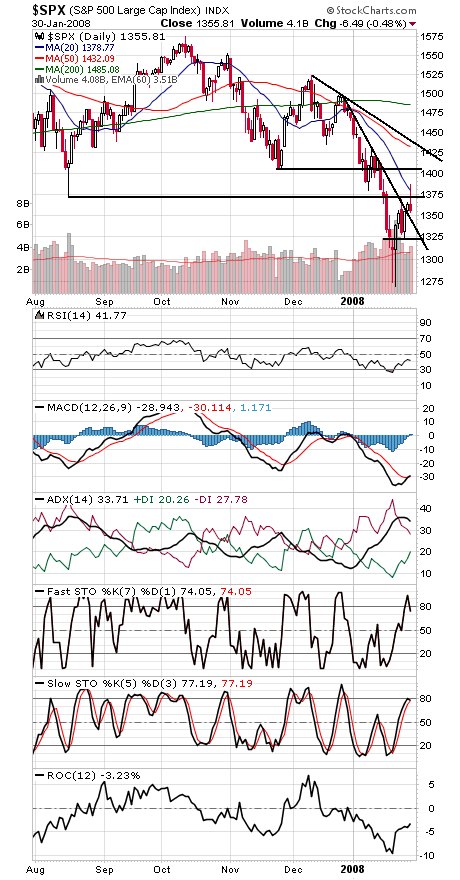

The S&P (first chart below) was unable to close above 1370 today, the bottom of a 15-month trading range that was broken earlier this month, which could leave the index vulnerable to a pullback. If the index can close above 1370, 1406 becomes the next big hurdle for the bulls. To the downside, 1350, 1338, 1322 and 1310-1312 are support levels to watch.

But the backdrop remains hopeful here, thanks in no small part to Ben Bernanke and company. Since peaking above 1,000 last week, 52-week lows on the New York Stock Exchange have all but dried up, staying under 80 for the last five trading sessions. It’s hard to get significant downside if there’s no one to lead the way. Still, we need buyers, and clearing 1370 and 1406 on a closing basis would suggest that they’ve arrived.

It would be good to see more enthusiasm from commercial futures traders and more forceful upside volume, but there is nonetheless much for the bulls to work with here. Sentiment certainly appears to be on their side, judging by the numerous bearish headlines in the last week or two.

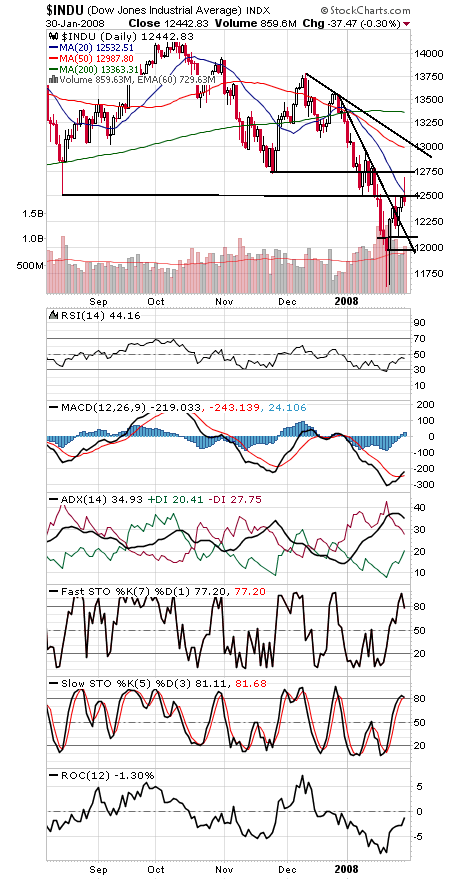

The Dow (second chart) stalled near the equally important resistance level of 12,724-12,786, and the index’s strongest support can be found between 11,971 and 12,125.

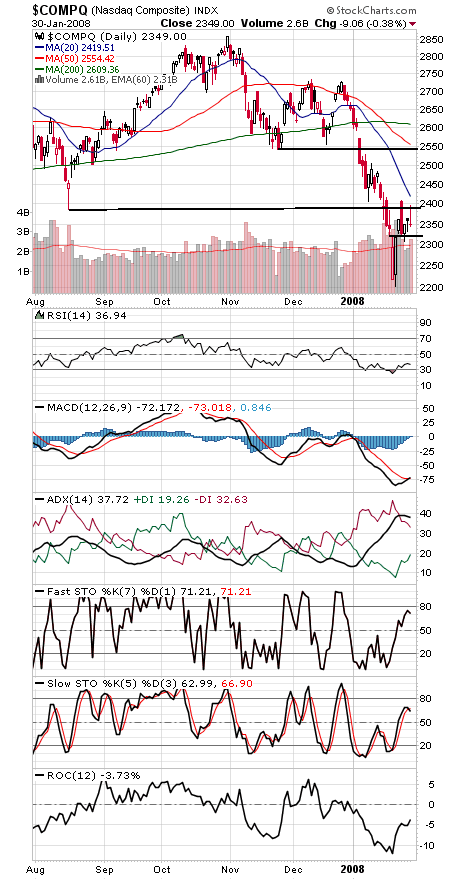

The Nasdaq (third chart) is struggling to get back above 2387-2400, and 2306-2328 is support.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.