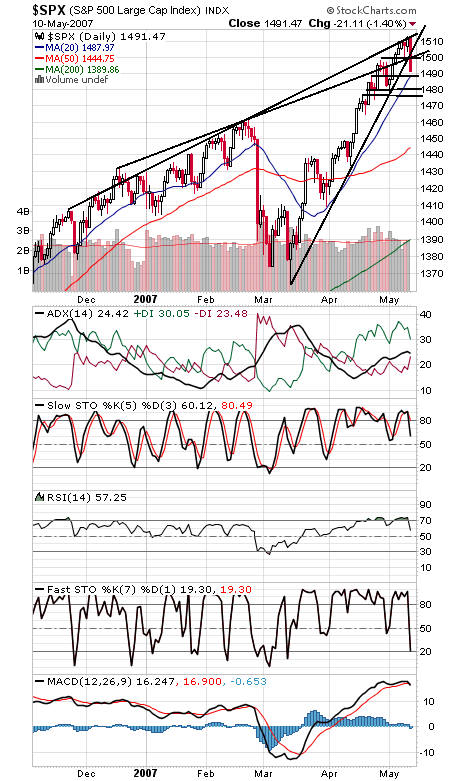

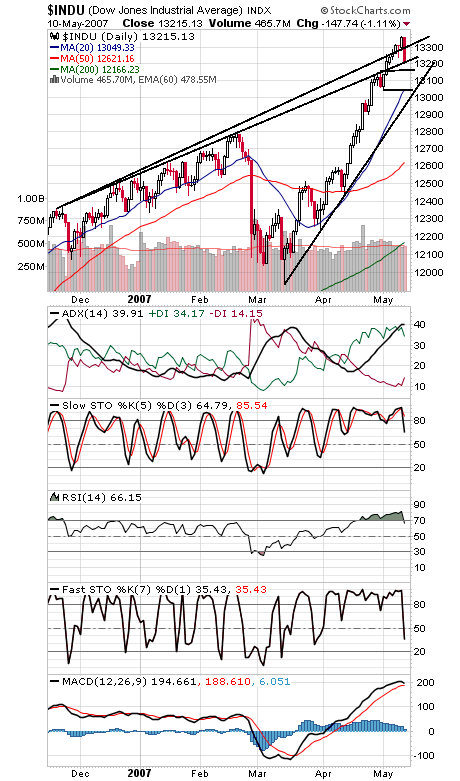

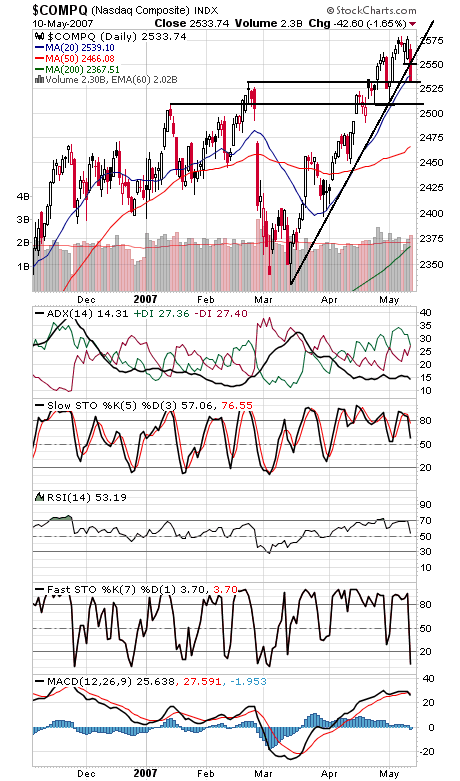

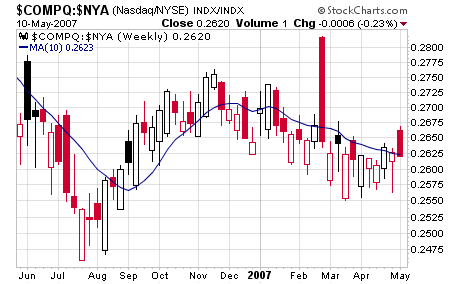

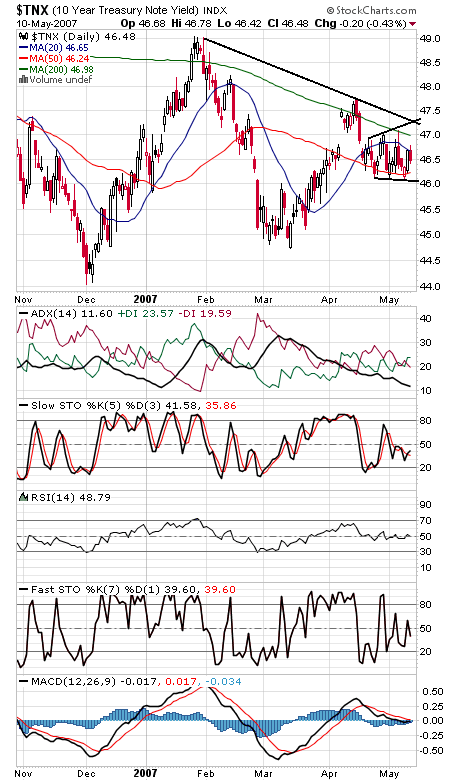

The S&P (first chart below) remains the big problem for the market here. Unless the index can clear its upper trendline at 1513-1514, the rally will remain at risk. First resistance is 1500-1501, and support is 1488 and 1476-1480. Some complacency has begun to creep into the market in recent days, such as a 5-point drop in Investors Intelligence bears this week, so some manner of correction could be healthy here. The Dow (second chart) ended the day right on a support line. Any lower and 13,160, 13,050 and 13,000 come into play. To the upside, 13,300 is significant resistance. The Nasdaq (third and fourth charts) could issue a sell signal tomorrow unless it can outperform the NYSE. The index returned all the way to 2532 support today; if that goes, 2510 could be the target. Resistance is 2550 and 2560. Given all the volatility in the bond market in recent months, it’s nice to see yields (fifth chart) rest here; perhaps inflation data in the next couple of days will break the stalemate.