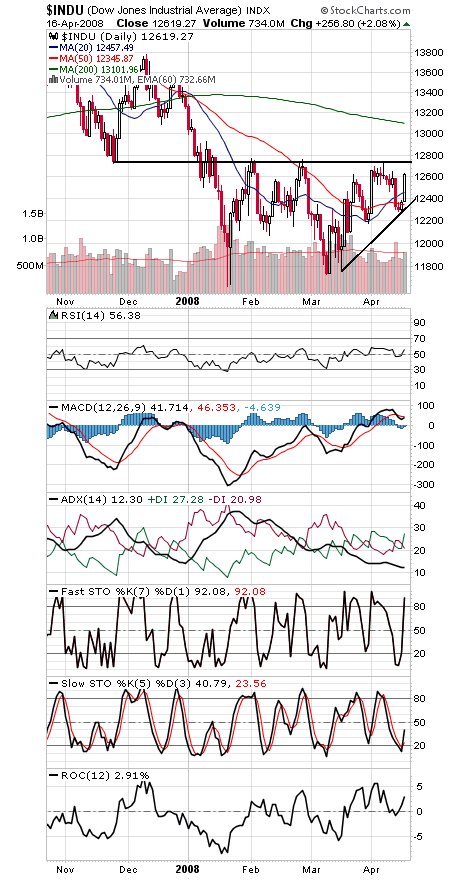

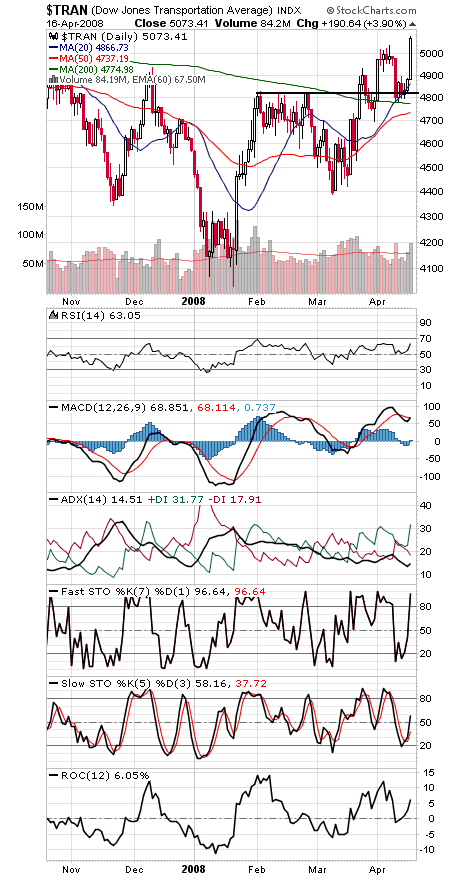

The Dow (first chart below) looks like it may be ready for another assault on 12,743.2. A close at that level or higher would confirm the Transports’ (second chart) higher high and generate a Dow Theory bull signal, reversing November’s bear signal and signaling that the worst of the credit crunch may be over.

On the plus side, the major indexes have all put in a series of higher highs and higher lows since the March bottom, the definition of an uptrend, if tenuous and choppy. But we’re still waiting for the Dow to give us a confirmed bottom, and Merrill Lynch and Citigroup earnings the next two days will be critical. Support on the Dow is 12,350-12,400.

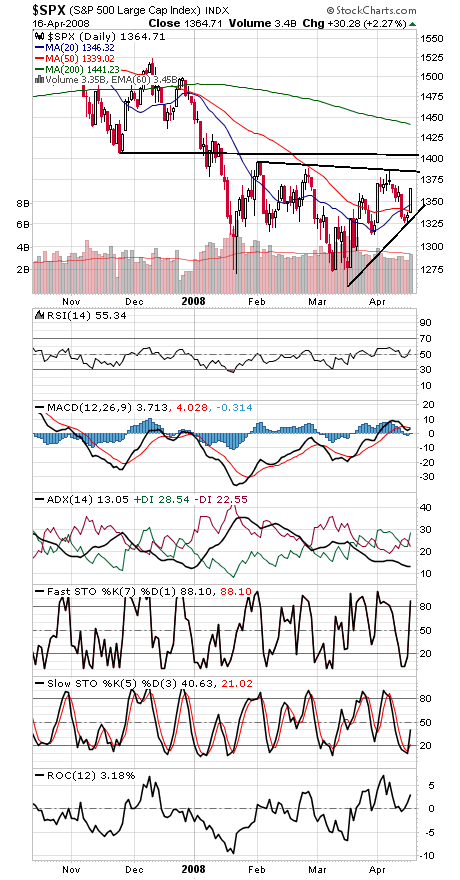

The S&P (third chart) needs to clear 1385-1406, and support is 1340.

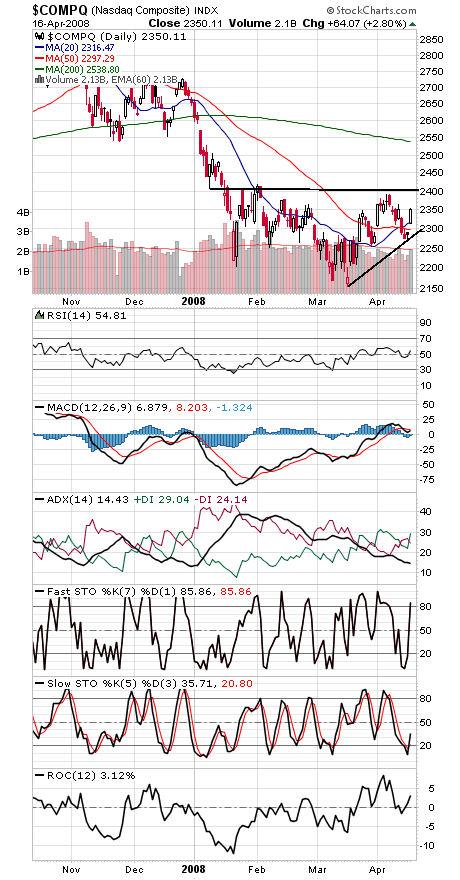

The Nasdaq (fourth chart) faces resistance at 2391-2419, and 2313 is first support.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.