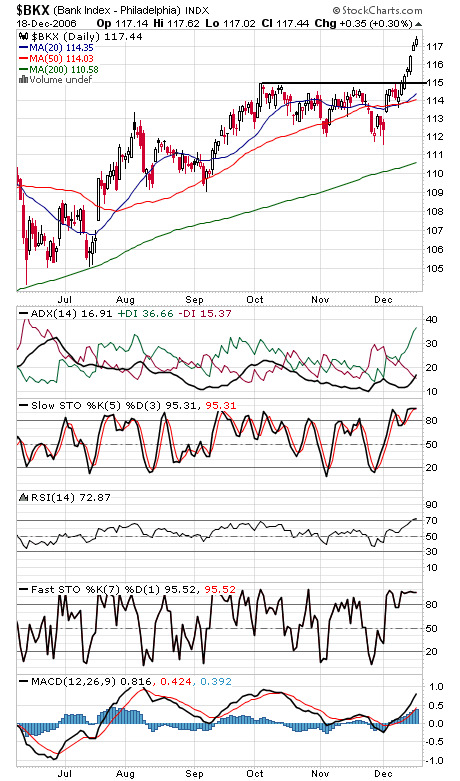

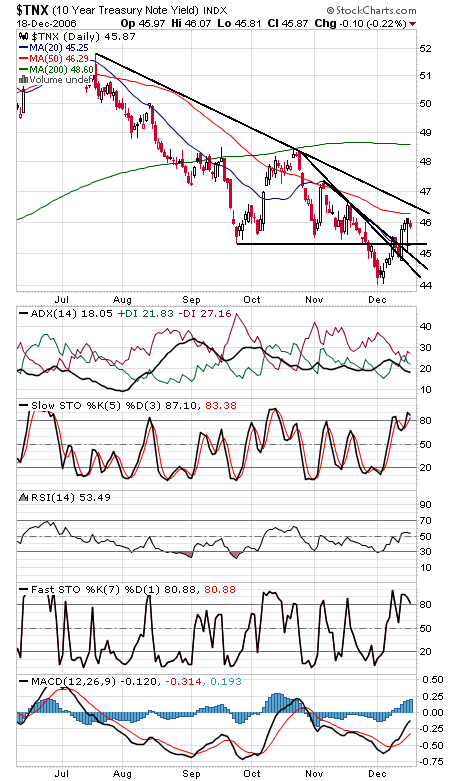

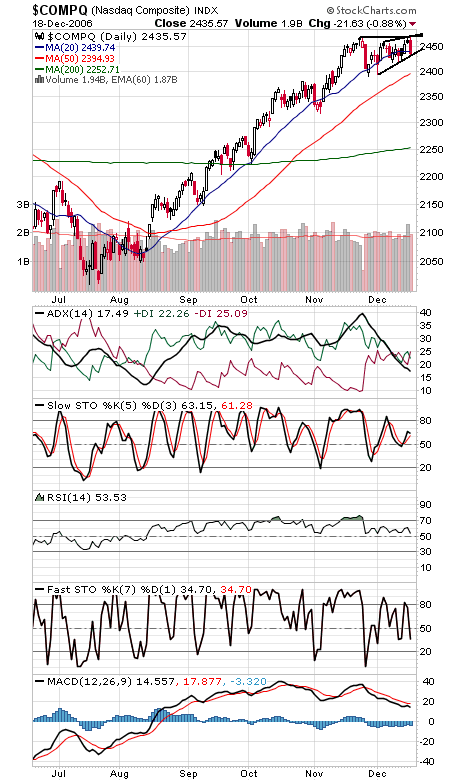

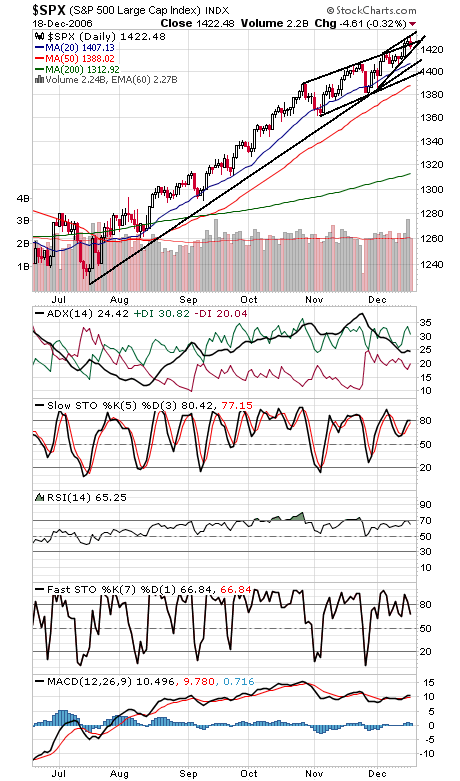

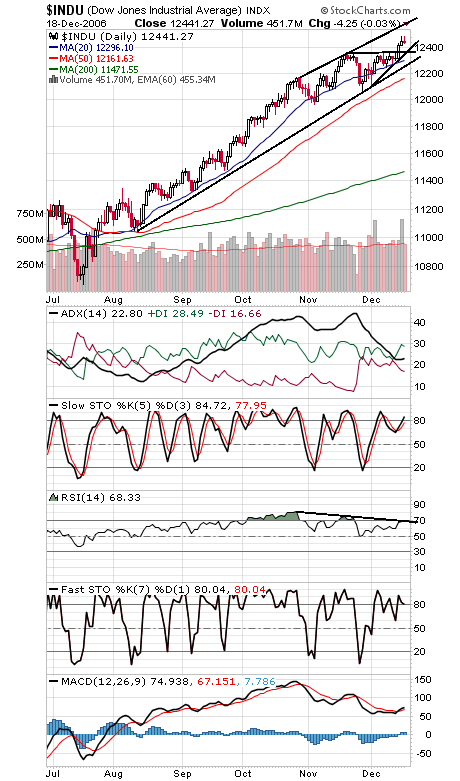

Traders have turned cautious in the last couple of days as the market becomes more selective. Time will tell if the sudden pattern of selling rallies is anything more than a short-term correction, but the good news is we are about to enter one of the most positive stretches of the year for stocks. The one positive here is the bank stocks (first chart below), which remain in full breakout mode despite pressure in the bond market (second chart). The Nasdaq (third chart) remains a problem, but at least the index could be forming a bullish ascending triangle here, just in time for the year-end rally. Resistance is 2471, and support is 2435, where the index closed today. The S&P (fourth chart) is threatening to give back Thursday’s breakout. Support is 1420 and 1417, and resistance is 1424 and 1432. The Dow (fifth chart) has important support at 12,360.