About the only good news is that we have monthly inflows to support the market next week. While we’ve had some very intense selling, we now need equally strong buying to cement a bottom, and that must occur by Thursday (within a week of the last 90% downside day) to be a good signal, according to the work of Paul Desmond of Lowry’s Reports on selling climaxes. Without such an “all clear” signal, stocks will likely continue to be subject to volatility as investors wrestle with the S&P 500’s all-time high. Sentiment doesn’t support a major top as of yet, but that doesn’t rule out a good old-fashioned panic, as we’ve seen a few times in the last year.

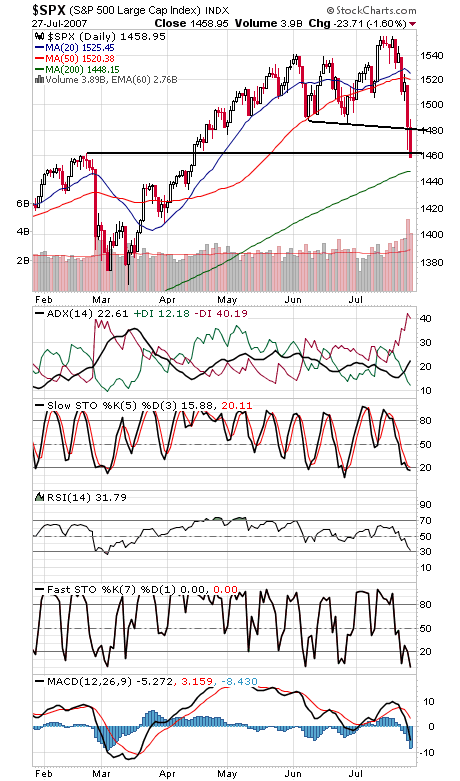

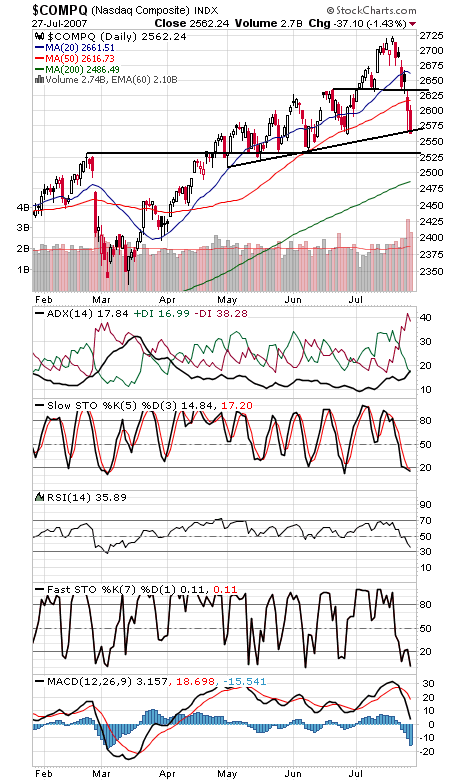

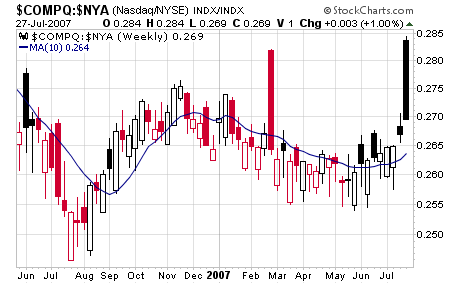

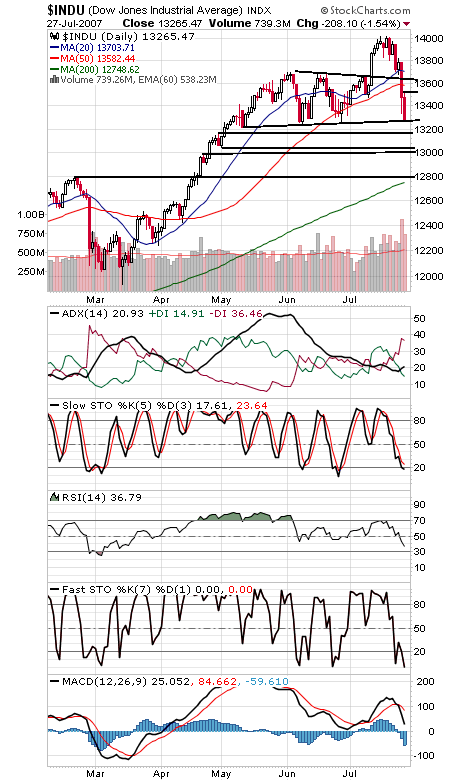

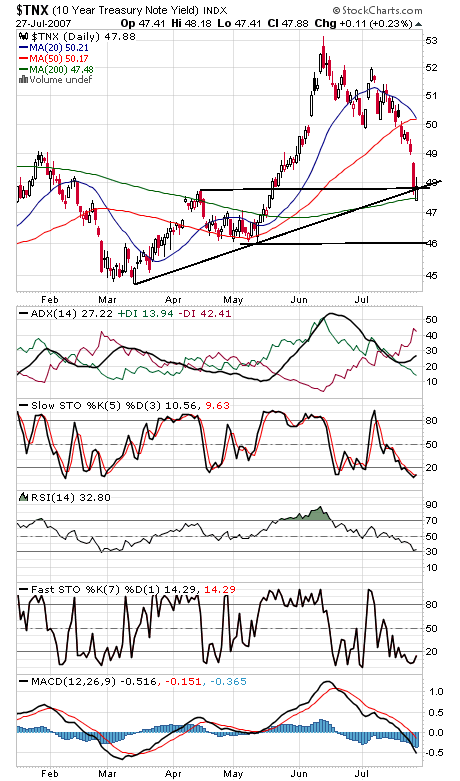

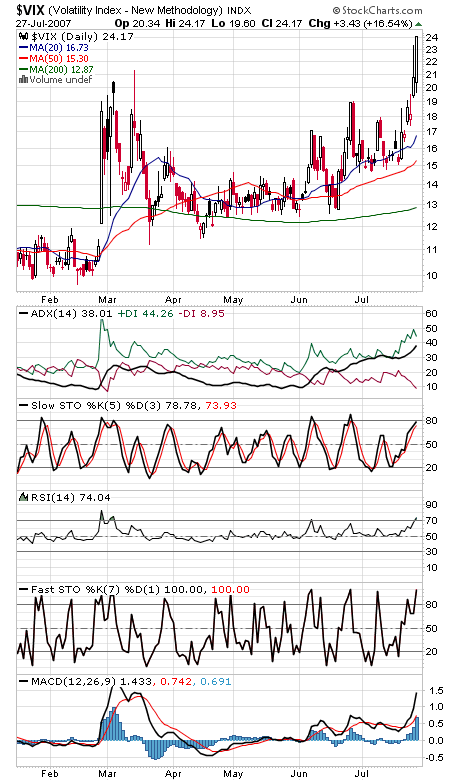

Not much in the way of good news on the technical front. The S&P (first chart below) overlapped its February peak of 1461.57, opening up the possibility of longer-term weakness. The 200-day average at 1448 is now the obvious next support level. A move above today’s high of 1488 would be a good start for the bulls, and 1480 is first resistance. The Nasdaq (second and third charts) continues to outperform the Dow and S&P, but that’s little solace in a down market. 2531 is next support, and resistance is 2609-2617 and 2632. The Dow (fourth chart) is just barely clinging to 13,250 support here. Resistance is 13,500-13,520, 13,586 and 13,640. Even the bond market (fifth chart) got hit today. Finally, the VIX (sixth chart) clearing its March top while the indexes are well above their March lows is a mild positive divergence. Now all we need is a blockbuster merger over the weekend to ease credit fears.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association