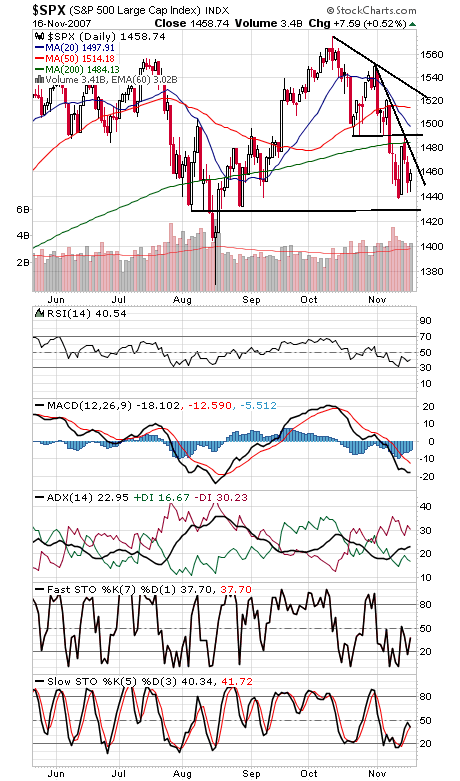

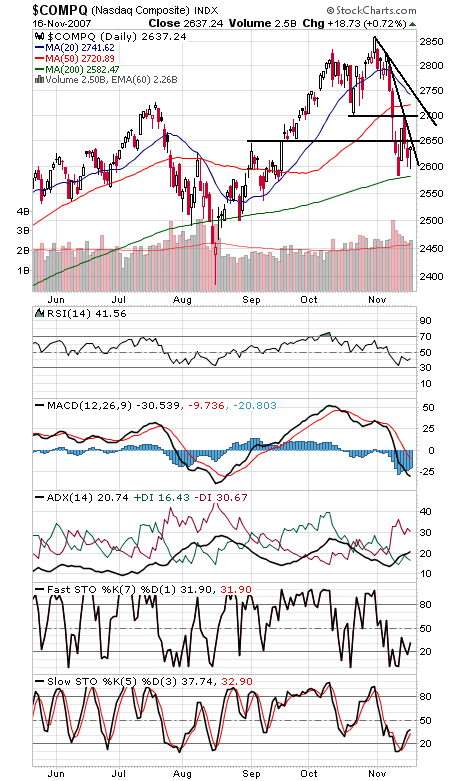

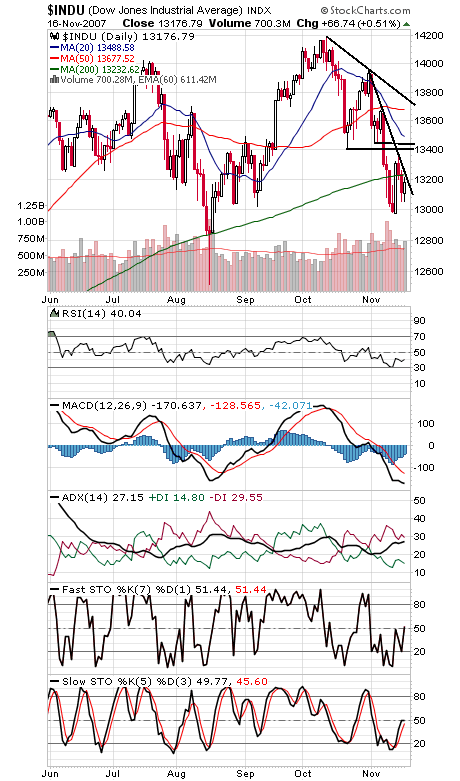

The indexes haven’t gotten very far off this week’s lows, but at least those lows are holding. We had some nice bullish readings in the CBOE and ISE put/call ratios today. Those may have been a little skewed by expiry, but the timing is interesting nonetheless: Monday begins perhaps the most bullish time of year for stocks.

According to David Steckler, Institutional Portfolio Manager at LPL Financial Services, the best results for the Nasdaq at this time of year have come from buying on the Monday before Thanksgiving and selling on the third trading day of January. That has produced 12 winning trades since 1994, for an average gain of 7.86%, with the only loser a 0.2% decline in 2003. Past performance is no guarantee of future results, of course, but it’s another data point in favor of the bulls here.

The S&P 500 (first chart below) needs to hold 1438.53-1441.35 support here, and so far it has. If that goes, 1427-1432 is next support, with 1416 and 1406-1410 below that. To the upside, resistance is 1470, 1484, 1493 and 1500.

The Nasdaq (second chart) needs to hold 2582 support. To the upside, 2650 and 2700-2720 are the levels to beat.

The Dow (third chart) needs to clear 13,200-13,232 to get another shot at 13,400-13,450. Support is 13,050 and 12,975-13,000.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.