Despite some potential bottoming signs last week, we find ourselves right back in the middle of heavy selling pressure. About the only good news is that volume declined today and we didn’t get another 90% downside day.

We should also note that Lowry Research — which pioneered the study of stock market bottoms — has crunched the numbers and is calling last Thursday a 90% upside day, meaning the market gave a bottom signal that day.

But the firm’s Richard Dickson is staying cautious, noting that since July 2007, the market has had four instances of four 90% downside days followed by a 90% upside day or back-to-back 80% upside days, and none has yet proved to be a major bottom, despite the system’s strong record since 1950. Dickson thinks the difference might be the absence of the 70-year-old uptick rule, which the SEC revoked in July 2007 and has resisted all efforts to reinstate it despite the explosion of volatility that began just a few weeks later.

“Clearly, something’s changed and it probably involves the uptick rule,” said Dickson. “We’re not ignoring the importance of 90% days, but their significance has to be more closely judged in the context of other indicators and market conditions.”

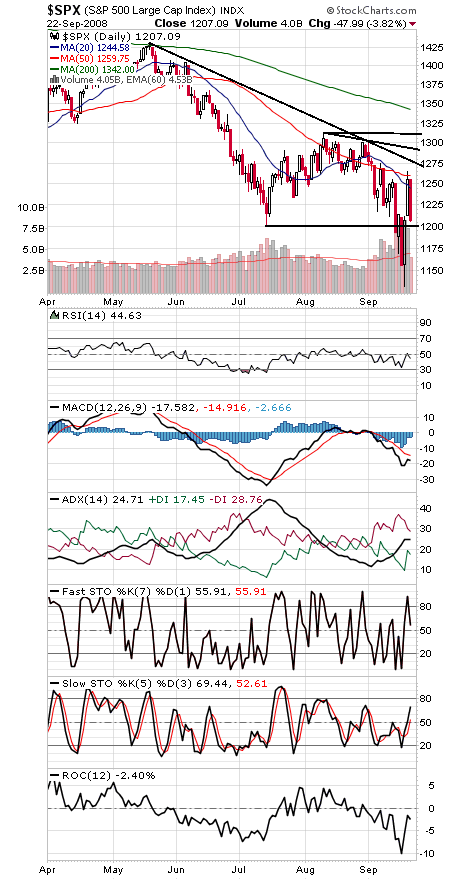

Back to the charts, and the message there is simple: We’d really like to see the market hold right here, at the gap open from Friday and the July bottom on the S&P (see first chart below). Below that, 1184, 1170, 1156 and 1133 come back into play. To the upside, 1233-1237, 1260-1265, 1275, 1290 and 1313 are resistance.

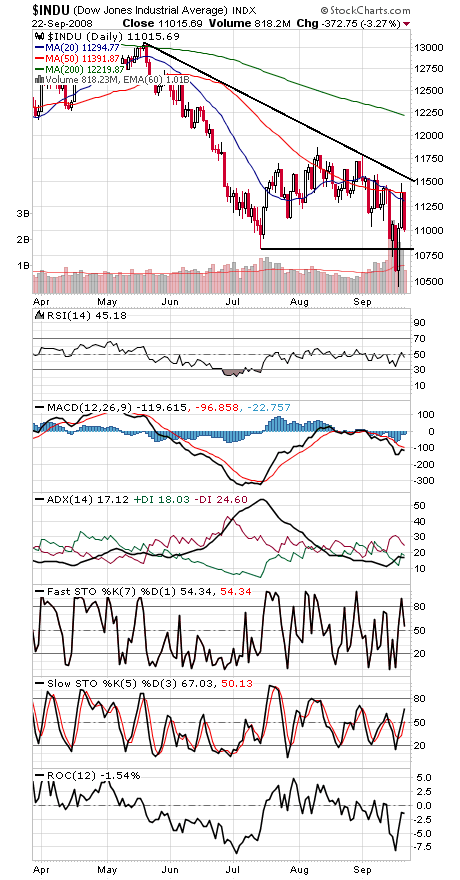

The Dow (second chart) has major support at 10,683-10,827, and resistance is 11,250-11,282, 11,400 and 11,500, with 11,750-11,867 above that.

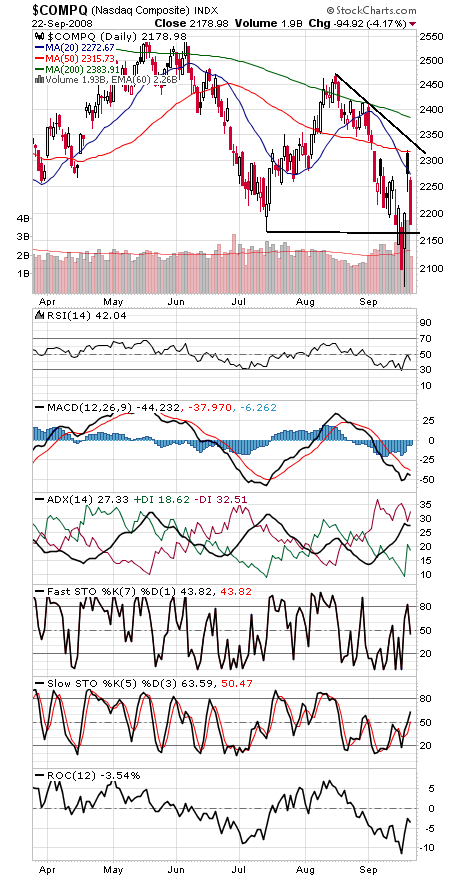

A nasty fall for the Nasdaq (third chart) from its open on Friday. Resistance is 2200, 2239, 2265-2273 and 2303-2318, and support is 2155 and 2070-2100.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.