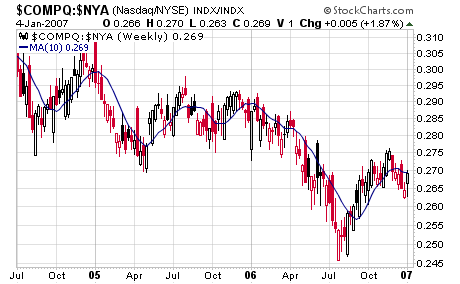

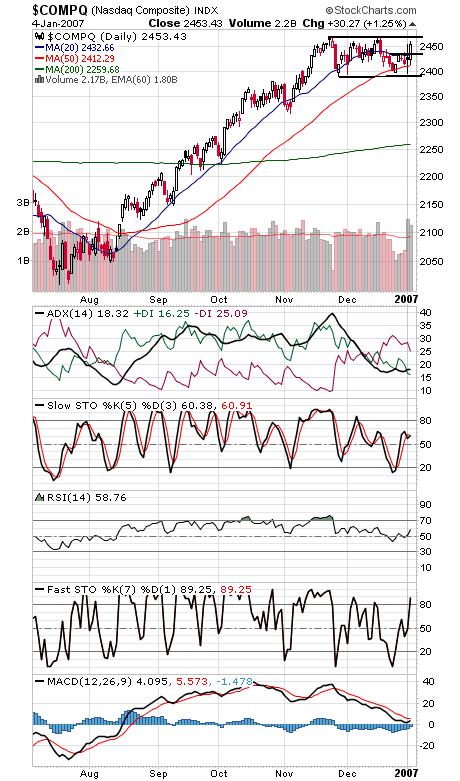

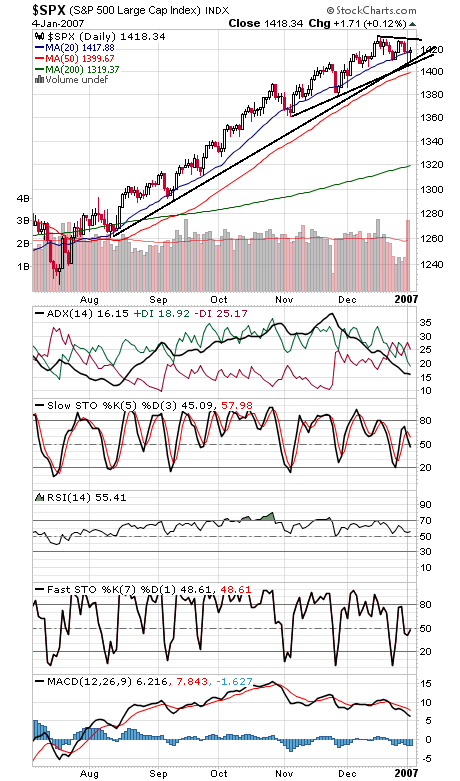

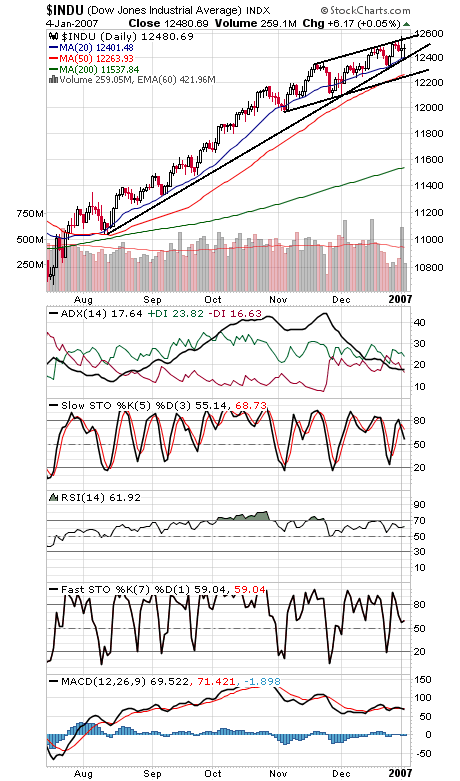

Nasdaq underperformance, one of the biggest problems for the market in recent weeks, could be on the verge of a happy resolution. All the index needs to do is keep pace with the NYSE tomorrow to get back on a buy signal on Gerald Appel’s Nasdaq/NYSE relative strength indicator (see first chart below). When high-beta stocks lead and investors are taking risks, that’s good for the broader market about 70% of the time. The Nasdaq (second chart) still must take out 2471 to launch a new leg up. 2433 looks like a good first support, with 2413 below that. The S&P (third chart) has important first support at 1408-1410, and resistance is 1429-1432. For the Dow (fourth chart), 12,400 remains important support, and 12,560-12,580 the level to beat to the upside. Bond yields (fifth chart) are providing a little relief the last couple of days.