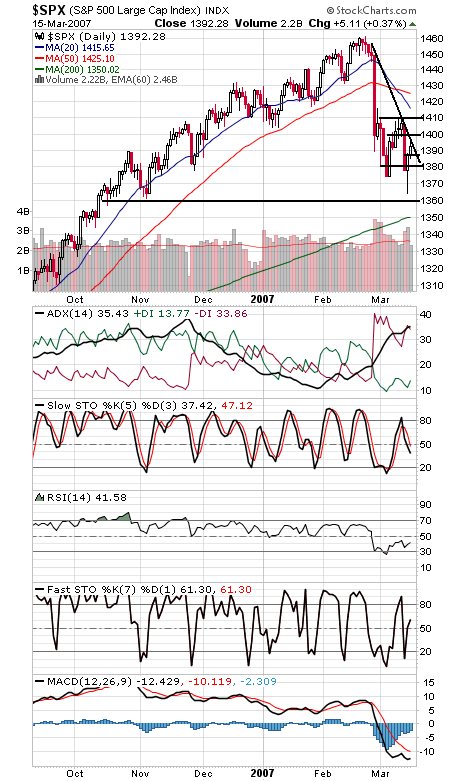

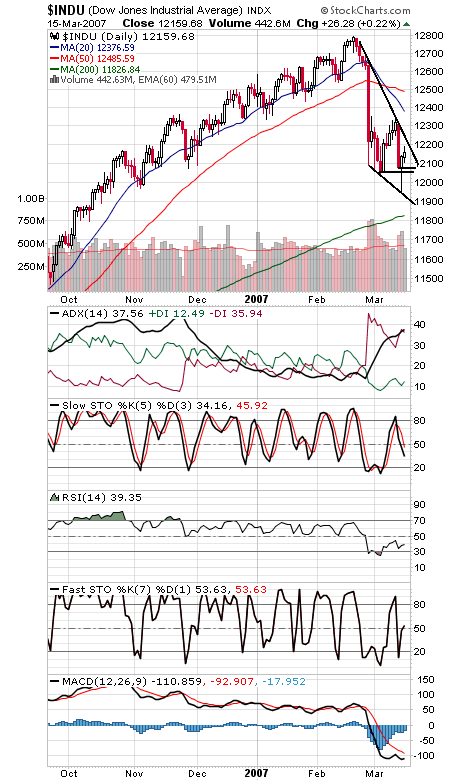

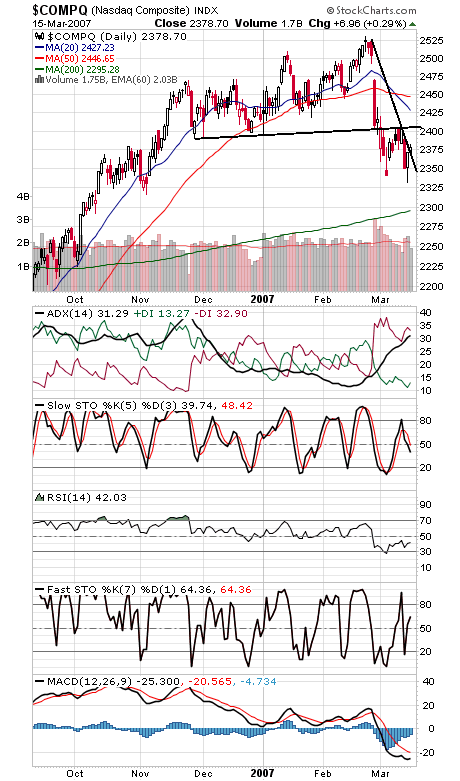

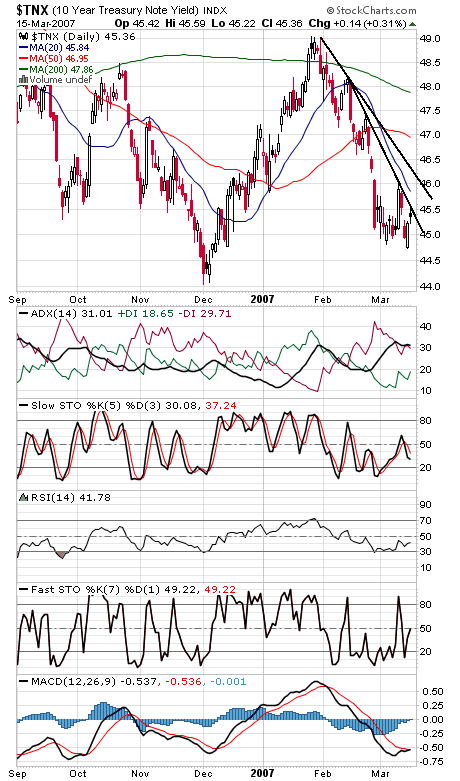

Nice resilience by the bulls in the face of disappointing data today, but the lack of a strong upside move to cement a bottom raises the odds that the market will have to slosh around a while longer before it can put in a meaningful bottom. The S&P (first chart below) was stopped at its downtrend line today. A move higher tomorrow would break that, setting up a test of 1397-1400 resistance. Support is 1388, 1385 and 1378-1380. The Dow (second chart) would hit its downtrend line at about 12,210. Support is 12,050-12,100. The Nasdaq (third chart) has already topped its blue chip counterparts, breaking its sharp downtrend today. 2390-2405 remains the big test, while support is 2368-2371 and 2360. Treasury yields (fourth chart) were stopped at a downtrend line today too despite some pretty bad inflation news. All in all, a better day than it could have been, but no all-clear signals either.