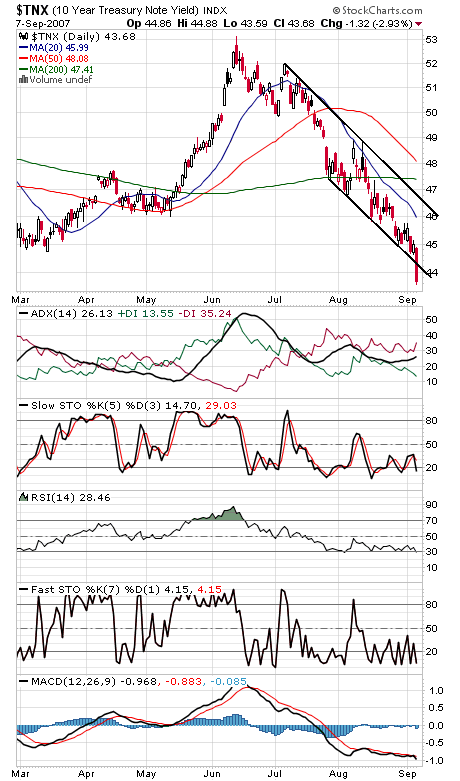

The Federal Reserve has little choice but to cut interest rates after today’s jobs report or it will risk not only a revolt by financial markets, but a full-blown credit crunch and recession. Odds are now for a 25 basis point rate cut on Sept. 18, but 50 seems like a better choice given the rapid deterioration in the jobs market. The bond market (first chart below) has been pricing in three rate cuts since the crisis began and started working on a fourth today. One negative we’d note is that commercial futures traders pared long positions ahead of the decline; it would remove an important bullish underpinning if that becomes a trend.

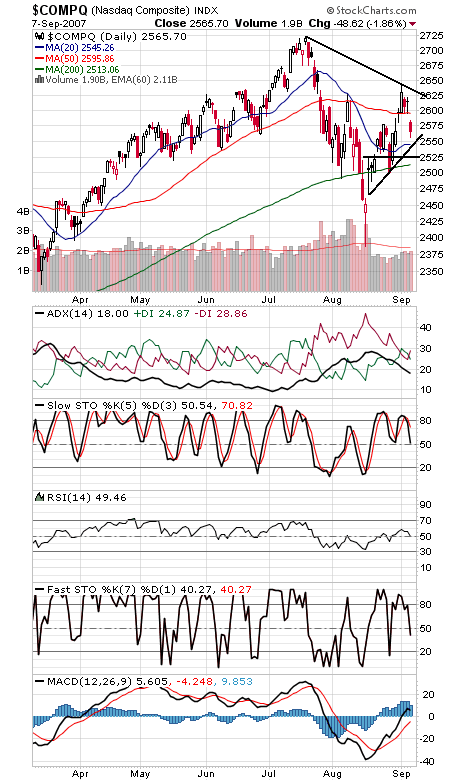

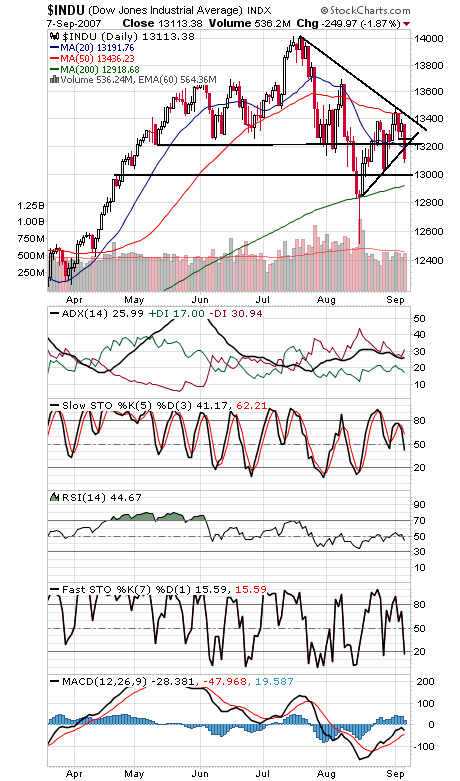

The Nasdaq (second chart) has support at 2550, 2525 and 2513, and resistance is 2576, 2581 and 2596-2600. The S&P (third chart) has support at 1450, 1440 and 1433, and resistance is 1460, 1467, and 1482-1488. The Dow (fourth chart) has support at 13,000 and 12,925, and resistance is 13,200-13,250.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association