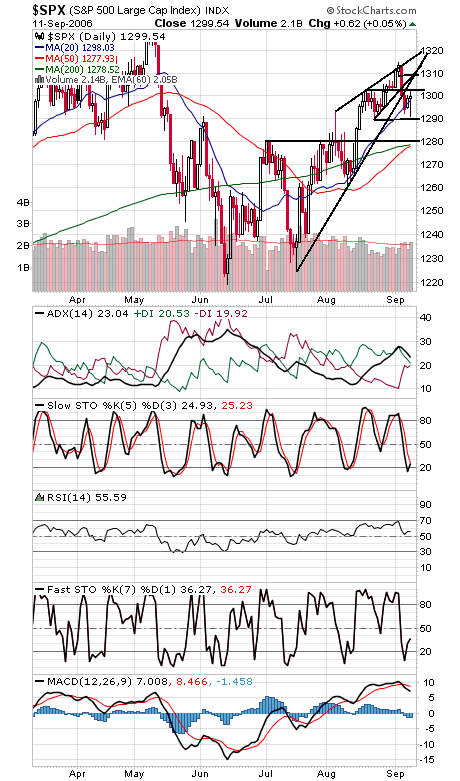

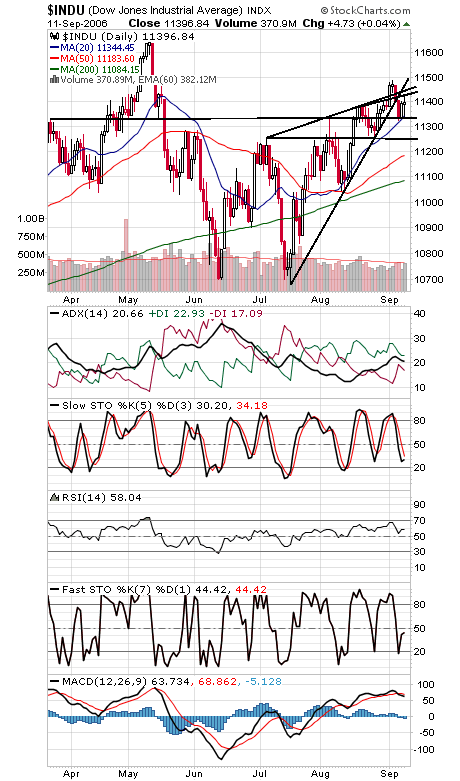

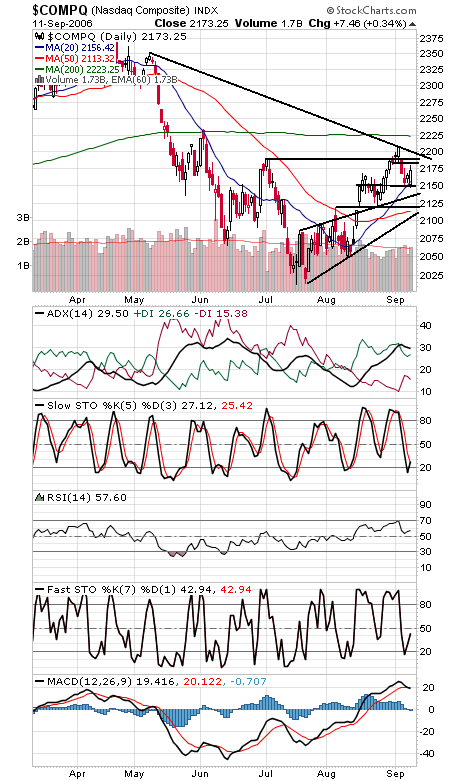

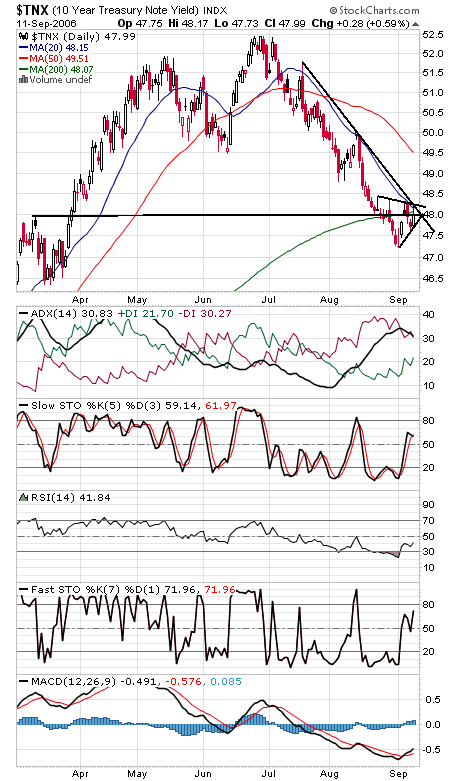

The S&P (first chart below) could be forming a head-and-shoulders top over the last few weeks, and coming on the heels of last week’s uptrend break too: a couple of patterns favoring the bears here. A move above 1303 could negate the head-and-shoulders top, but 1309 looks like rock-solid resistance for now. 1289-1291 is important first support, with 1278-1281 below that. The Dow (second chart) faces resistance at 11,425, 11,460 and 11,500, and support is 11,350, 11,320 and 11,250. The Nasdaq (third chart) faces resistance at 2183, 2190-2193 and 2200, and support at 2150 (2147) is so far holding, with 2137 below that. Bond yields (fourth chart) still haven’t put in a convincing reversal and so far look like a consolidation in a downtrend.