October may not have produced much in the way of sell-offs over the last several years, but the month still has traders on edge, as today showed. It’s not clear if today marked the start of a bigger pullback, but with sentiment getting a little frothy and the calendar favoring the bears, caution seems like a good idea for the next couple of weeks.

The Investors Intelligence survey had a big move this week, with bulls gaining four points to 60% and bears falling four points to 21.5%, and options indicators like the CBOE equity put-call ratio and ISEE sentiment index have also shown a big drop in fear by investors, both data points favoring the bears. But futures positions remain solidly in the bullish camp, a good longer-term sign for the market. In short, a pullback here to refresh sentiment and set the stage for a year-end rally would be an ideal scenario, but as always, the market will have its own ideas.

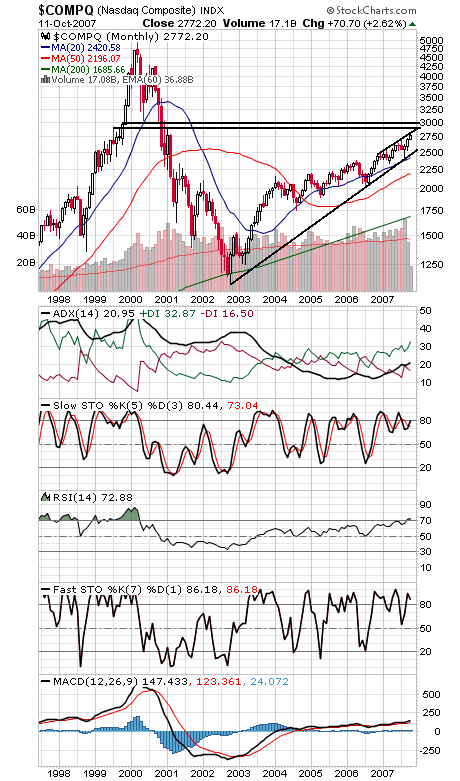

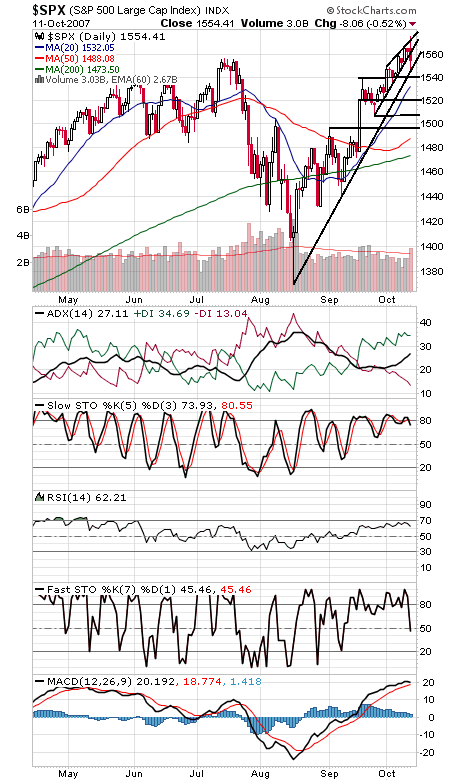

It’s worth remembering that in addition to the S&P 500’s all-time high, the Nasdaq (first chart below) faces equally difficult resistance as it nears 3000. Also keep an eye on the S&P’s August uptrend line (second chart), which stopped today’s decline.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.