The two strongest months of the year could do nothing to break the market out of its six-month trading range. And election years tend to be choppy, so there’s no guarantee that the indexes will break out any time soon.

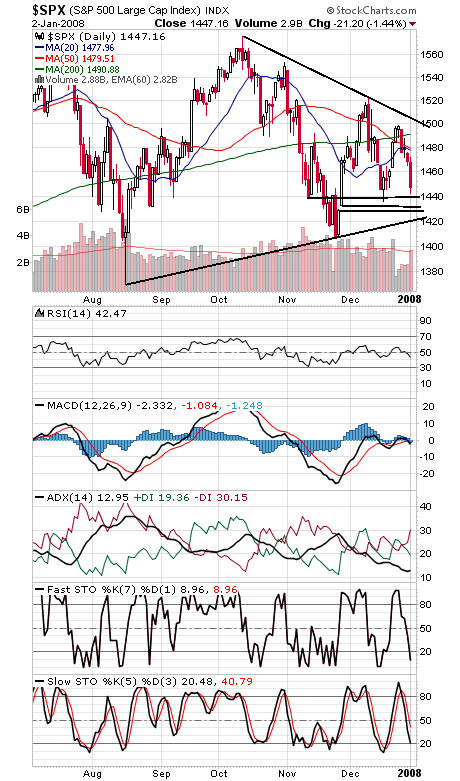

The S&P 500 (see first chart below) remains stuck near the bottom of its trading range. If it goes much below 1440, 1428-1432 and 1420 come into play, while 1480-1500 remains a big hurdle to the upside.

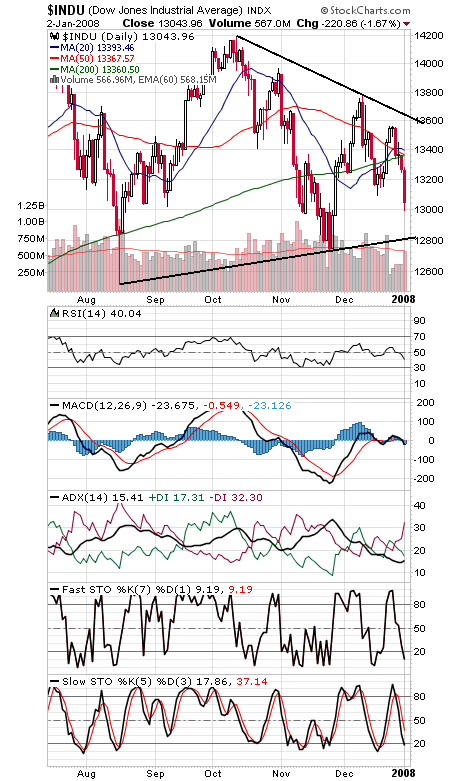

If 13,000 goes on the Dow (second chart), 12,800 could be next. To the upside, 13,360 is a big resistance area.

The Nasdaq (third chart) has support here at 2600, with 2590 and 2540-2550 below that. Resistance is 2650-2660, 2680 and 2700.

In short, still a very range-bound market, but one that could get a lift later this month in anticipation of more rate cuts.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.