Another day, another good sign for the bulls. New 52-week lows on the New York Stock Exchange have dropped from 1,098 to 79 in two days, one of the signs we were looking for to suggest a possible trend change. A dramatic shift that suggests that selling momentum may be drying up, but one that needs to continue.

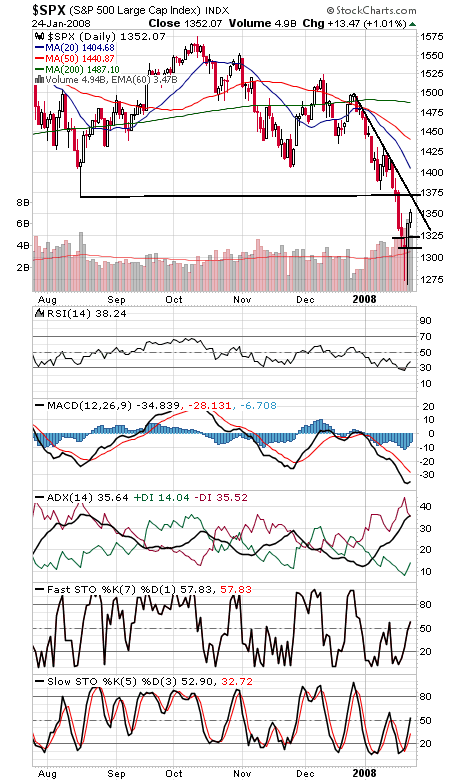

But the bulls are nearing what will perhaps be their biggest test: 1364-1370 on the S&P 500 (first chart below). If a pullback is going to occur, that’s as good a spot as any. If the index can get through that level, the bulls could be off to the races. Support on the S&P is 1320 and 1310.

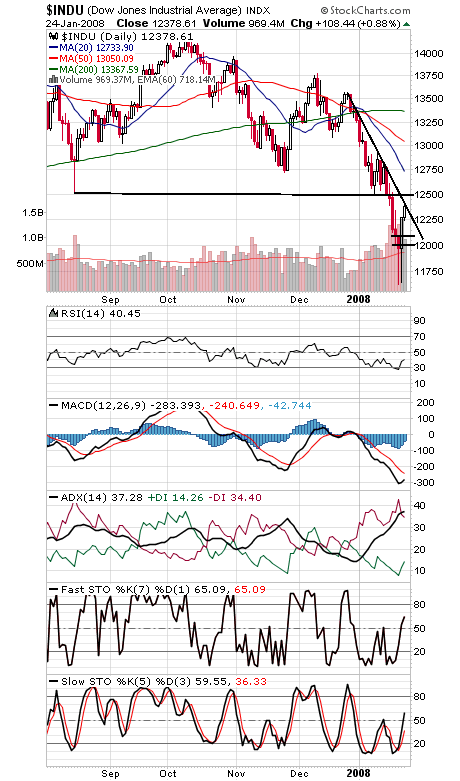

For the Dow (second chart), 12,500 is the level to beat, while 12,092 and 12,000 are support.

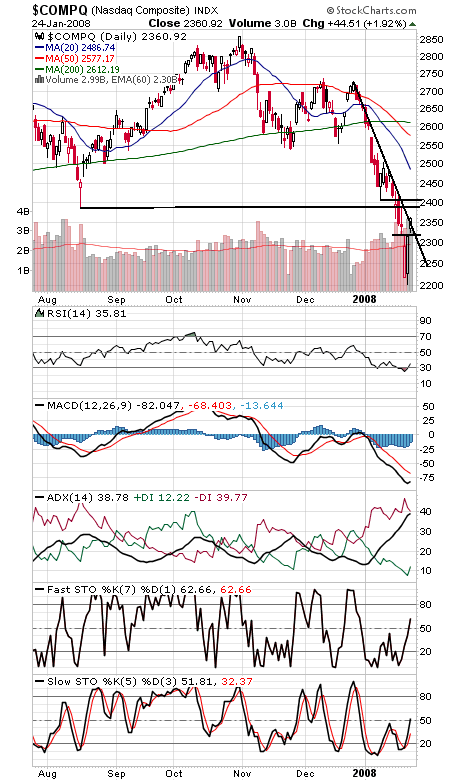

The Nasdaq (third chart) needs to clear 2387-2400, and 2316-2330 is first support.

In short, the signs are good, but there is still room for disappointment if, for example, the Fed doesn’t cut interest rates by enough next week or a bailout of bond insurers fails to materialize.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.