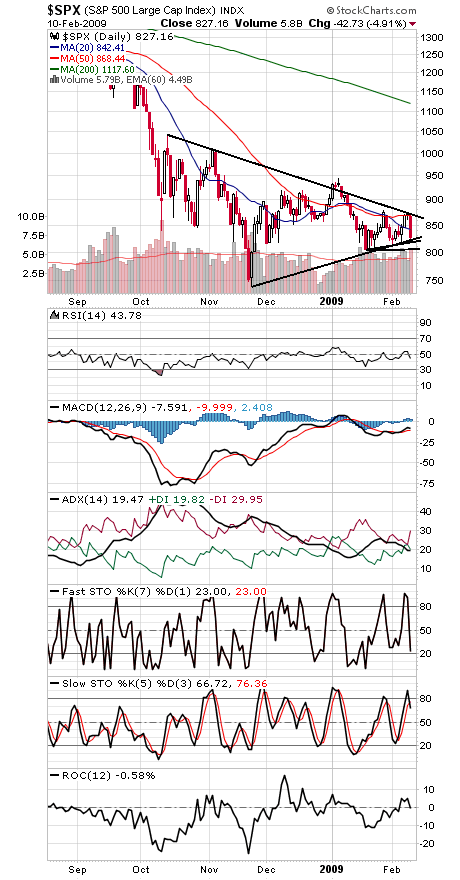

The S&P 500 (first chart below) spent all of a day at the major resistance level of 868-878 before failing, turning sharply lower today.

That remains the level to beat to the upside, while 820-823 and 804 need to hold to the downside or the stock market could be starting another wave down here.

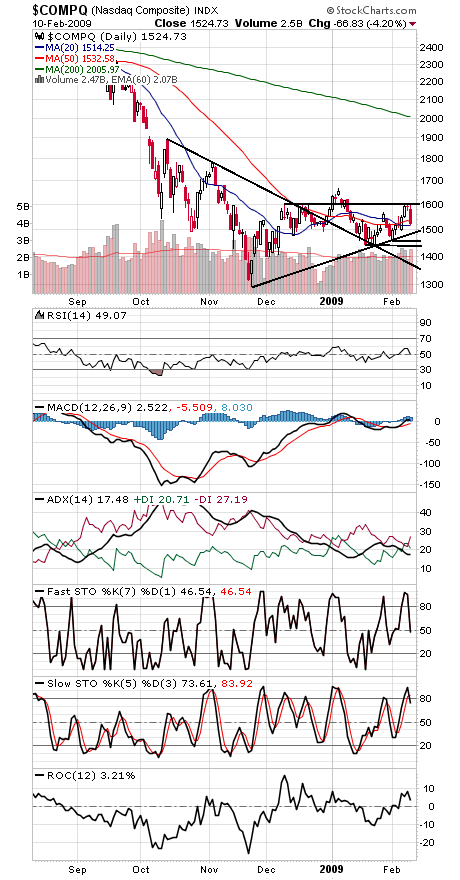

Ideal support for the Nasdaq (second chart) is 1490; below that, 1460 and 1434 are the next support levels. To the upside, 1600-1604 is once again a tough hurdle.

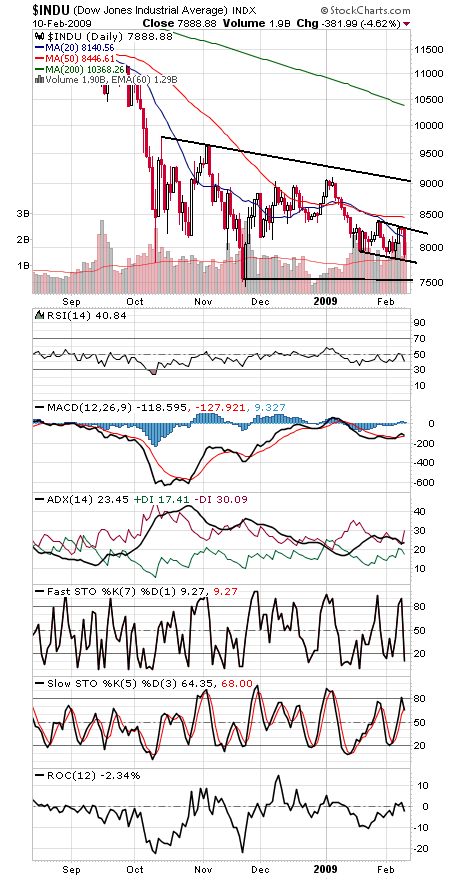

The Dow (third chart) needs to hold 7800 or its November closing low of 7552.29 could come into play. To the upside, the index must clear 8400-8500.

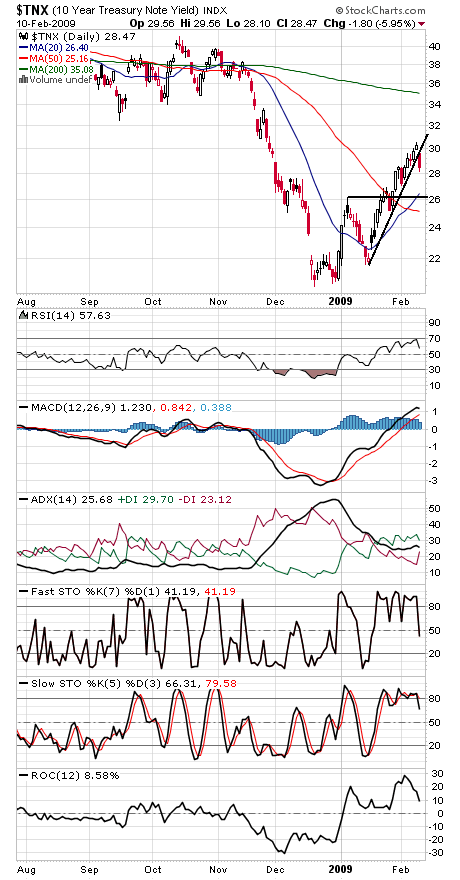

Treasury yields (fourth chart) also turned sharply lower today, a negative development for the reflation trade.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.