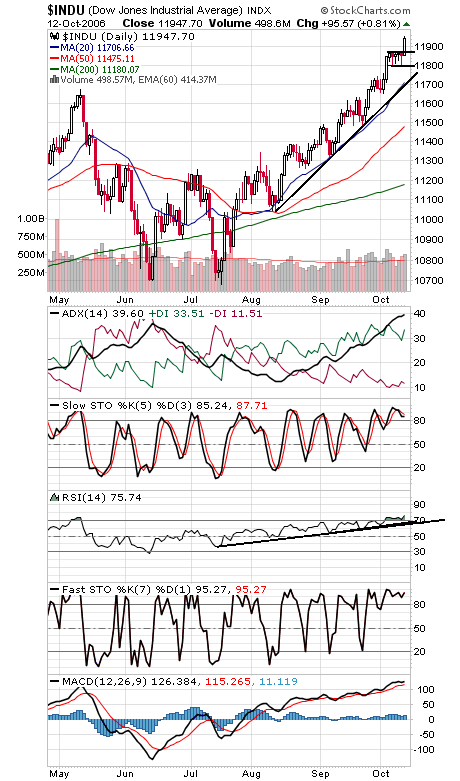

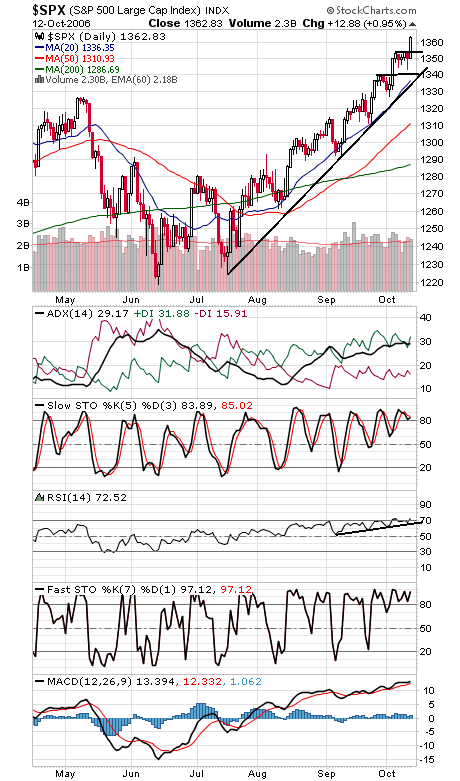

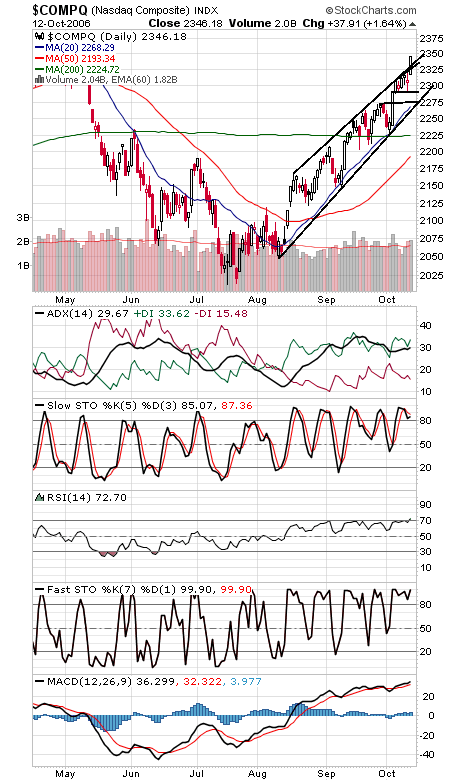

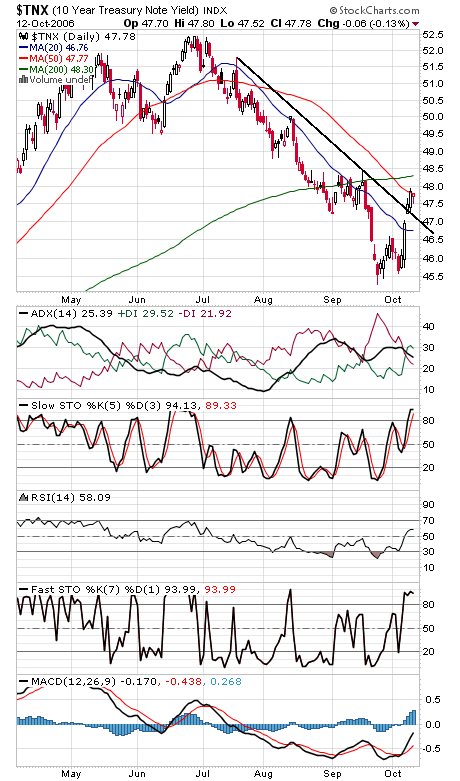

So far, extreme overbought conditions have led to a five-day consolidation and another big move higher. That’s impressive strength. That said, the flat consolidation in the Dow and S&P (first two charts below) over the last week suggest that we may be in a wave 5 up in Elliott wave terms, suggesting the possibility of at least a near-term pause soon. Given that the Dow is approaching a Big Round Number, a consolidation or correction would make sense here. The Dow has support at 11,880, 11,800 and 11,722-11,750. The S&P cleared 1361 and could be headed for 1376-1389. 1354 is first support, with 1344, 1340 and 1336 below that. The Nasdaq (third chart) is about 30 points from a new post-2002 high. 2325-2333 is first support. Bond traders (fourth chart) finally took the day off from selling.