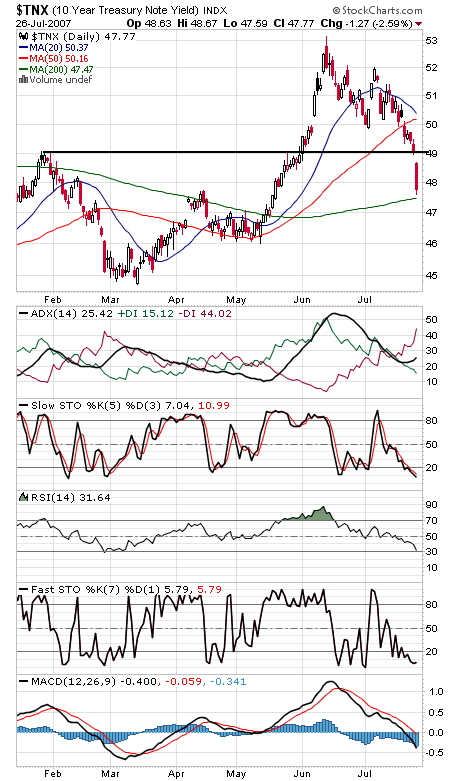

Another day of intense selling, as we’ve now had three days in the last two months where both declining issues and volume have approached 90% on the NYSE, a pretty rare event. While that will lead to a good bottom eventually, at this point we’ll probably need an equally impressive 90% upside volume day for an all-clear signal. We’ll get the added benefit of new monthly inflows next week, but we could face rough sailing until there’s some sign that credit is beginning to loosen up. NYSE new lows hit levels today last seen in May 2004, July 2002, Sept. 2001 and Aug.-Oct. 1998, all of which were followed by pretty good bounces, so the bulls have plenty to build on if they can.

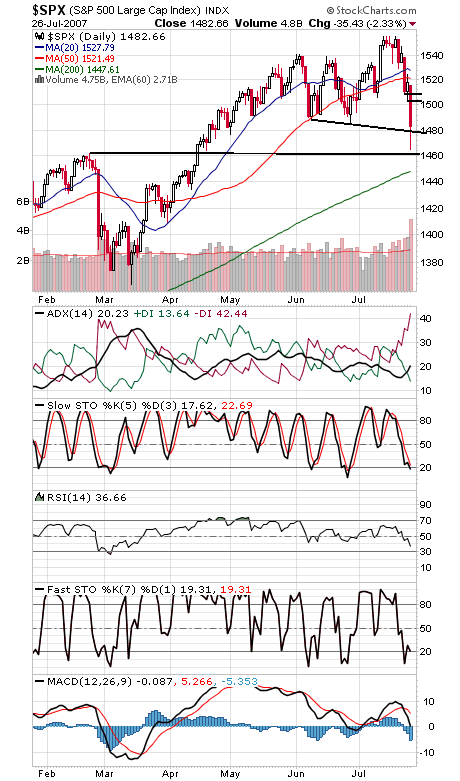

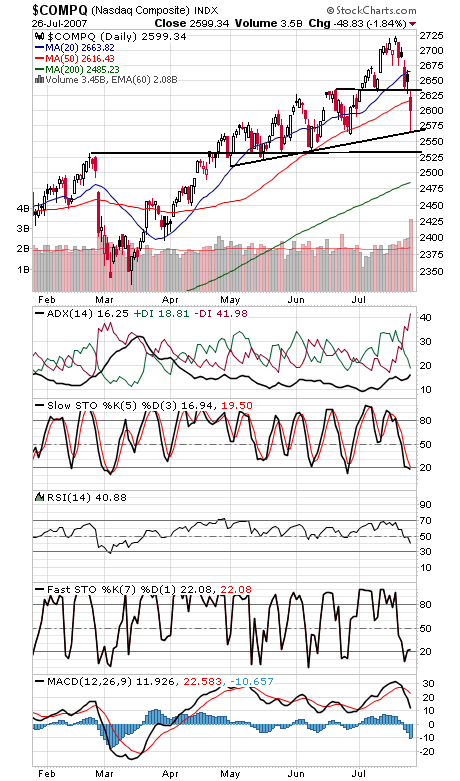

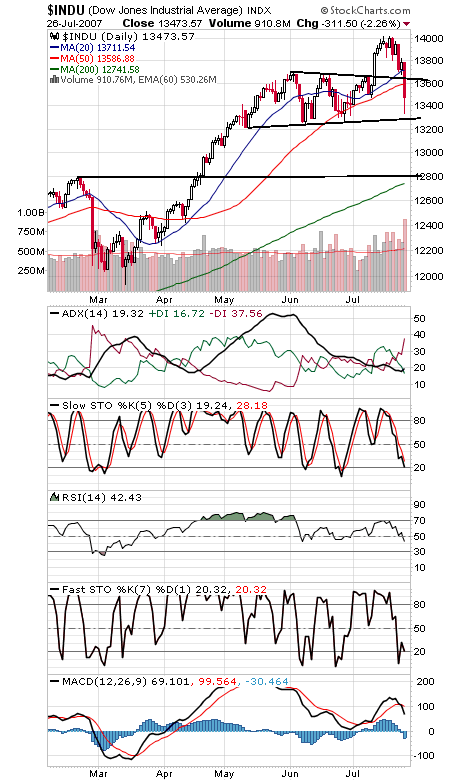

Ideally, the S&P (first chart below) will hold around today’s low and above the February peak of 1461.57, avoiding overlap in the wider timeframes that could signal longer-term weakness. If that goes, the 200-day will be just below 1449 tomorrow. To the upside, 1503-1509 is resistance. The Nasdaq (second chart) has important support at 2563 and 2531, and resistance is 2617 and 2632. The Dow (third chart) has important support at 13,250-13,280, and resistance is 13,586 and 13,640. Nice flight to quality in the bond market (fourth chart) today. All the signs of panic are there, but now we need stock buyers to step in.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association