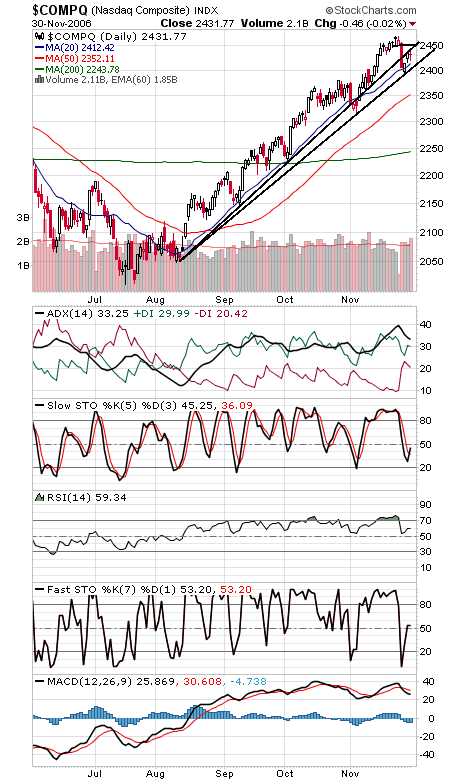

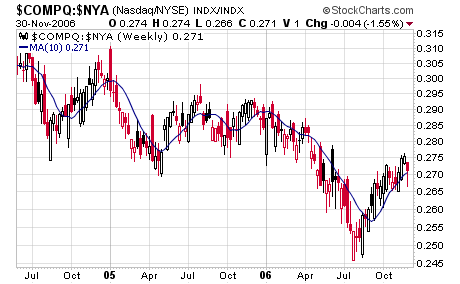

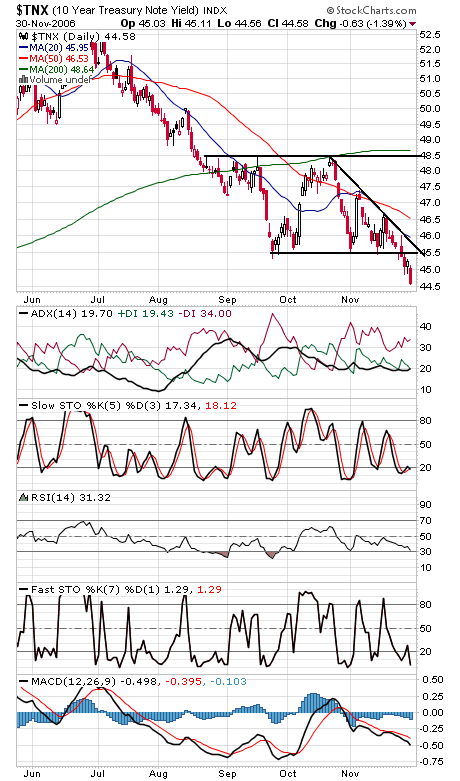

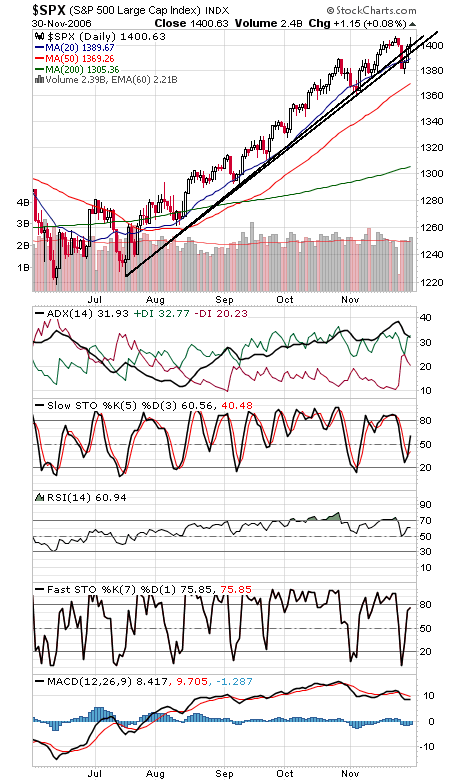

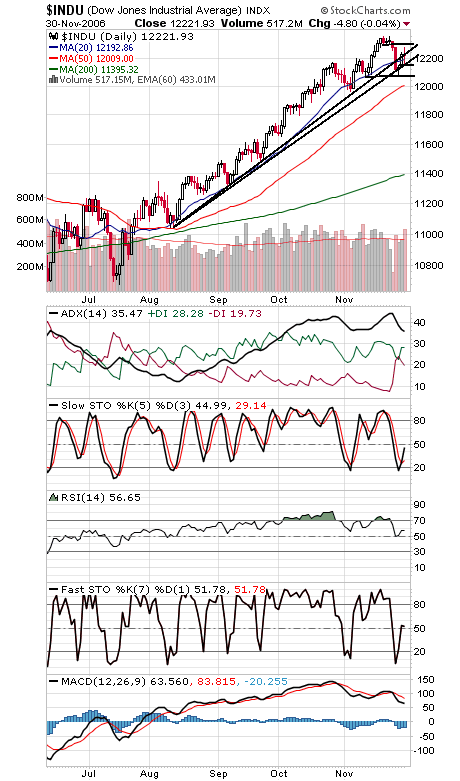

Stocks turned a little wobbly again today, but first-of-the-month inflows and an ISM reading above 50 tomorrow could be all the bulls need for another rescue here. The Nasdaq (first chart below) continues to stall at its old uptrend line; 2447-2450 is resistance for tomorrow, and support is 2419 and 2408. It’s worth noting that any underperformance by the Nasdaq tomorrow could give a sell signal on Gerald Appel’s 10-week Nasdaq-NYSE relative strength ratio (second chart). That would be strike two for the market after Monday’s breakdowns. Early December tends to be up, but then tends to drift until the year-end rally; we’ll see if that pattern repeats this year. Looking further out, we expect the market to put in a sentiment-refreshing correction eventually, and perhaps at levels not too much higher than this. Bonds (third chart) seem to be pricing in a recession here, something the stock market doesn’t seem to have considered yet. The S&P (fourth chart) has support at 1396, and resistance is 1408 and 1414-1426. The Dow (fifth chart) has support at 12,180, and resistance is 12,240, 12,300 and 12,355-12,361.