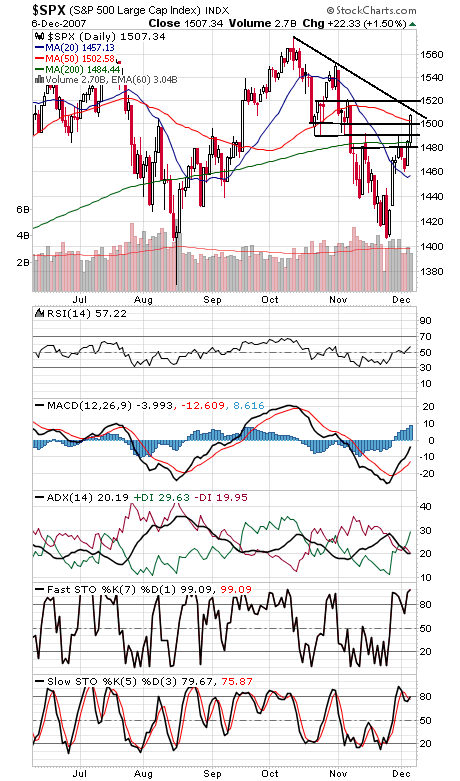

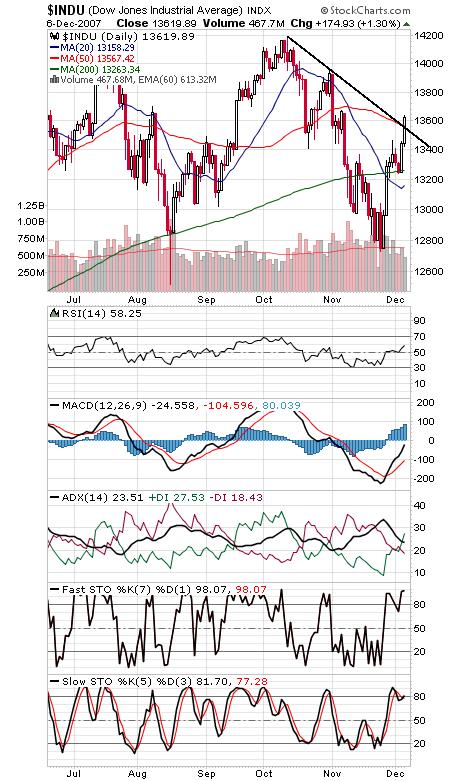

Stocks are building nicely on last week’s apparent bottom, with blue chip stocks looking particularly strong (see S&P and Dow charts below).

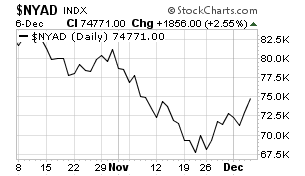

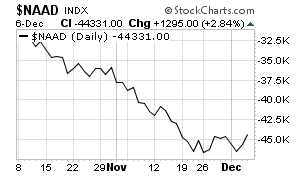

That said, breadth hasn’t been all that strong on this move, with the NYSE advance-decline line lagging and the Nasdaq A-D line doing even worse (charts three and four below). Unless the rally broadens, this could turn out to be a selective rally and make the market vulnerable to another large decline. It also raises the possibility of more backing and filling before a sustained advance can occur.

The S&P cleared important resistance between 1493 and 1502 today, but its main downtrend line lies dead ahead at about 1511. To the downside, 1493-1502 and 1480 are support. The Dow cleared its main downtrend line today, making 13,540-13,565 an important first support level.

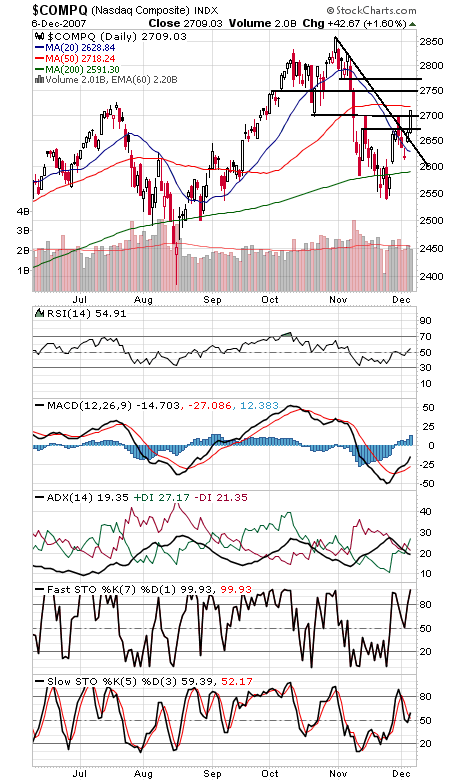

The Nasdaq (fifth chart) also cleared a level that had given it some trouble — 2700 — but its 50-day average lies just ahead at 2718, with 2750 and 2770 above that. Support is 2700 and 2672.

In short, it remains the toughest market environment in years, but the bulls have the advantage to build on their recent gains.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.