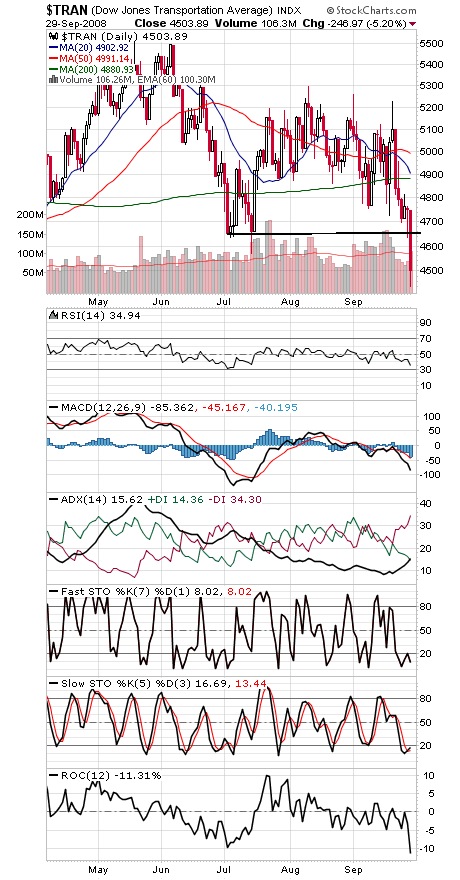

For starters, we had a Dow Theory sell signal today, with the Industrials and Transports (first two charts below) closing at new intermediate term lows. And the Dow is now back below major support that could signal wider economic weakness to come.

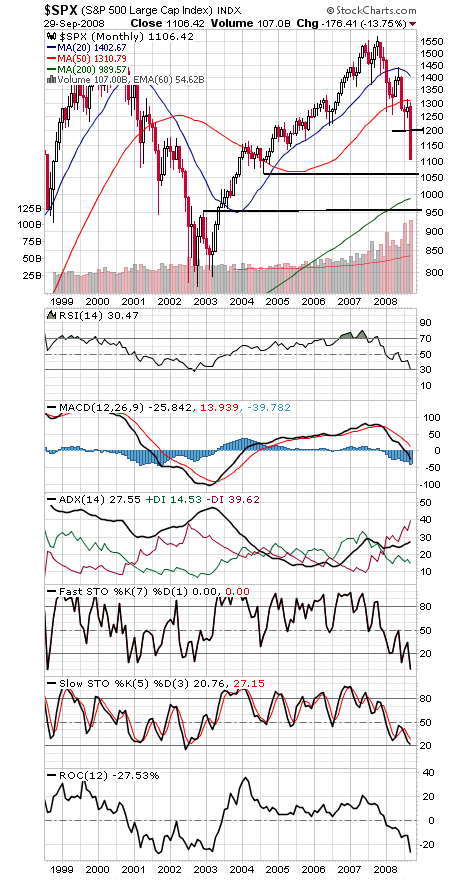

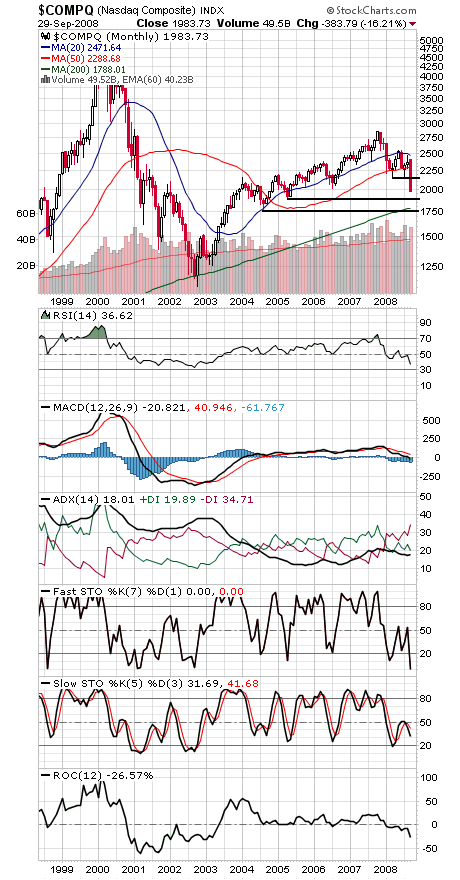

Still, as with all technical damage, it can be undone, and to do that the Dow needs to get back above 10,683-10,827, the S&P (third chart) back above 1200, and the Nasdaq (fourth chart) back above 2155-2167.

To the downside, the Dow could find support at 10,000 and 9700, the S&P at 1060, and the Nasdaq at 1890 and 1750.

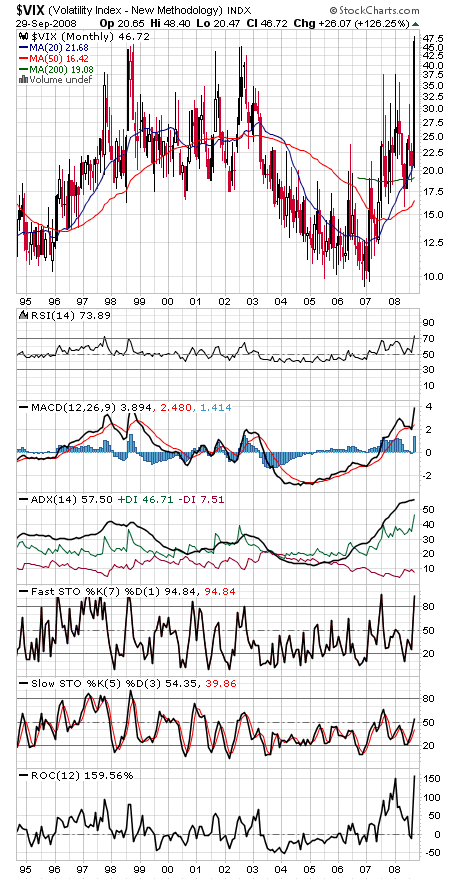

Finally, a big spike in the VIX (fifth chart), the “fear index,” to one of the highest readings on record. That’s some support for the bulls if they can make a stand soon.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.