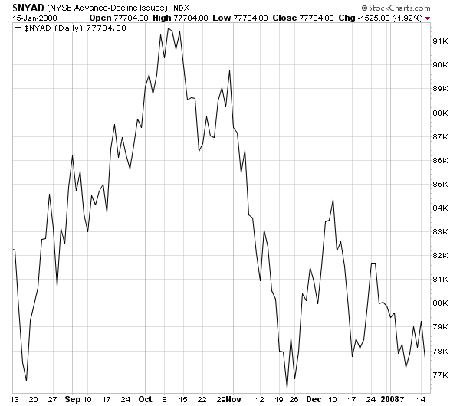

We’ll repeat the mantra of positives here: a spiking put-call ratio, an outperforming NYSE advance-decline line (see first chart below), and new lows that are half of what they were a week ago in this same area (and a third of what they were in August).

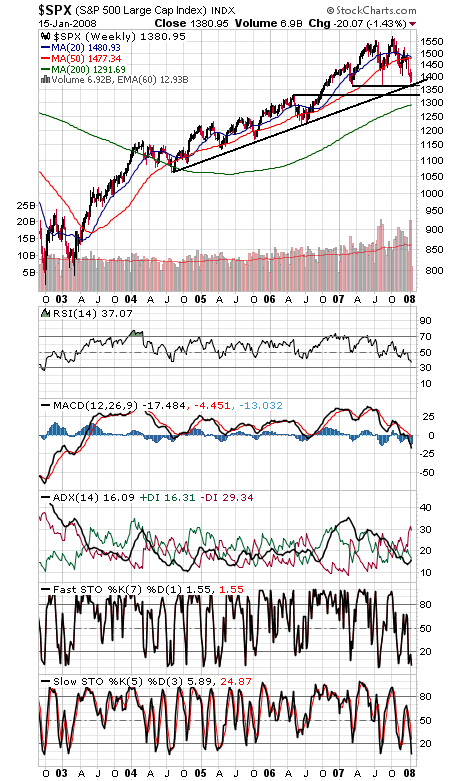

Plenty of ammunition for the bulls — but it won’t matter if the S&P 500 (second chart) can’t hold 1364-1370 support. If that goes, 1327 looks like the next decent support level, but more importantly, a 15-month trading range would have broken the wrong way.

In short, a good a place as any to reverse the downtrend, but the persistent weakness at a historically positive time of year remains troubling.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.