About the only good news out of all this volatility is that the list of similar historic occurrences is a short one.

The bad news is that there’s no clear direction to glean from historical precedents to the current stock market volatility.

On Friday, we gave you a sense of how deeply oversold the market was, so at least the bounce was foreseeable.

Indeed, there have been only four markets in the last 71 years that have had both deeply oversold readings and more than half of all NYSE stocks at 52-week lows: October 1987, June 1962, May 1940 and October 1937. In October 1987, the market spent two months basing before turning higher, while in 1940, the market turned higher after basing for a few weeks. In 1937 and 1962, the market still had further to fall before turning higher. The process took just a matter of weeks in 1962, while it took six months in 1937.

What about the performance of the market after big up days like we had yesterday? Until yesterday, all but one of the Dow’s 10 best days occurred during the Great Depression (the other was October 21, 1987). Six of those days occurred at or near a top, while four of the markets had further to run.

We’d also note that both the November 1929 and July 1932 lows were similarly oversold, and both were followed closely by very big up days (almost immediately in the case of 1929, but three weeks later off the 1932 low).

One other observation: since the recent low was a single-day reversal, some retest may be likely eventually, based on the 60-year-old observation of Robert Edwards and John Magee that bear markets as a rule do not end in one-day reversals.

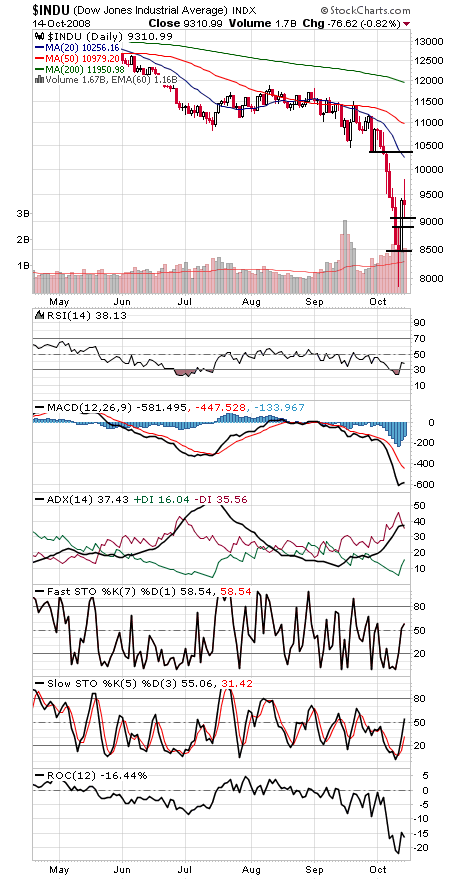

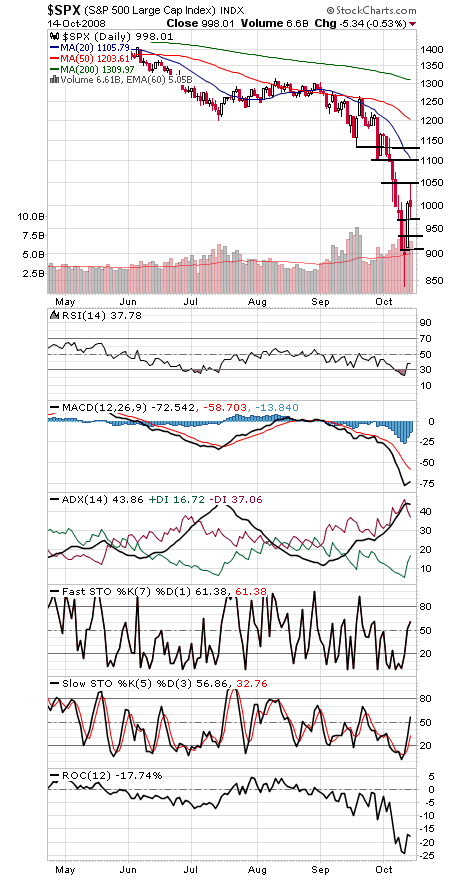

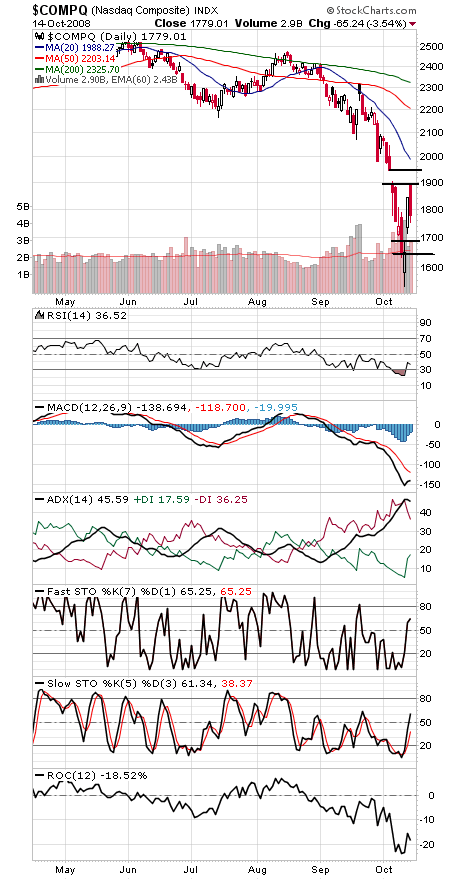

And now onto the charts for support and resistance levels.

The Dow (first chart below) faces resistance at 9700, 9794 and 10,000, and support is 9043-9085, 8901 and 8387-8579.

The S&P (second chart) has resistance at 1044, 1060, 1111 and 1133, and support is 972, 936 and 899-912.

The Nasdaq (third chart) faces big gap resistance at 1900-1947, and support is 1752, 1734, 1715, 1690 and 1645-1649.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.