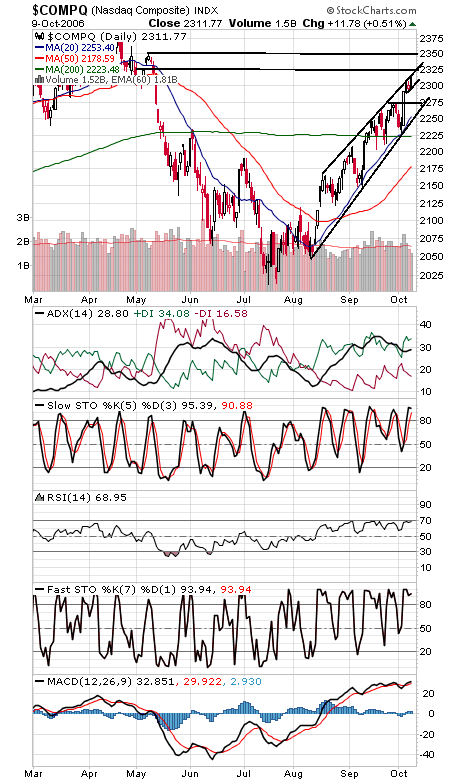

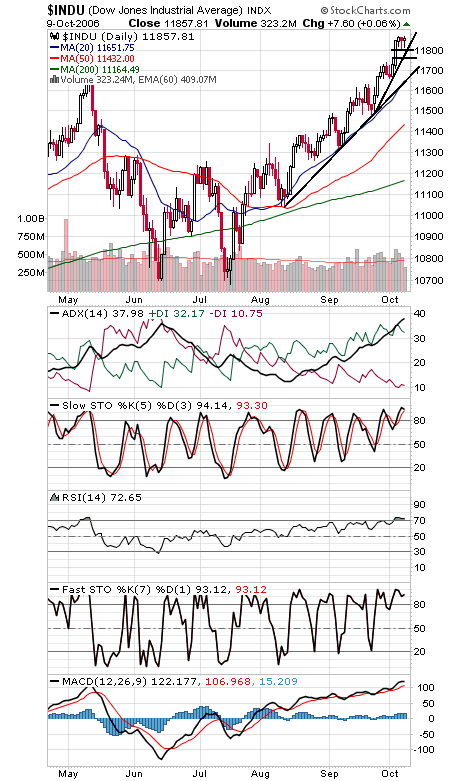

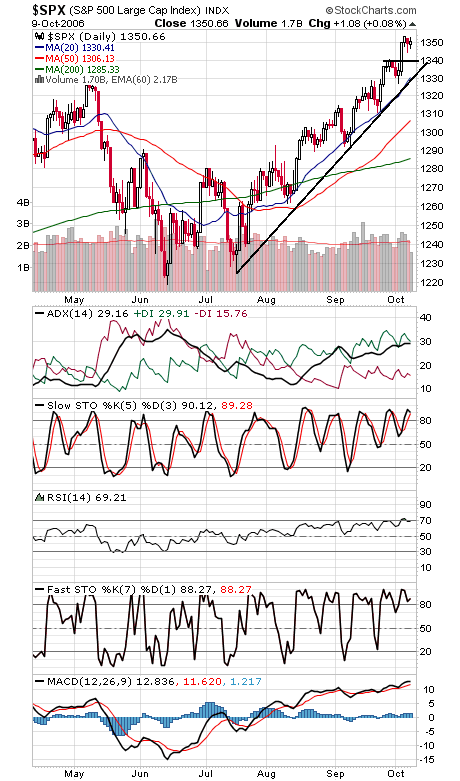

Freed from having to fret about the bond market, stocks showed some resilience today despite more geopolitical turmoil — a familiar theme lately that has translated into higher prices. The Nasdaq (first chart below) has taken the lead since the Dow (second chart) hit a new all-time high last week, as lagging sectors begin to attract money. That’s good, since the high-beta Nasdaq stocks tend to dictate market direction, but the market is very overbought here and some sort of breather or correction would seem appropriate, and the longer the better. Support on the Nasdaq is 2300, 2290 and 2275, and resistance is 2325-2333, 2350 and 2375. The Dow and S&P (second and third charts) are consolidating at their highs here, a hopeful sign for the bulls. The Dow has the clearest range in the short-term: 11,873 to the upside, and 11,800 to the downside. The S&P faces resistance at 1354, 1361 and 1376-1389, and support is 1344, 1338-1340 and 1331.