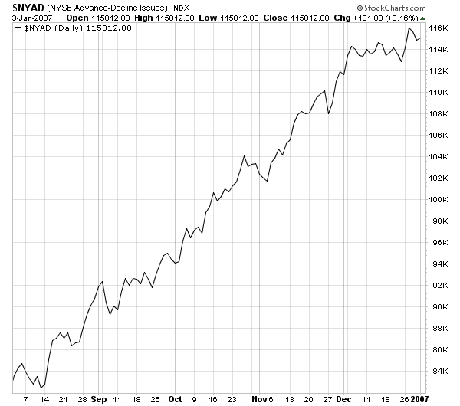

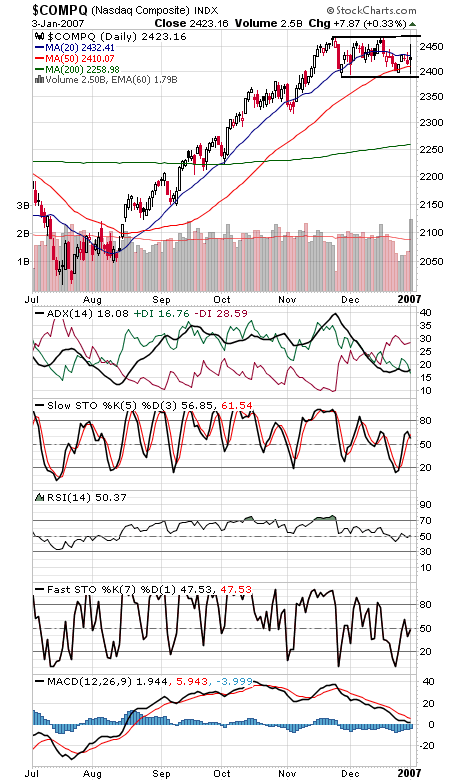

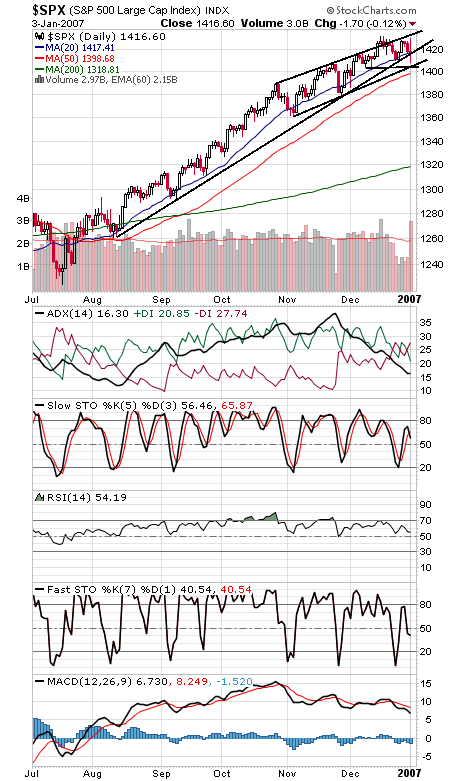

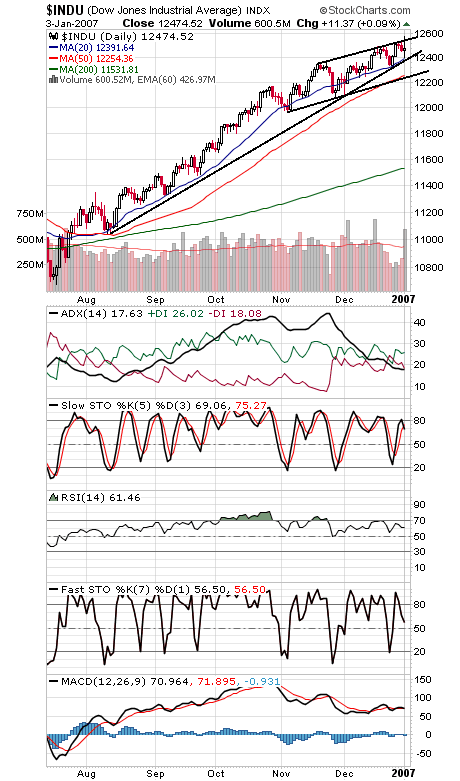

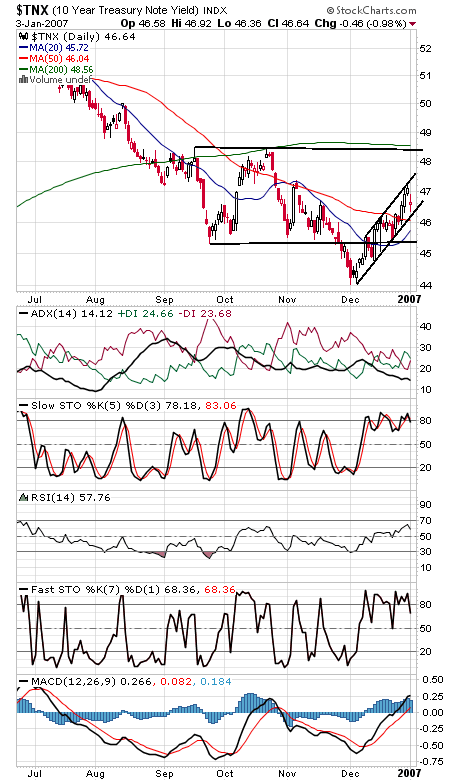

What a start to the new year, with big “outside days” on the major indexes. If today’s action is any indication, volatility could be due for a comeback in 2007, which it’s certainly overdue for. Not much change from our outlook two weeks ago. The NYSE advance-decline line (first chart below) has improved, but commercial traders have gone short on the Nasdaq in the last two weeks, so that positive has been erased. On the plus side for techs, as long as the Nasdaq (second chart) can hold 2390, it could be doing nothing more than completing a “flat” correction within an uptrend. The S&P (third chart) is another index at important support here, with a possible completed correction at today’s low of 1407. 1406, 1403 and 1399-1400 are other potential support levels on the index. 1429-1432 is upside resistance. The Dow (fourth chart) has been holding up better than the Nasdaq or S&P, but the potential bearish wedge developing since late November is cause for concern. If 12,390 goes, the index could see 12,250. To the upside, 12,560-12,580 is the level to beat. Bond yields (fifth chart) remain in an uptrend, another worrisome factor for stocks. In short, we’ll continue to give the benefit of the doubt to the bulls, but they need to point the market back up soon.