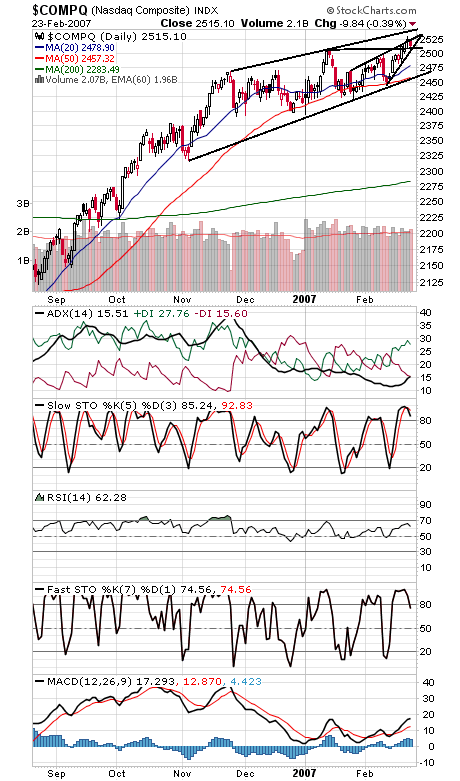

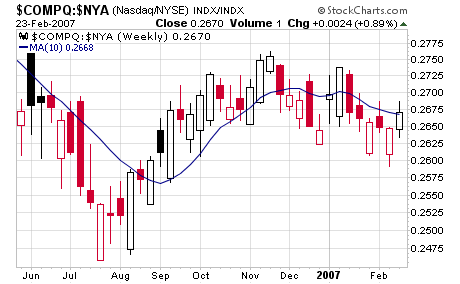

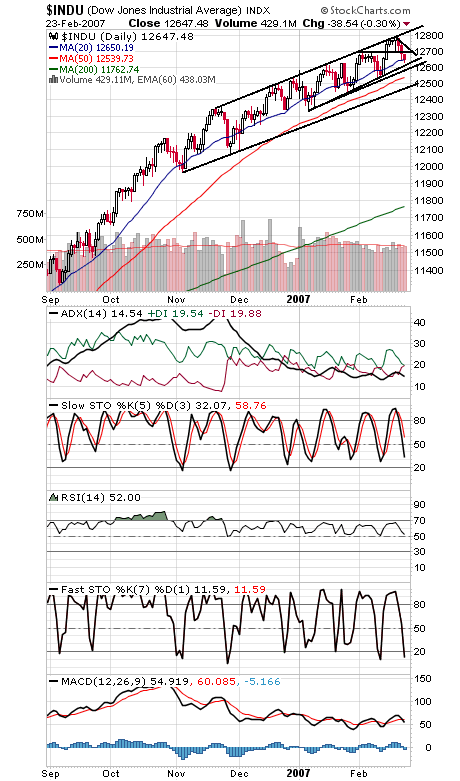

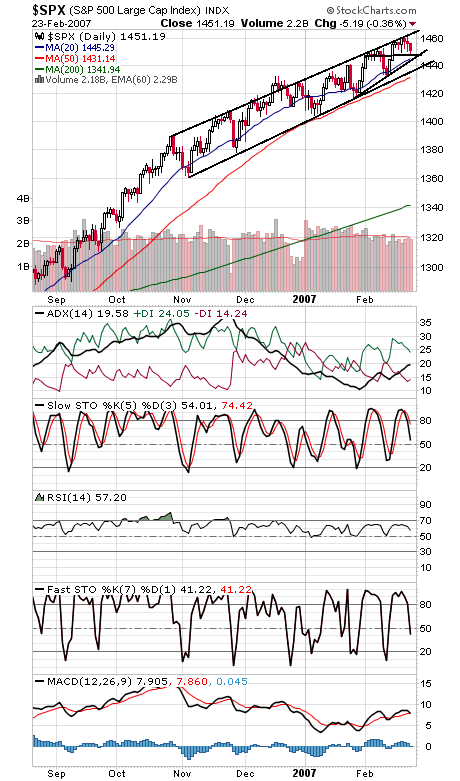

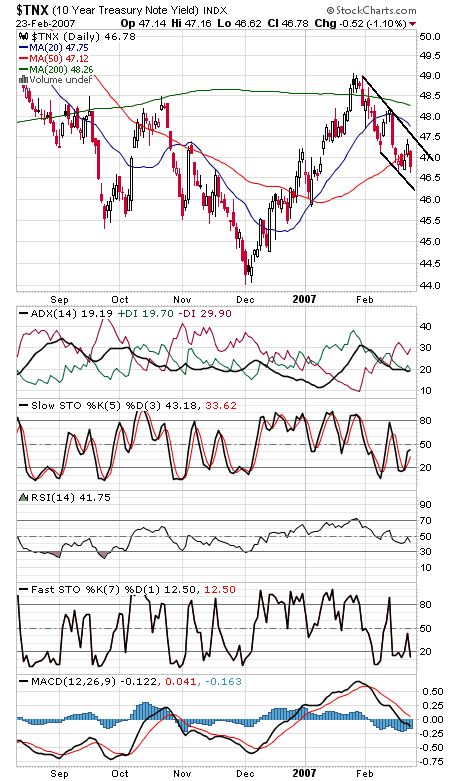

The Nasdaq (first chart below) outperformed the NYSE just enough this week to register a buy signal under Gerald Appel’s 10-week Nasdaq/NYSE relative strength indicator (second chart). Combined with a big jump in put-call ratios and end-of-the-month buying just around the corner, stocks could be in for a good week or two. First they need to turn back up, though. The Nasdaq has put in something of a topping pattern the last few days. 2500-2509 is important first support, and resistance is 2525-2531 and 2550. The Dow (third chart) has important support at 12,600-12,625, and first resistance is 12,700-12,725. The S&P (fourth chart) is creeping below 1450 support. 1445 is next, and 1436 is critical. 1465 is resistance to the upside. Bond yields (fifth chart) had another wild day today. The 10-year remains in a downtrend as long as it stays below 4.74%.