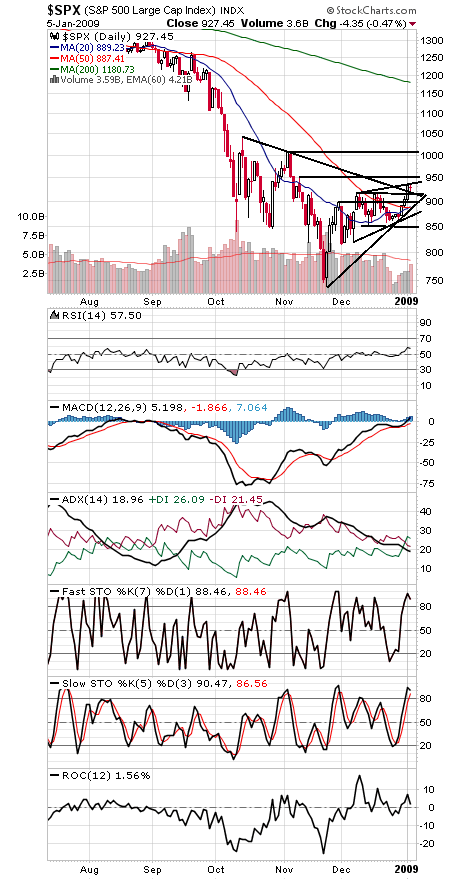

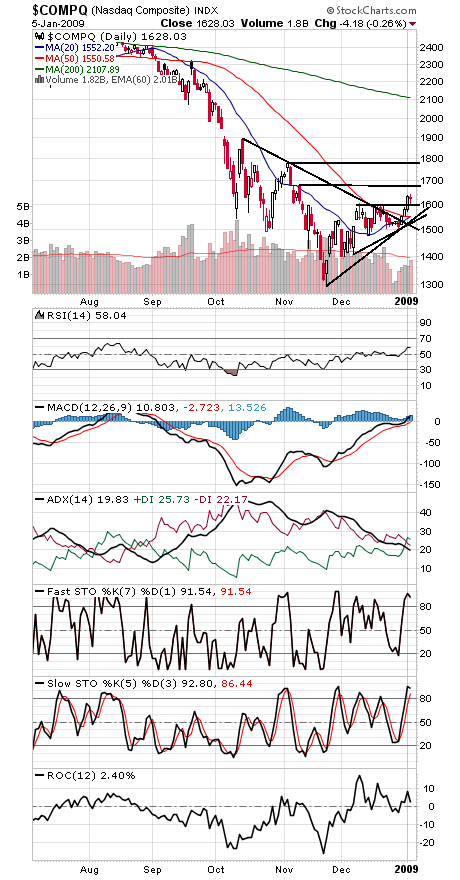

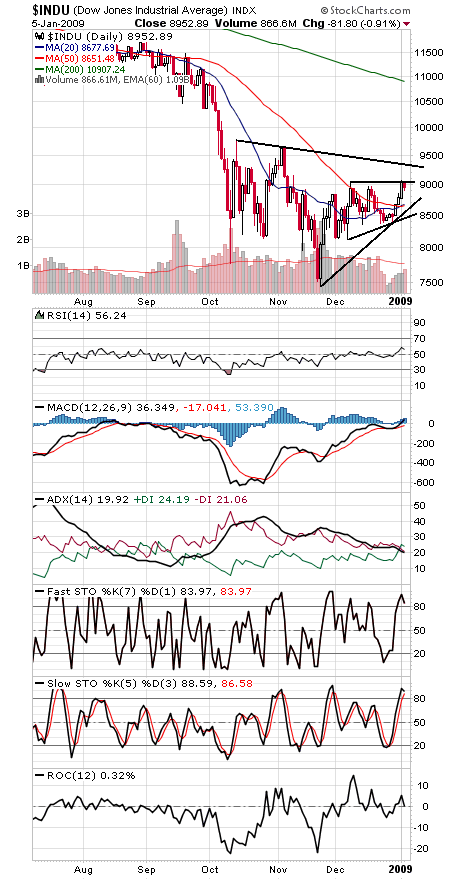

The major stock indexes held up well today after clearing a three-week trading range on Friday; solidly constructive action so far.

The S&P 500 (first chart below) cleared horizontal resistance and a downtrend line at 918 on Friday, then held on the backtest of that breakout today. If 918 can’t hold, then 890-900 could come into play. To the upside, if the index can clear 942-952, it should be headed for 1000.

The Nasdaq (second chart) cleared the 1603 level on Friday and held it as support today. Below 1600, 1550 could come into play, while the next resistance levels are 1680 and 1780.

The Dow (third chart) remains the laggard here; its big test is yet to come at 9300, and support is 8500-8700.

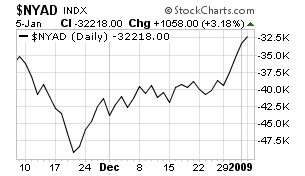

Finally, the NYSE advance-decline line (fourth chart) has been very strong; that’s good for technical strength and investor confidence to see the rally broaden and value get rewarded.

In short, a solid if unspectacular rally, but the market is so far finding its footing.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.