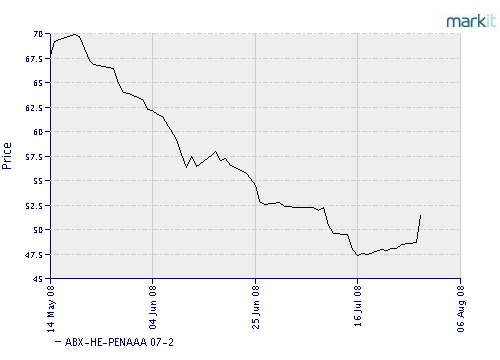

The big question today is whether Merrill Lynch (NYSE: MER) put a floor under the credit markets, and a quick glance at the ABX indexes (see first chart below) looks encouraging, as many charts in the sector turned up sharply after Merrill set a price on its CDO holdings.

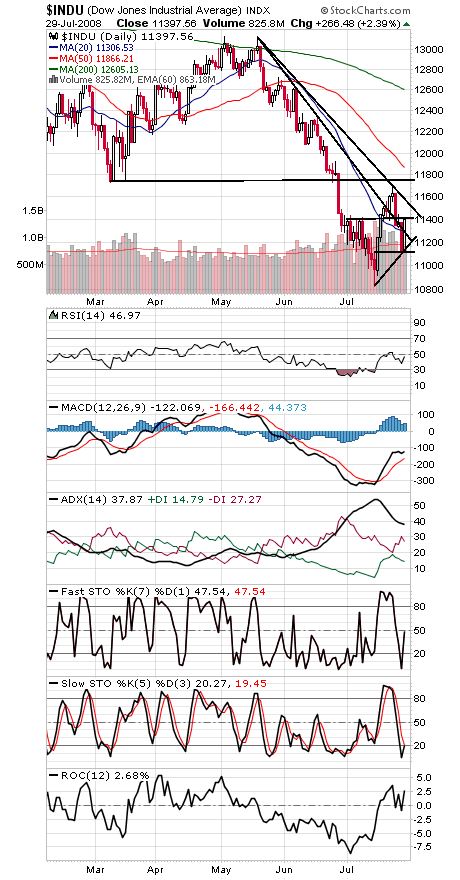

That said, we’re still looking for evidence of a major bottom for stocks here. We got 80% upside volume on the NYSE today, a big improvement from the last rally attempt, but we’d need another day like it tomorrow to call a bottom, per the work of Paul Desmond of Lowry’s Reports.

Resistance on the Dow (second chart below) is 11,420-11,444, 11,530-11,558 and 11,731-11,750. Support is 11,190-11,230 and 11,123.

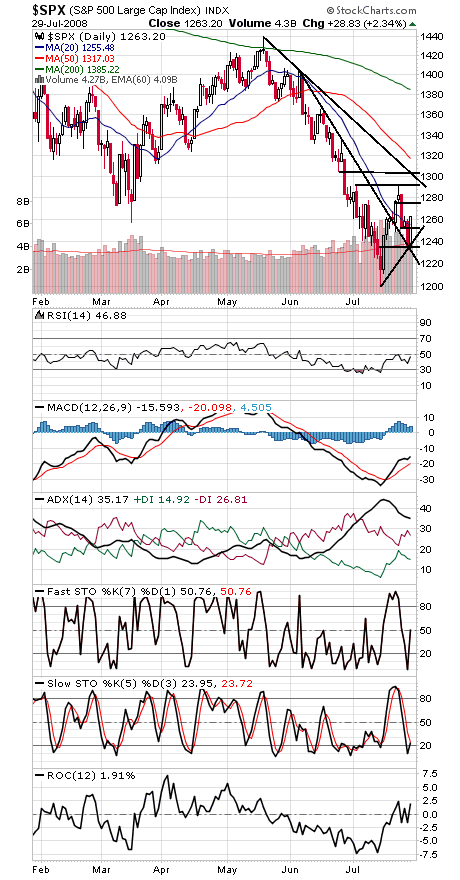

The S&P (third chart) faces resistance at 1276, 1292, 1300 and 1304, and support is 1257, 1250, 1242 and 1234.

The Nasdaq (fourth chart) faces resistance at 2350, 2375 and 2388, and support is 2300, 2285 and 2250.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.