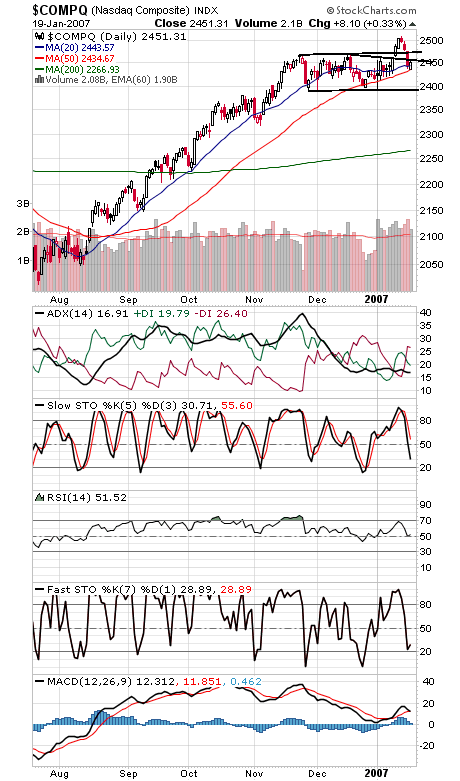

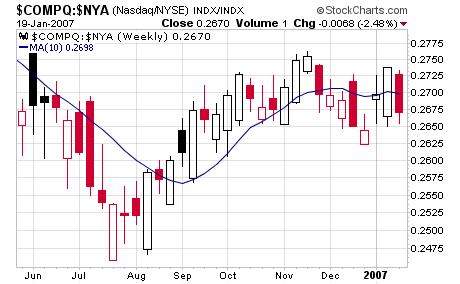

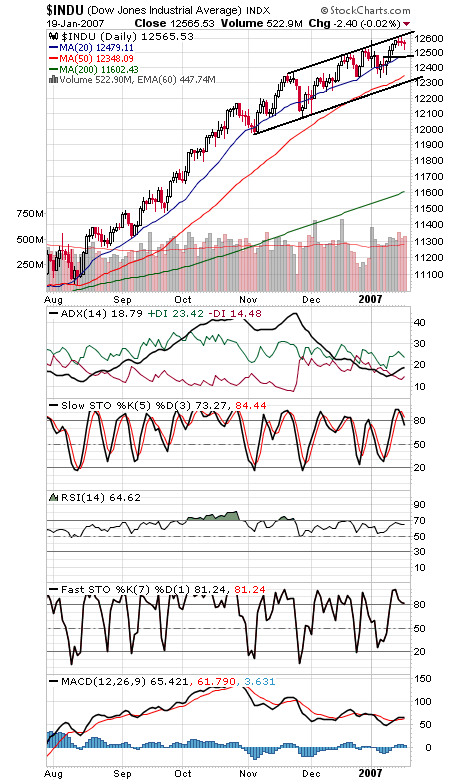

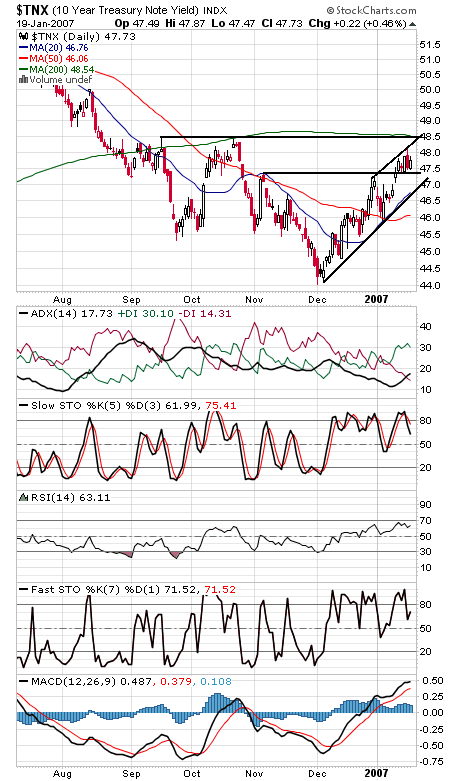

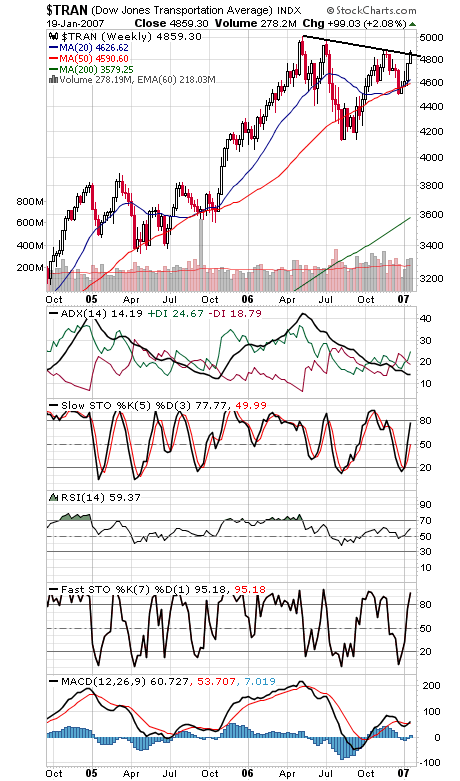

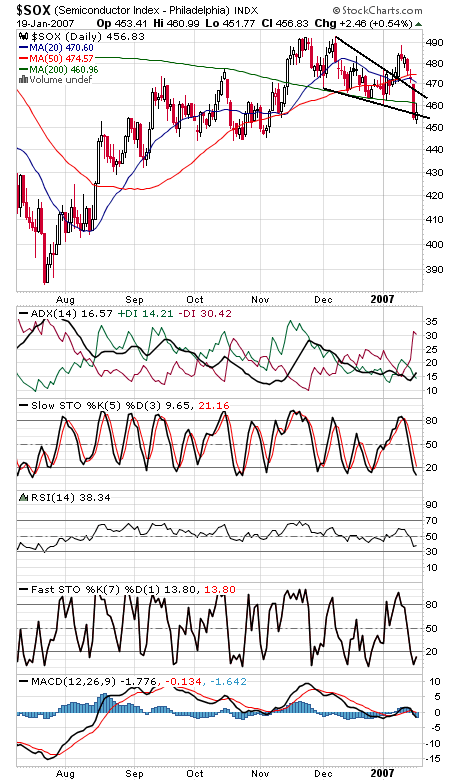

Not a bad day at all for the Nasdaq (first chart below), which managed a modest gain despite disappointment over IBM’s results, but it wasn’t enough to avoid a sell signal under Gerald Appel’s relative strength indicator (second chart), and the index ended the week back inside its two-month trading range. Disheartening developments, and while they don’t necessarily mean that techs will turn lower from here, they do suggest that for the time being blue chips may be the safer place to be. 2437 should be good support on the Nasdaq for Monday, and resistance is 2455 and 2471. The Dow (third chart) has resistance at 12,614-12,630, and support is 12,523 and 12,466-12,500. The S&P (fourth chart) has support at 1425, 1421, 1416 and 1409-1412, and resistance is 1433-1435 and 1438. Bonds (fifth chart) have entered a holding pattern. And finally, two more mixed signs: the Transports (sixth chart) look promising, while the chips (seventh chart) have faded. Two more signs in favor of blue chips here.