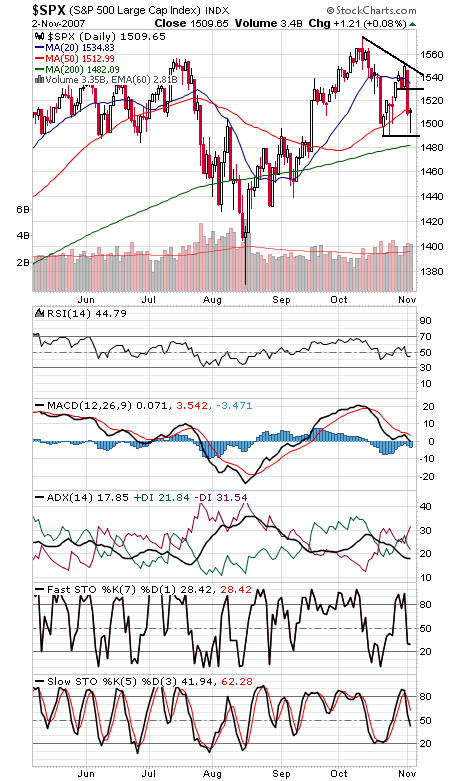

The S&P 500 (first chart below) found support just above our 1482-1489 level and ended the day with a slight gain. A good start after a retest of the low of two weeks ago, but 1512 and 1530 are two big initial hurdles to the upside.

But with stocks entering the strongest months of the year and commercial futures traders solidly long, the bulls have plenty on their side if they’re going to clear the S&P’s 2000 peak and the equally important 2900-3000 level on the Nasdaq.

Here’s one data point that suggests they may have a chance. Private trader Jay Pasch ran the numbers and found that stocks tend to post substantial gains over the next couple of months after falling sharply the day after a Fed ease. That’s only seven occurrences in the last 25 years, but the average gain 37 days later was 9.1%, with a high of 18.2% in 1991 and a low of 0.7% in 2002. Given the seasonal strength and long commercial positions, it’s one more data point in favor of a year-end rally of some sort.

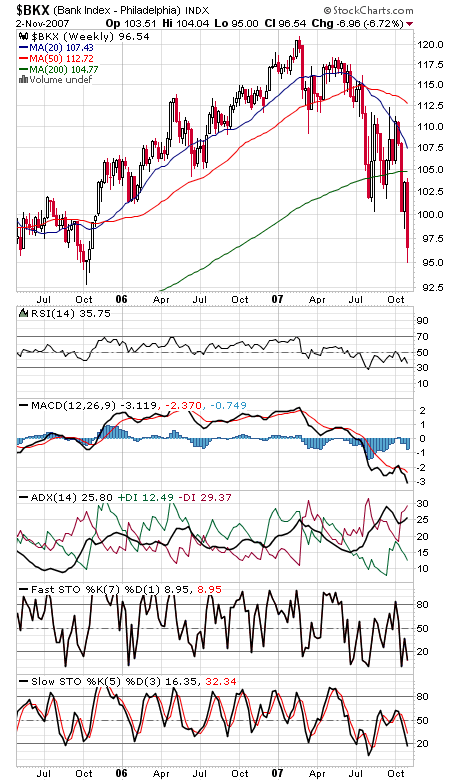

The biggest obstacle, of course, remains the banking sector (see second chart below). That all-important index will have to turn up sharply to keep from dragging the rest of the market down with it.

It’s going to be a fun battle to watch.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.