Note: The Technical Analysis column will be on hiatus until Jan. 2. Happy Holidays, and best wishes for a prosperous New Year.

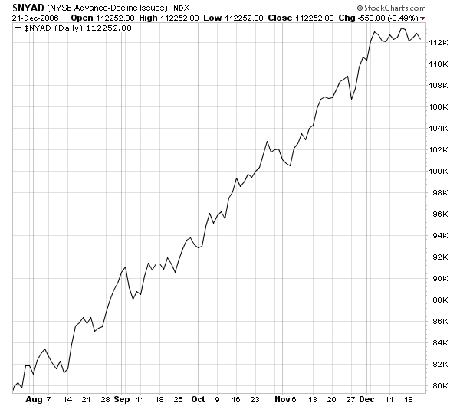

The market has turned wobbly in recent weeks, with a number of sectors and indicators sporting worrisome developments, with technology, transportation and retail among the sectors showing dangerous levels of underperformance. The NYSE advance-decline line (first chart below) is another we’d like to see looking a little livelier. That said, after a little more downside, we expect holiday strength to support the market for the next couple of weeks. Sentiment is mixed, with Investors Intelligence bulls leading bears by a three to one margin, but ISE options averages nowhere near previous highs. Historically, strong mid-term years (1986, 1982, 1958, 1954, 1950 and now 2006) have been followed with more strength the following year, so the market remains in a positive seasonal period for several more months, perhaps until mid-2007. As long as leading sectors like the banks hold up and the Dow and S&P maintain some semblance of an uptrend, the benefit of the doubt will continue to go to the bulls despite some obvious weakening of the market’s underpinnings here.

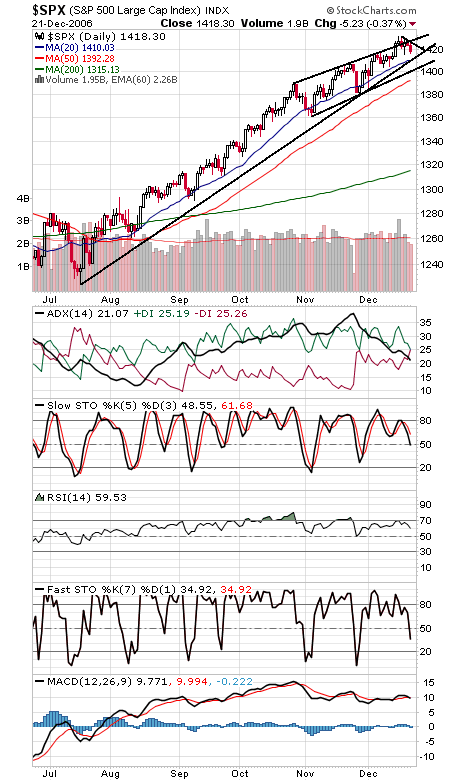

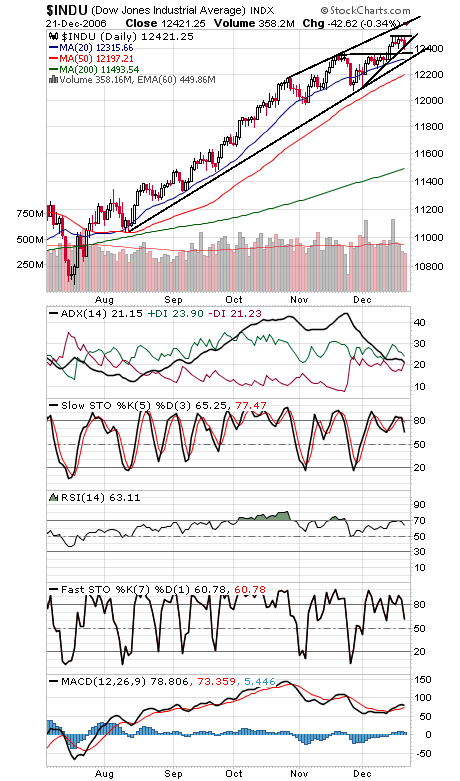

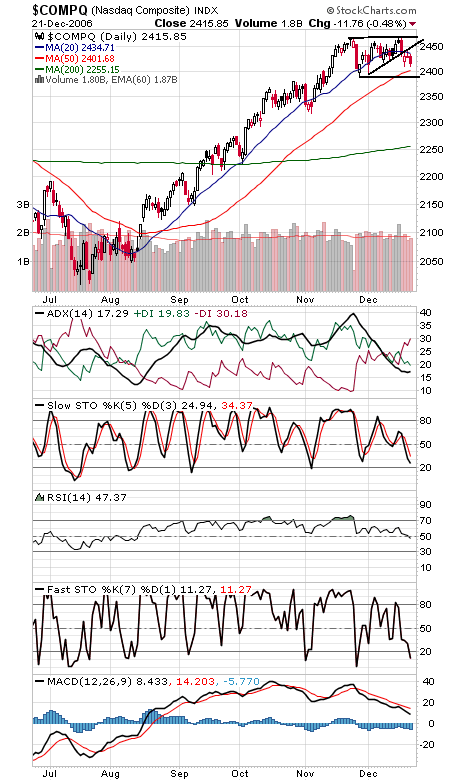

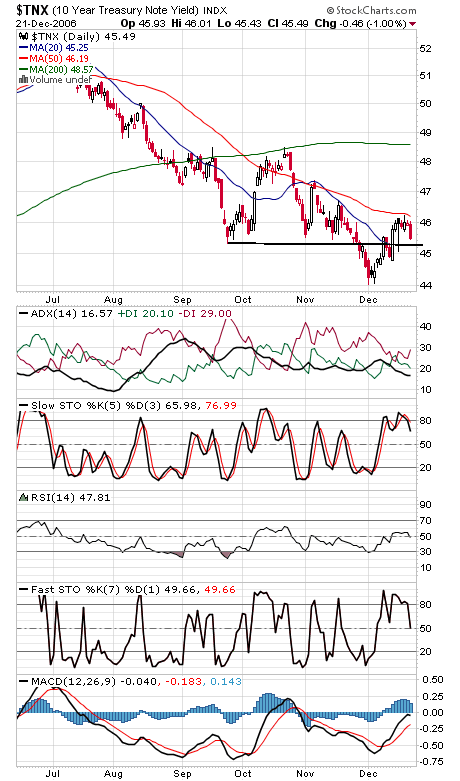

We’d like to see the S&P (second chart) hold its main uptrend line at 1412 here, although the lower trendline at 1402 and rising could also support the index. Resistance is 1424, 1427 and 1432, with 1438 and 1454 above that. The Dow (second chart) needs to clear 12,440 and 12,500 to the upside, and support is 12,360 and its main uptrend line at 12,320 and rising. The Nasdaq (third chart) needs to hold 2390-2400 support, or the techs could be in for a deeper correction. Resistance is 2450 and 2470. Bond yields (fourth chart), like the Fed, are caught between rising inflation and slowing growth here; a tough spot for the economy in general.