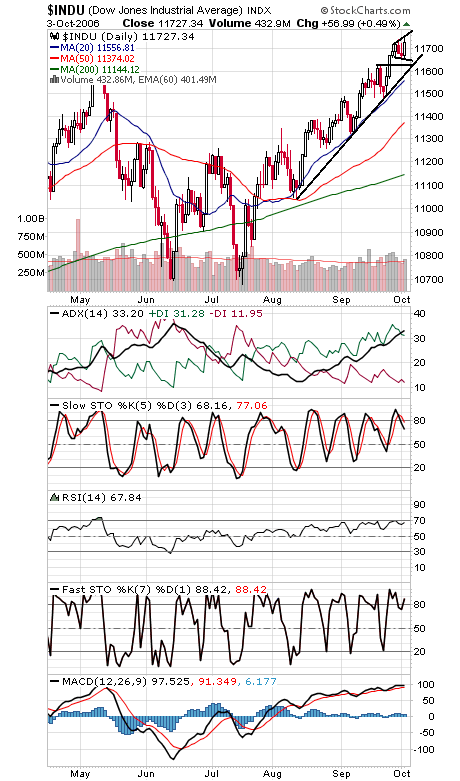

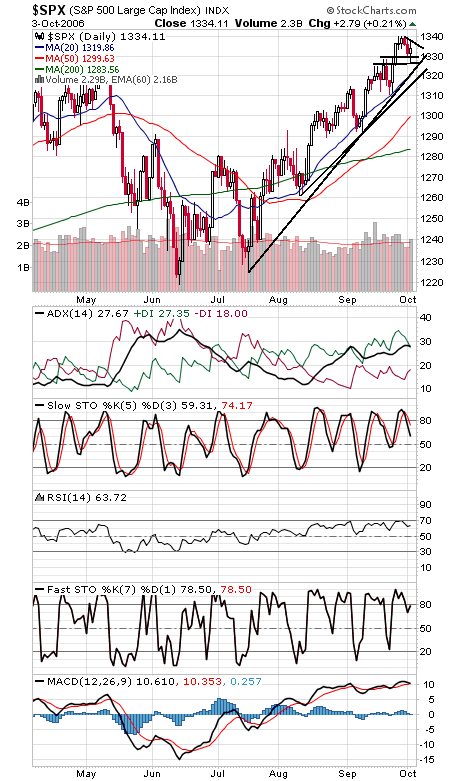

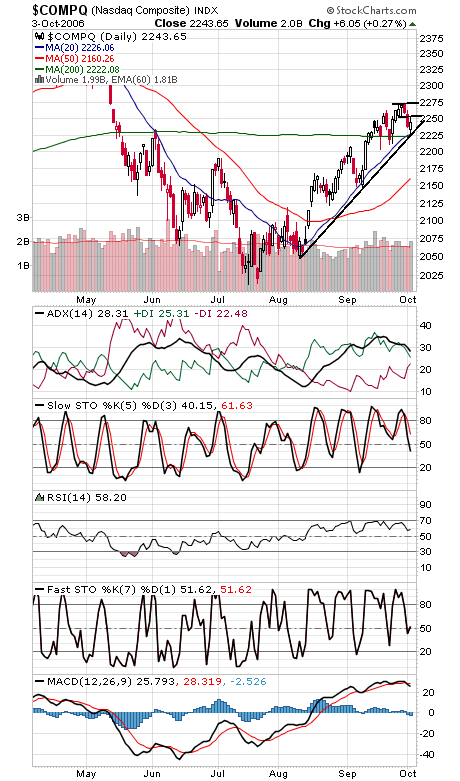

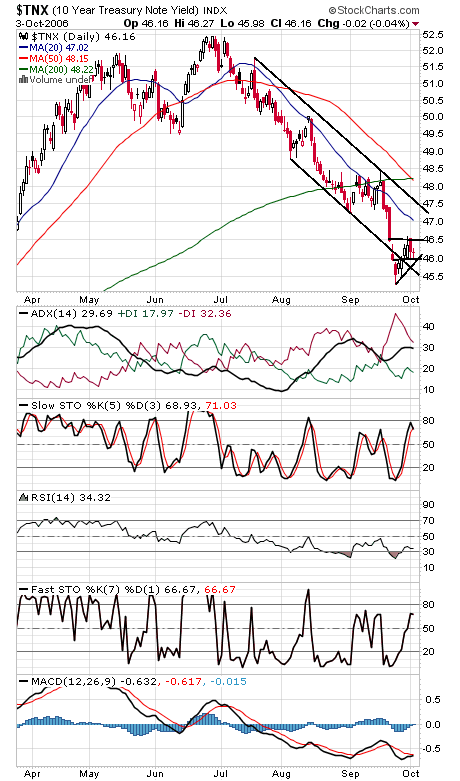

The Dow (first chart below) finally set a new all-time high today, but the index didn’t have a lot of support getting there. Even at its highs for the day, up volume and advancing issues on both the NYSE and Nasdaq barely cleared 50%, and the Russell 2000 and NYSE finished the day in the red. That’s some pretty significant erosion of internal support. Still, the one positive remains sentiment (we’ll see how Dow all-time high headlines affect that tomorrow), and selling pressure has been nowhere to be found. The benefit of the doubt remains with the bulls until support levels start to break, but this sure looks like a good spot for some profit-taking. The Dow has support at 11,650, 11,630 and 11,600, and 11,750-11,760 is resistance. The S&P (second chart) faces resistance at 1337 and 1340, and support is 1330 and 1327. The Nasdaq (third chart) hung onto its uptrend and 200-day average today, but just barely. Support is 2228 and 2222, and resistance is 2252, 2258, 2263 and 2273. Bond traders were indecisive today, but as long as 10-year yields (fourth chart) hold 4.6%, another leg up looks possible.