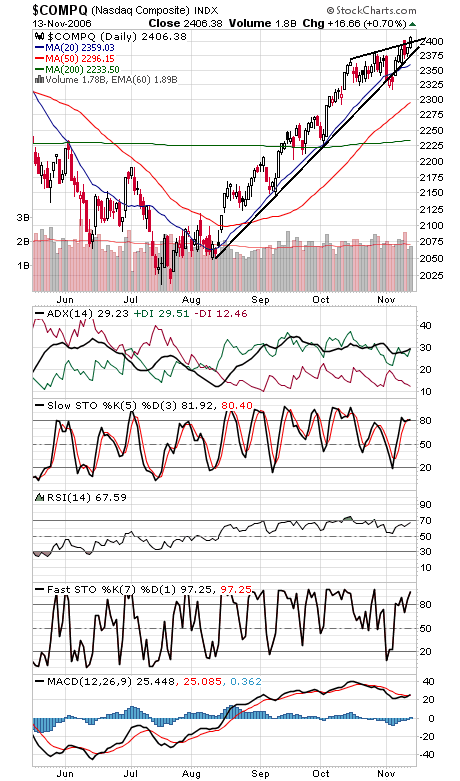

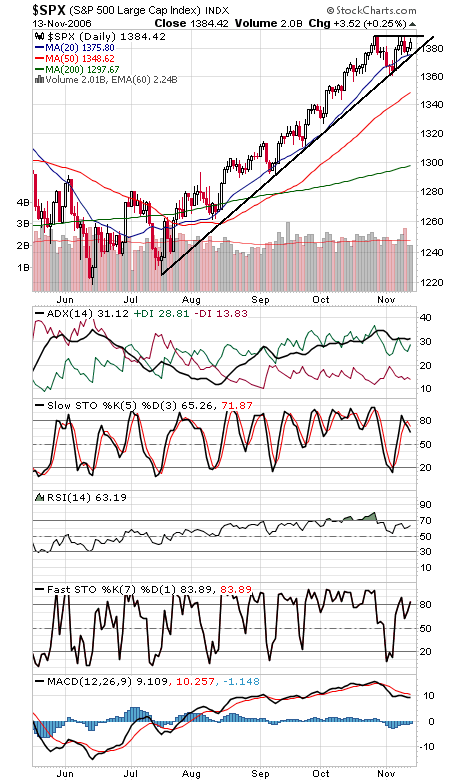

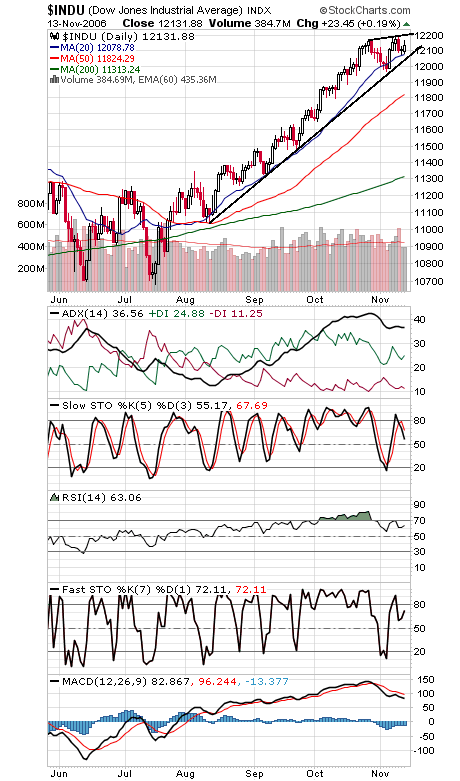

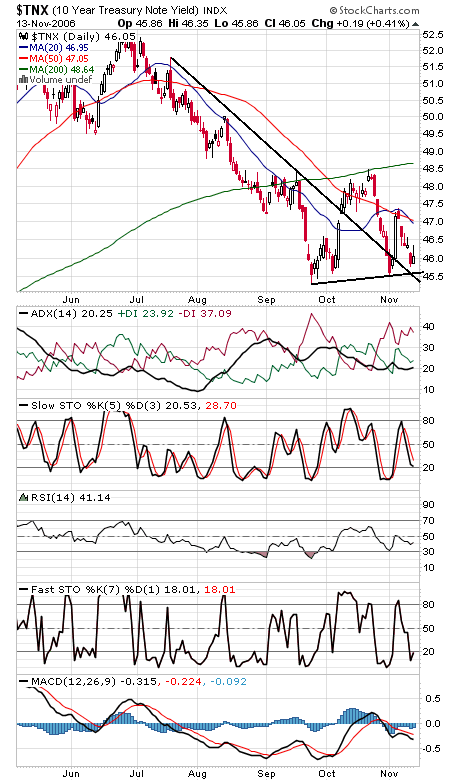

The Nasdaq (first chart below) has taken the lead here as blue chips stall out. Tech leadership is a pretty healthy thing for the market, as long as it doesn’t become too extreme. One modest negative we’d note is that commercial futures traders remain short the big S&P contract; since they were net long at this time the last two years, we’ll take that as a sign that stocks could struggle later this year or early next. But with the midterm year nearing an end, the mid-year low of 10,700 should mark the maximum low of any reaction for the next few years. Next up for the Nasdaq is 2420-2425, and support is 2400 and 2380. The S&P (second chart) continues to pause at 1389, with 1400 the next milestone above that. 1376 remains critical support. The Dow (third chart) also continues to stall here, with 12,200 the level to beat to the upside. Critical support can be found at 12,060. Bond yields (fourth chart) paused at support today, but tame inflation data the next few days could be just the thing to give the bond rally new life.