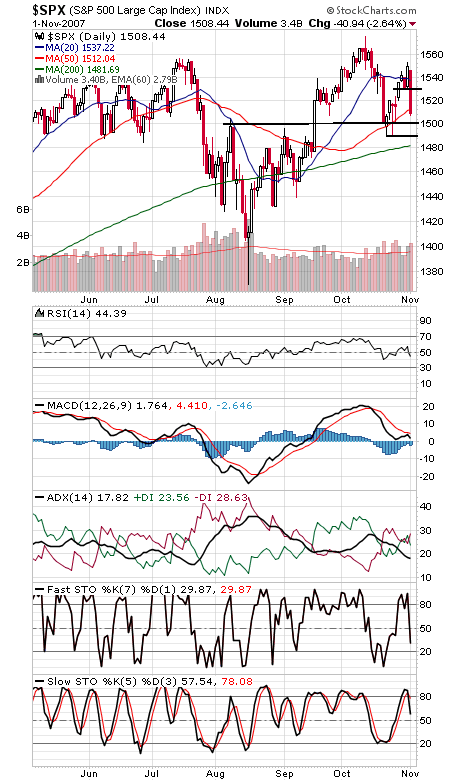

The banking sector’s troubles caught up with the market again today. We’d note that a similar decline two weeks ago reversed the next day; will the market be as lucky this time? The answer could lie in how the S&P 500 handles the support range it is nearing (see first chart below).

If the S&P can’t hold 1500, 1482-1489 should provide support; if those levels go, then 1466 becomes the target — and with any luck, the end of the decline. To the upside, 1530 is important first resistance.

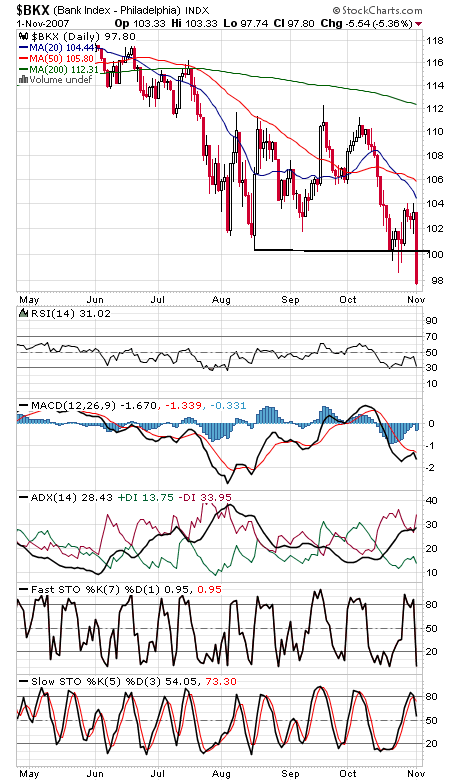

But the market’s biggest problem remains the banking sector (second chart below). Without the engine of finance, the rest of the market isn’t likely to get very far. The $41 billion injected into the banking system by the Federal Reserve today suggests that we aren’t the only ones troubled by that chart.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.