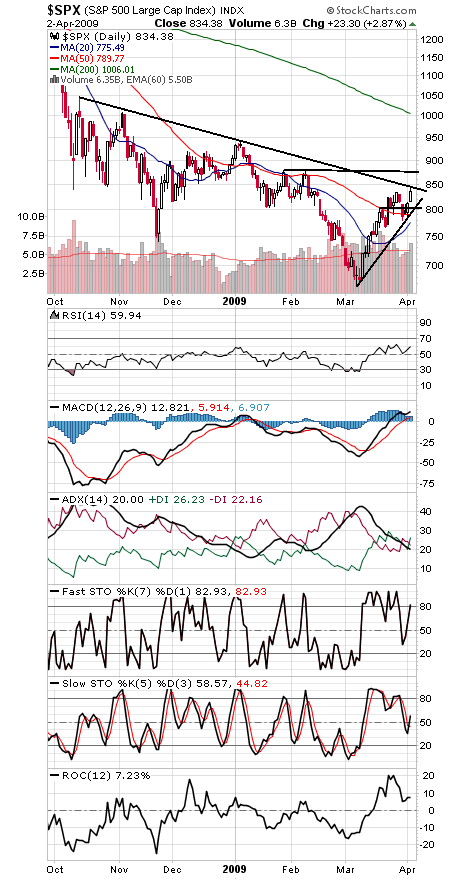

The S&P (first chart below) today ran straight into a downtrend line that has capped every rally since October.

A move above today’s high of 845 would be a plus for the bull case, but 866-878 is potentially an even bigger level, since at that point the rally would equal the 200-point advance from November to January; if it’s a bear market rally, that would be the place to look for it to end. Higher than that and the market would appear to have entered a longer recovery.

To the downside, 804 and 790 are important support levels, and 779 and 768 are the lowest we’d like to see the market go. Now that we’re back above the 2002 bear market lows, we need to hold them.

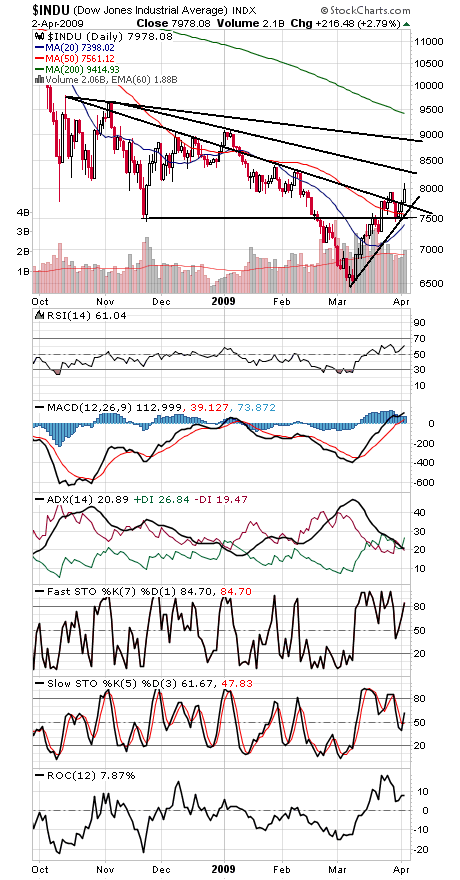

8300 and 8450 are the next big levels for the Dow (second chart) if it can close above 8000, and support is 7700, 7571 and 7437, with 7192 a critical level below that.

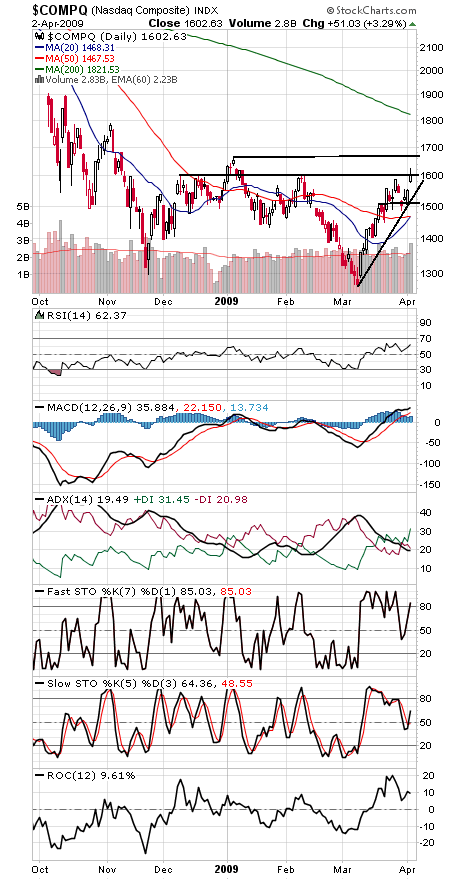

The Nasdaq (third chart) faces its next big test at 1665, and 1540-1550 and 1509 are good places to look for support.

In short, the rally continues to look pretty solid, but the bulls can’t breathe easy yet.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association. He is a co-author of the book “Dow Theory Unplugged” from W&A Publishing.