Despite bearish sentiment being at 12-year highs, according to the Investors Intelligence weekly survey (check out the bear on the cover of this week’s Barron’s), stocks have yet to find a bottom.

After the worst first half for stocks since 1970 — and with the strongest half of the election year coming up — the bulls have a good chance of putting together a strong second half if they can find a catalyst.

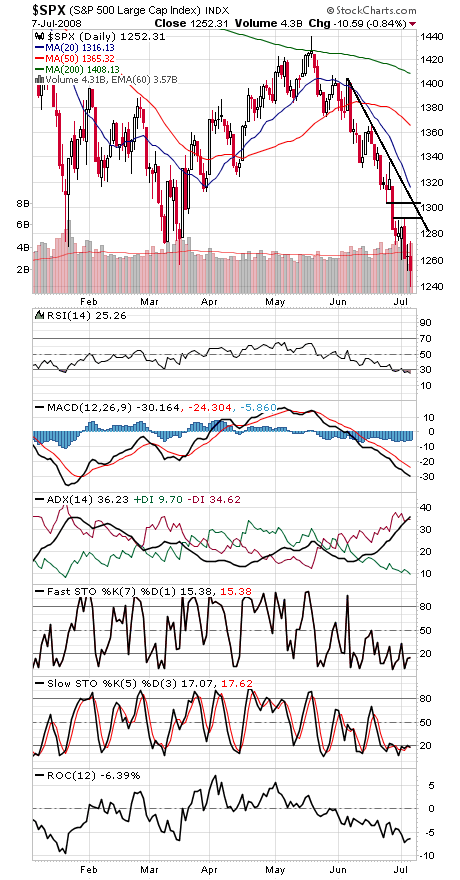

The 2006 lows seem to be as good a place as any to look for that catalyst. That would be 1219-1236 on the S&P and 10,683-10,739 on the Dow.

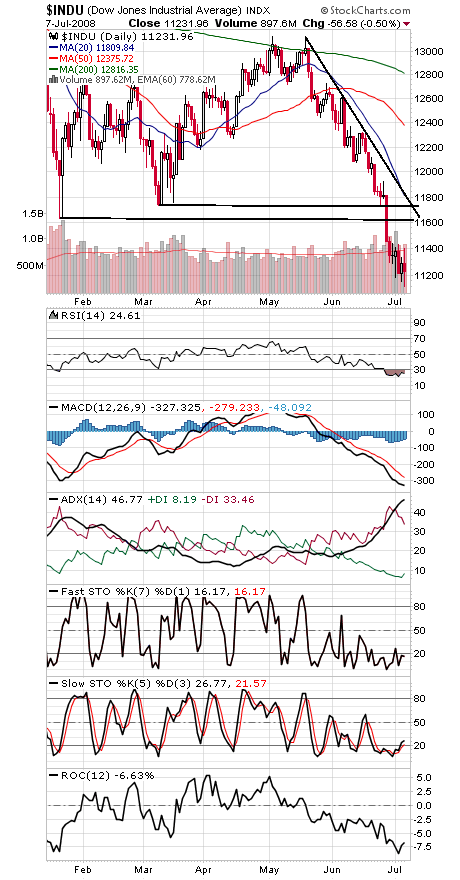

The S&P (first chart below) tested the top of that range today, hitting 1240 before reversing. To the upside, 1292-1304 is a big first resistance zone for the S&P, while the Dow (second chart) must clear 11,434-11,500 and 11,634-11,750.

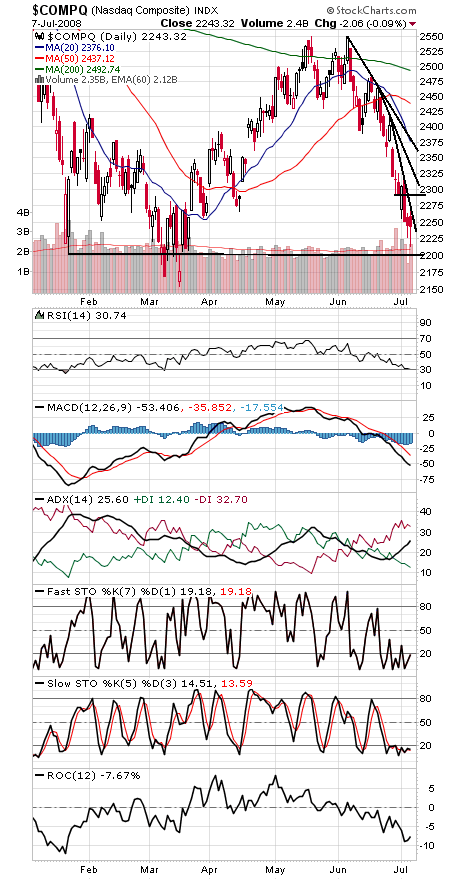

The Nasdaq’s decline (third chart) seems to be getting steeper, but it wouldn’t take much of a pop to break the steepest of those downtrend lines. 2200 and 2155 are support, and 2276 and 2317 are first resistance levels.

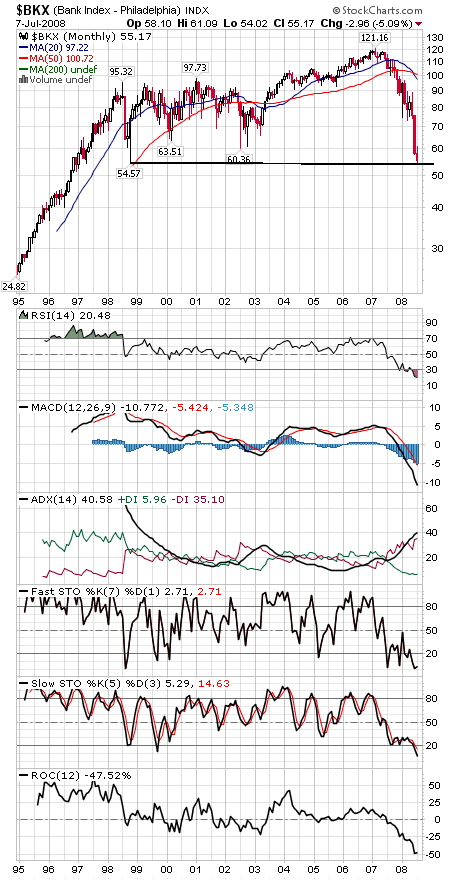

The bank stocks (fourth chart), meanwhile, are just barely holding on to the 1998 lows here.

Finally, it’s time to look back at the dismal performance of our Oct. 2007 stock picks: down 28%, compared to a 20% loss for the Dow. So what went wrong? For starters, just selling GM (NYSE: GM) at the first sign of earnings losses in November would have made for a very good stop for that stock and cut the losses of the portfolio in half. And using Sy Harding’s seasonality timing system would have cut that loss to mid-single digits.

Since the market is likely much closer to a bottom than a top, we’ll try once again. Using valuation metrics developed by Larry Williams, here’s a few stocks for the months ahead: Chevron (NYSE: CVX), Boeing (NYSE: BA), Home Depot (NYSE: HD), Alcoa (NYSE: AA) and Caterpillar (NYSE: CAT). We suspect this year’s list will do a lot better, and we’ll revisit the list in the fall.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.