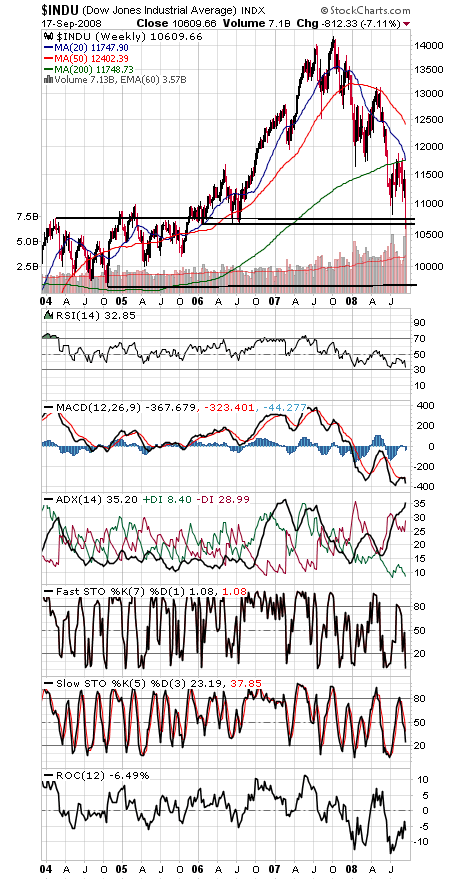

The Dow (first chart below) fell below major support today, making a quick recovery of 10,683-10,827 essential here. If not, the next major support looks like 9700, although 10,000 is obvious round number support.

The Dow’s quick recovery is important here because except for a few breaches in 1947-1949, the midterm election year low has held for four years in every election cycle since 1934. An early breach suggests an ineffective response to economic stimulus, a sign of potential economic turbulence ahead.

Today was the sixth 90% downside volume day on the NYSE since June and fourth this month, the most intense string of selling the stock market has seen since the 1974 lows and the third most intense bout of selling in the last 48 years, lagging only 1974 and 1962. But as we’ve said repeatedly, it’s not a bottom until confirmed by a 90% upside day. What the catalyst will be for that remains to be seen, but at some point credit risk will be judged to be diminished.

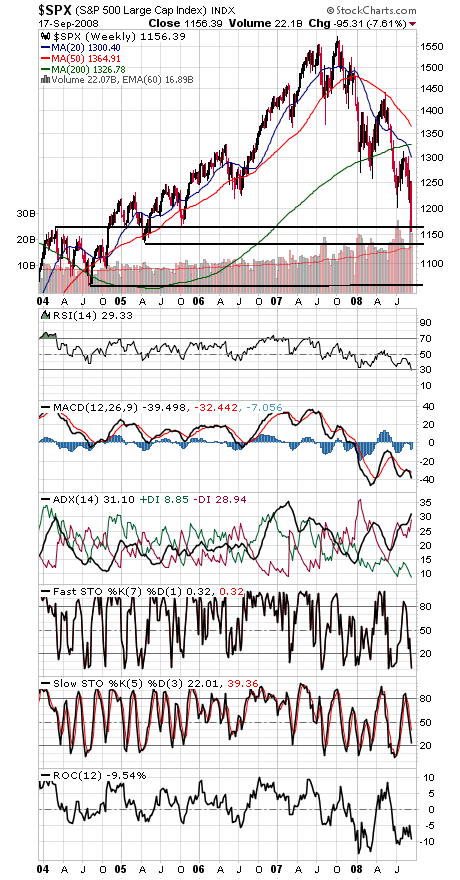

The S&P’s (second chart) next support levels are 1136, 1100 and 1060, while 1200-1219 is a very big first resistance area.

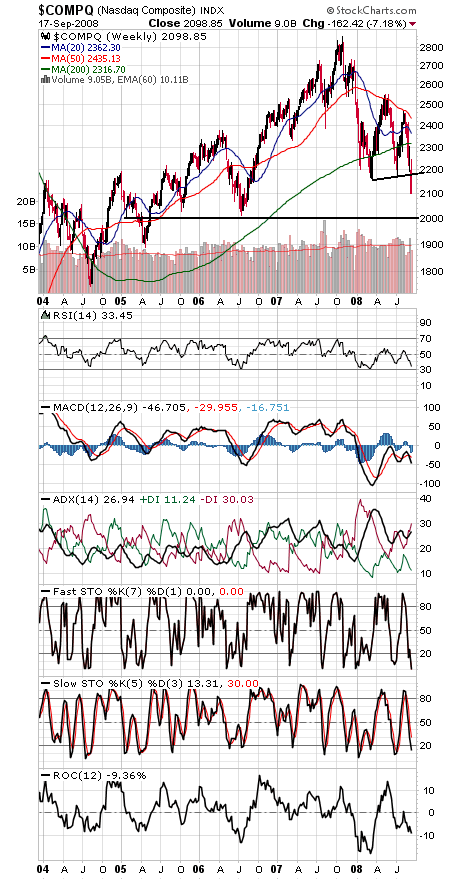

The Nasdaq’s (third chart) next obvious support is 2000, and 2155-2200 is tough first resistance.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.