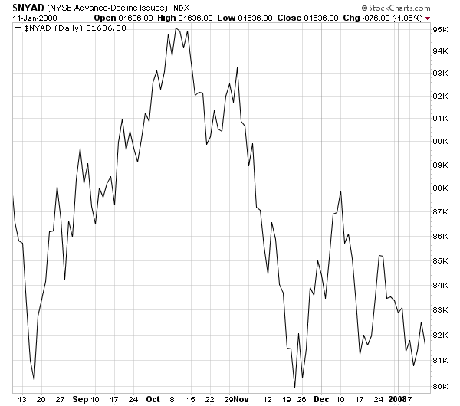

The best hope for bulls here are a couple of signs that sellers may be running out of steam.

The NYSE advance-decline line (see first chart below) remains above its November and August lows, and the number of new lows on the NYSE plunged from 750 Wednesday to 216 yesterday — and didn’t expand today despite another big down day. If they can continue to dry up — say, under 100 — before new highs expand considerably, we could see a bottom begin to form.

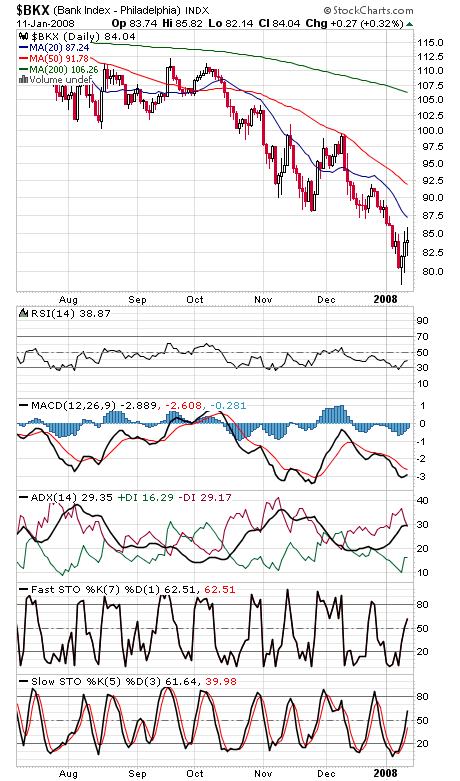

And despite the doom and gloom, note the performance of the banks (second chart) today.

We’d also note that S&P commercial futures traders added to long positions this week, but they still remain net short.

All in all, a few glimmers of hope, but they all need to develop further if the market is going to form a bottom here.

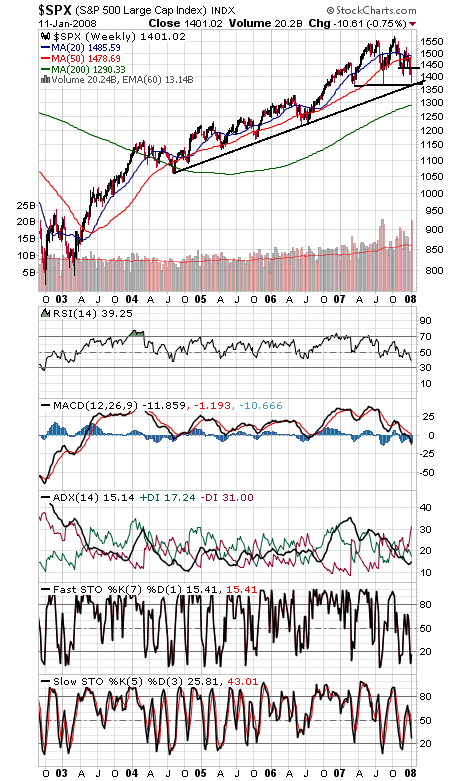

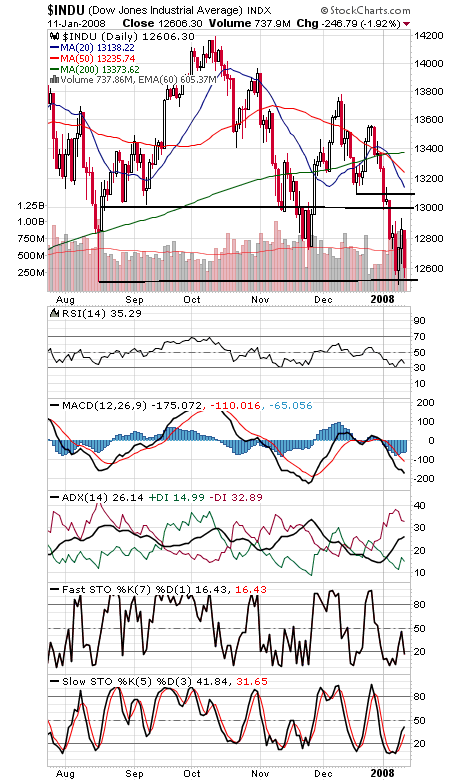

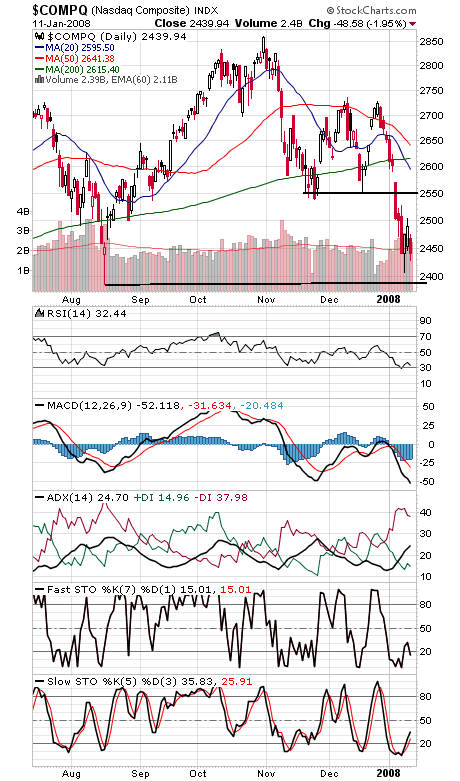

The major indexes (charts three, four and five) continue to hold their August lows, if not by much.

We continue to key on 1360-1370 on the S&P as critical support for the bulls here, while a move above 1430-1435 and 1442 would be a good start to the upside.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.