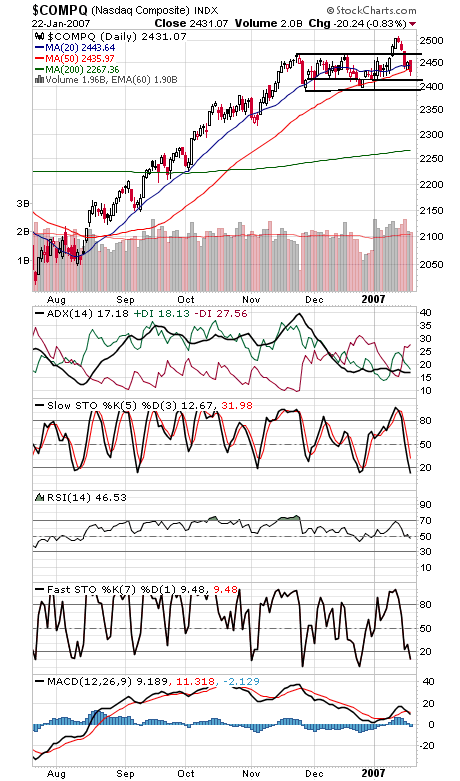

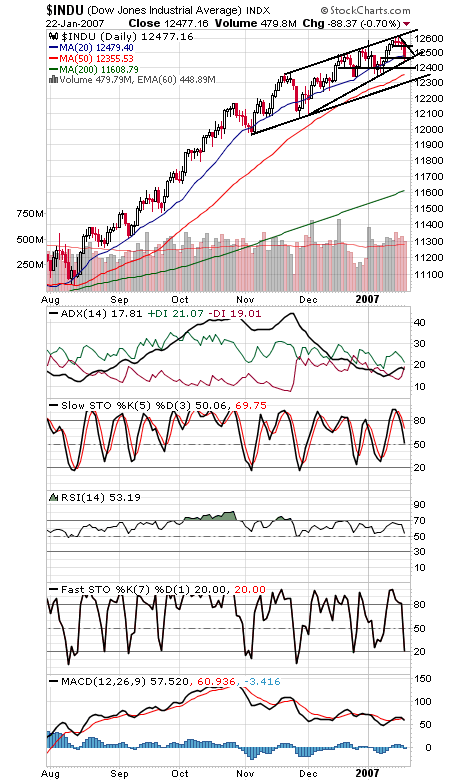

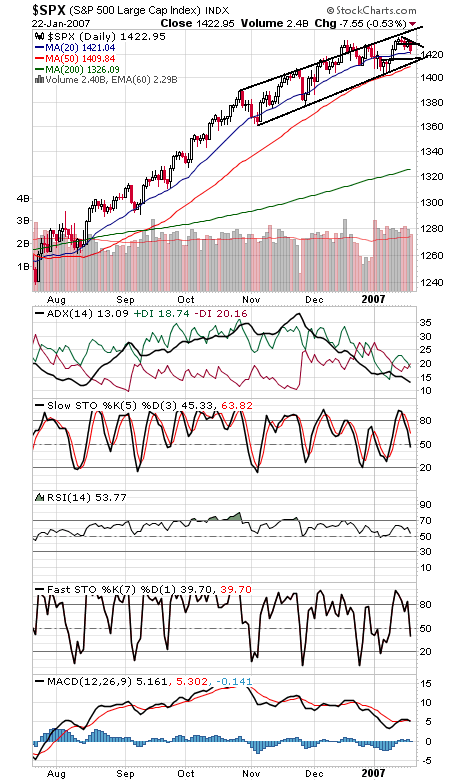

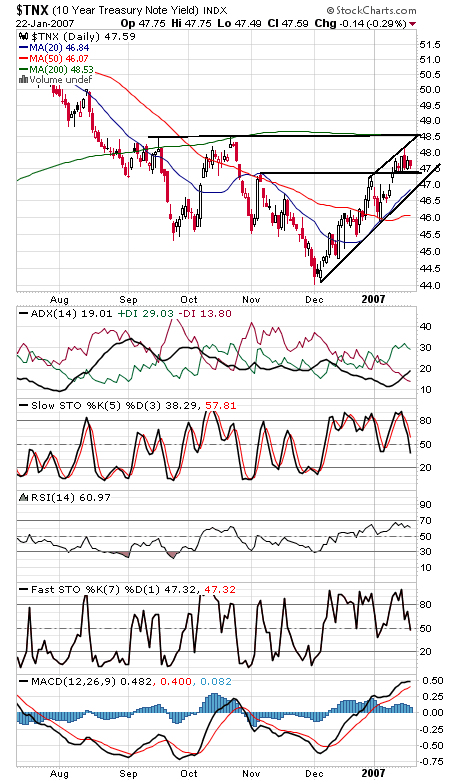

Just about everything turned lower today, as Nasdaq underperformance dragged the rest of the market down with it. On the plus side, financials fell much less than the rest of the market, which can be a sign of underlying strength, and with strength tonight in chip stocks — another sensitive sector — downside may be limited. Still, the Nasdaq (first chart below) has taken out a lot of support in the last few days, so there’s not much in the way of support for the index until 2390-2400, although 2420 or so may provide some support. To the upside, resistance is 2437, 2444 and 2455. The Dow (second chart) is trying to stabilize at a trendline dating from early November. 12,450 is first support, with 12,400, 12,360 and 12,300 below that, and resistance is 12,500, 12,550 and 12,614-12,635. The S&P (third chart) has support at 1420, 1416, 1413 and 1410, and resistance is 1428-1429, 1433-1435 and 1440. Bond yields (fourth chart) are consolidating at the highs, which should mean more upside for interest rates.