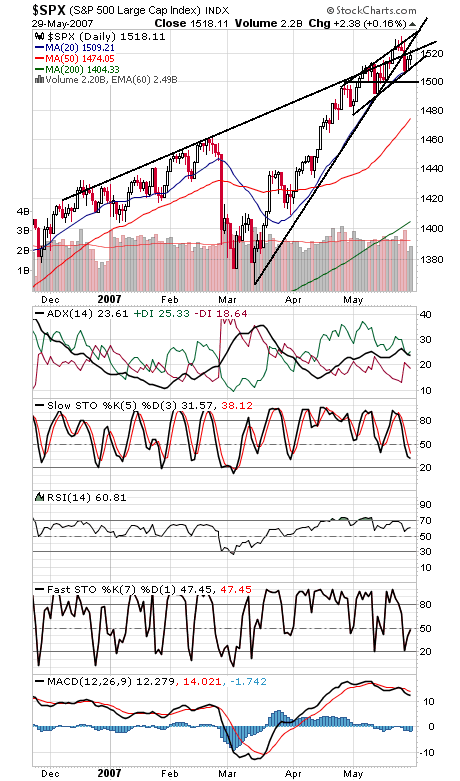

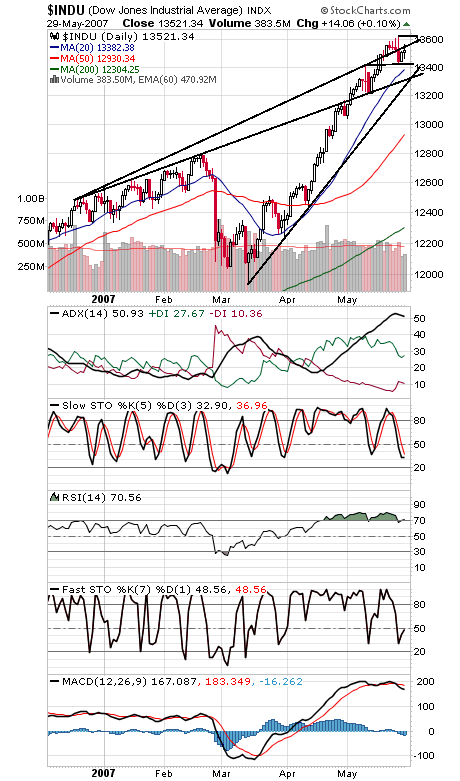

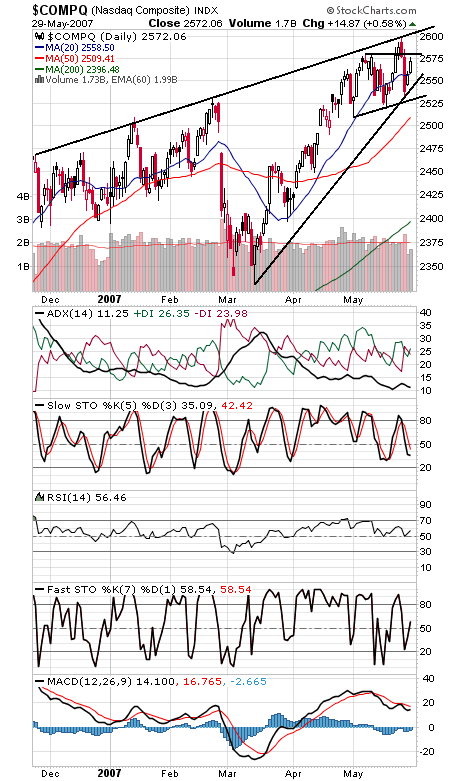

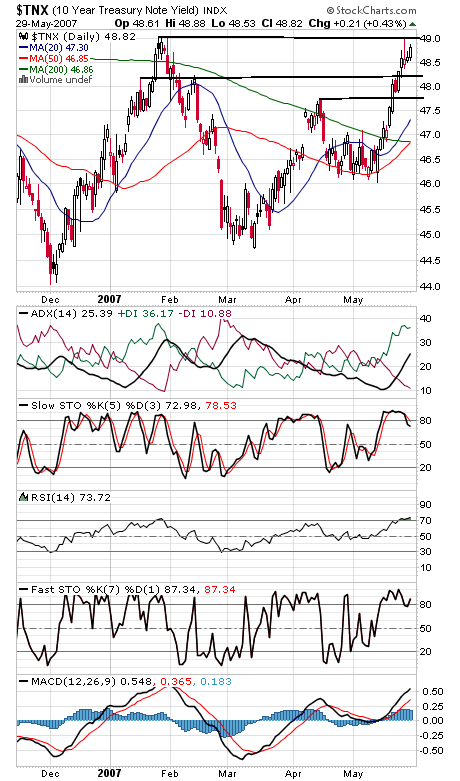

Stocks remain range-bound here, but one very important group continues to bet on more upside: commercial futures traders continue to add to long positions in the big S&P futures contract. That’s the biggest accumulation by the big traders in several years, at least since the 2002 lows. That suggests to us that stocks should remain a relatively safe bet for a couple more months, and could continue to surprise to the upside. In the short term, the next few days could benefit from first-of-the-month inflows. 1527.46-1552.87 remains the big level for the S&P (first chart below). 1522 is the first resistance level and 1510 and 1500 are support. The Dow (second chart) has support at 13,390-13,424 and 13,300, and 13,565 and 13,625 are resistance. The Nasdaq (third chart) is outperforming at the moment. The index faces resistance at 2581 and 2600, and support is 2560 and 2545. The 10-year yield (fourth chart) is creeping higher, but 4.9%-5.0% could prove tough resistance.