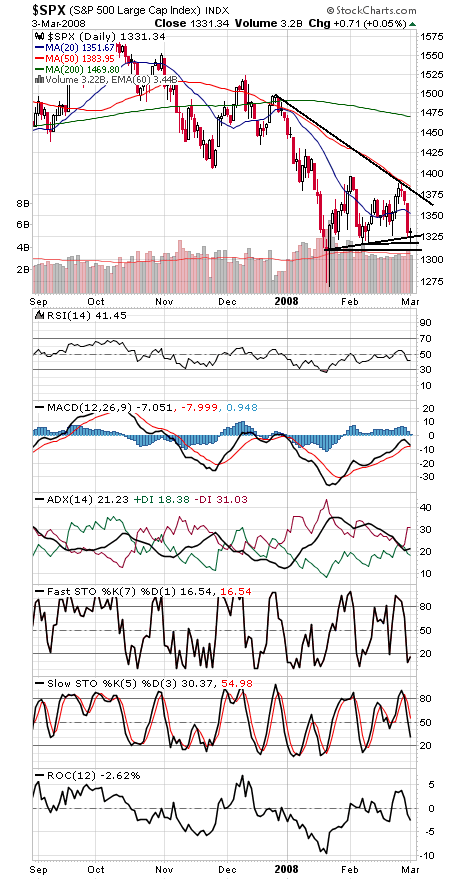

The bulls have plenty going for them here, with record lows in the ISE sentiment gauge, among other measures showing high investor fear, yet stocks continue to struggle and appear as likely to retest their lows as they do to break out to new highs.

That said, first-quarter sell-offs in election years have historically turned out to be good buying opportunities, so there’s still time for the bulls to pull off a victory here.

The S&P 500 (first chart below) is barely hanging on to 1320-1325 support here, with 1310 the last level standing in the way of a retest of the lows at 1270-1275. To the upside, resistance begins at 1375-1380.

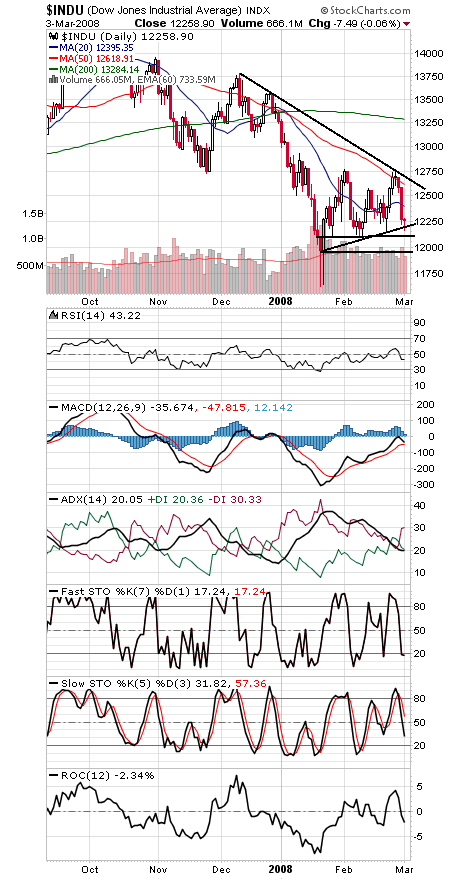

The Dow (second chart) is barely holding 12,100-12,200 support, and its main resistance is a strong downtrend line just below 12,700 and falling.

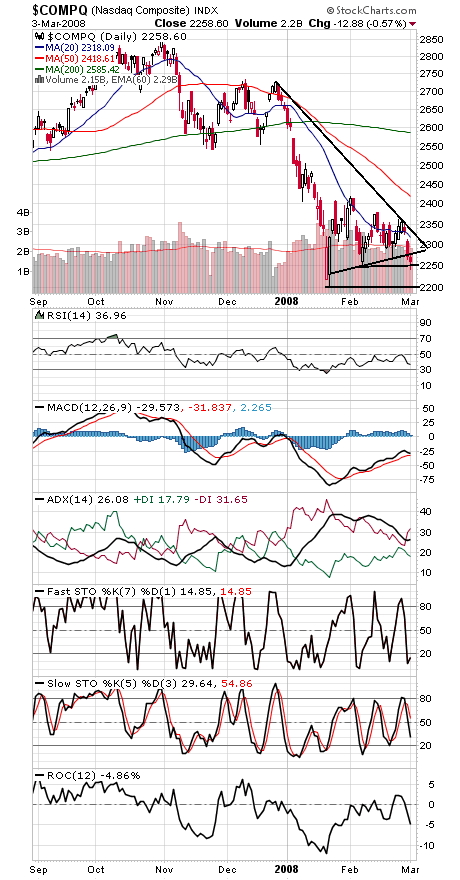

The Nasdaq (third chart) continues to be the weakest of the three major indexes, barely holding onto 2250 support today, with the lows of 2200-2221 below that. To the upside, 2280, 2310 and 2340 are resistance.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.