Bears retook control of the market in a big way last week, but they have yet to show much in the way of follow-through, suggesting that the market may not be ready for new lows just yet — and may even see some more upside in the near-term.

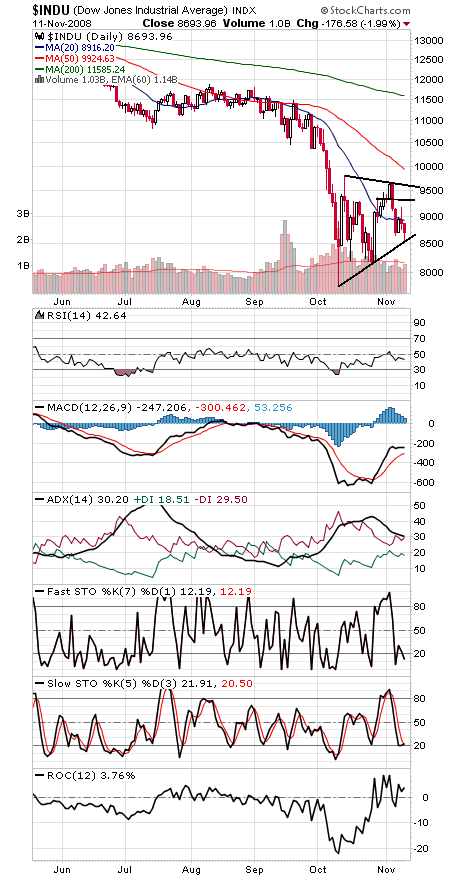

The Dow (first chart below) looks like the most important index here — and is actually sporting something of an uptrend after the third touch of an uptrend line today. We’ll call that line at about 8600 for tomorrow, an important first support level for the market.

To the upside, the Dow needs to take out 8867, 9160, 9325 and 9625 to establish a cycle of a higher low and higher high, which would be another sign of health for the index.

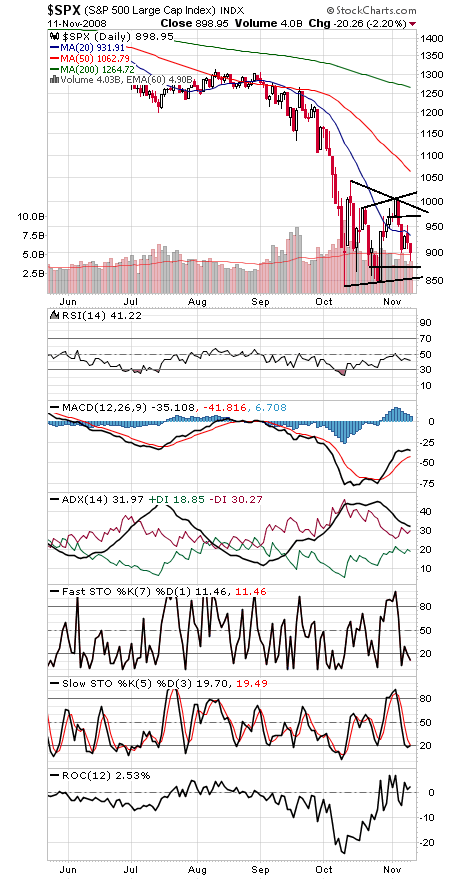

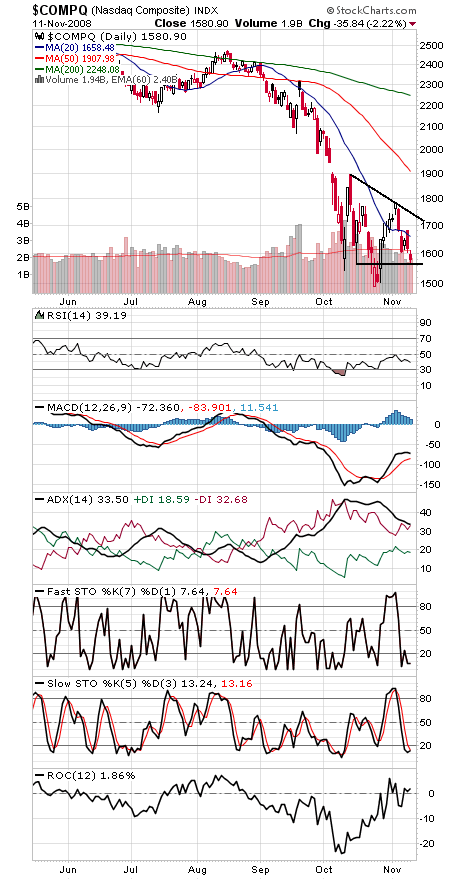

The S&P and Nasdaq (charts two and three) don’t have much in the way of an uptrend going.

Support for the S&P is 875 and 854, and resistance is 917, 952 and 990.

The Nasdaq has support between 1540 and 1565, with 1493-1506 below that. To the upside, the techs need to clear 1612, 1680 and 1730.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.