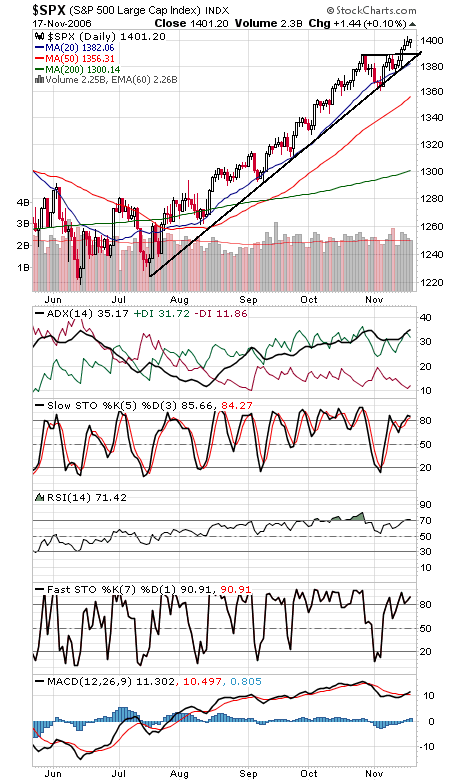

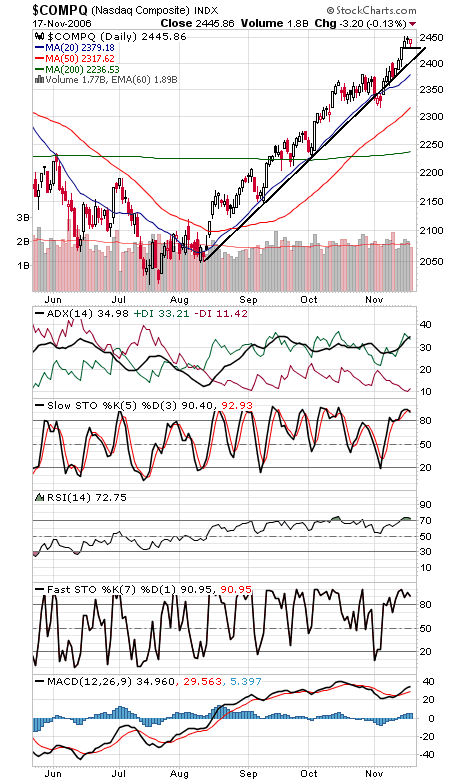

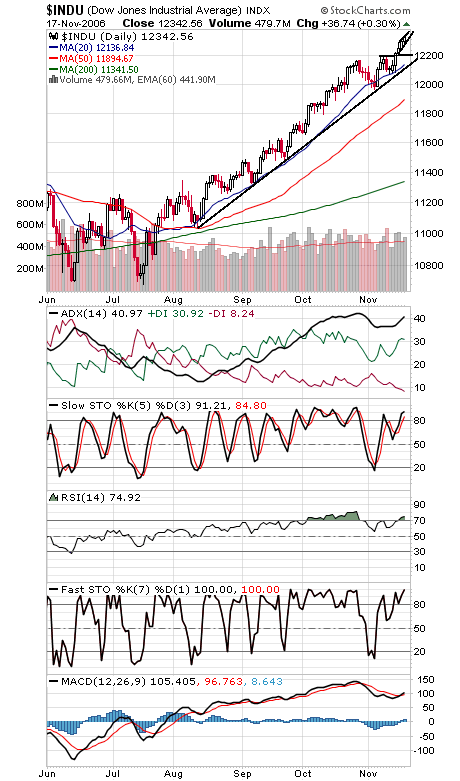

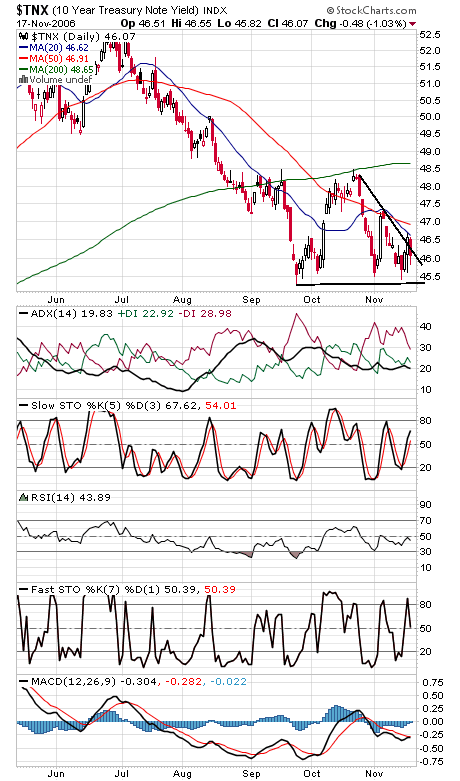

Another narrow rally today, with a steep drop in new highs, and commercial futures traders continue to short the big S&P contract. If we start seeing options traders throw caution to the wind, the advantage could tip toward the bears. The S&P (first chart below) finally edged above 1400 today. 1414-1426 is the next big resistance zone. First support is 1395, with 1389 and 1386 below that. The Nasdaq (second chart) is still struggling around 2450. Support is 2425-2430 and 2410. The Dow (third chart) has support at 12,280, 12,200 and 12,130. In short, the market looks vulnerable to a correction, but momentum remains pointed up and light volume next week could keep it that way for now. Bond yields (fourth chart) continue to paint a confusing picture, but the bias has been toward the low end of a big trading range.