Note: The Technical Analysis column will return on Monday.

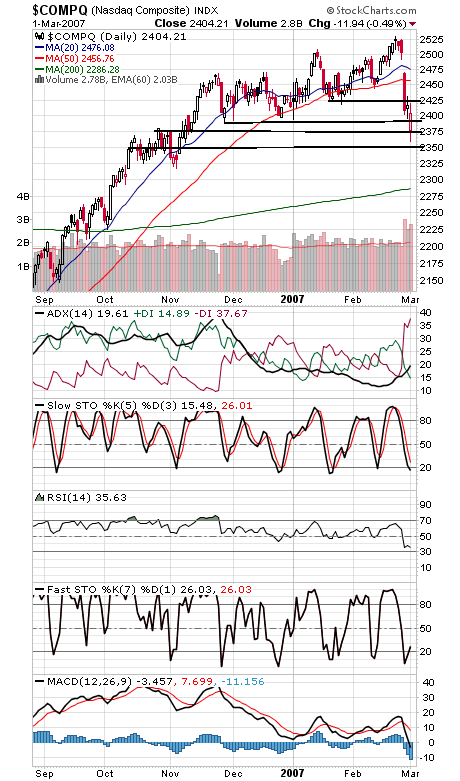

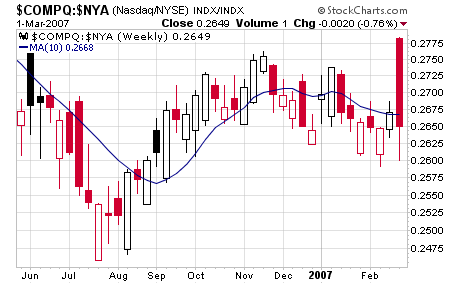

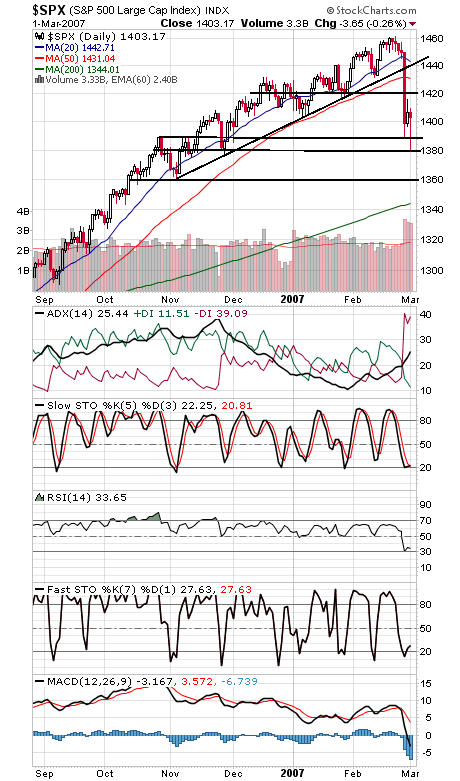

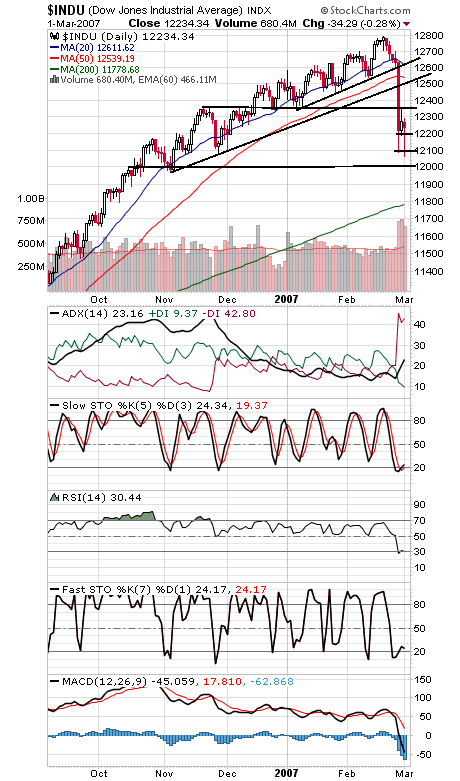

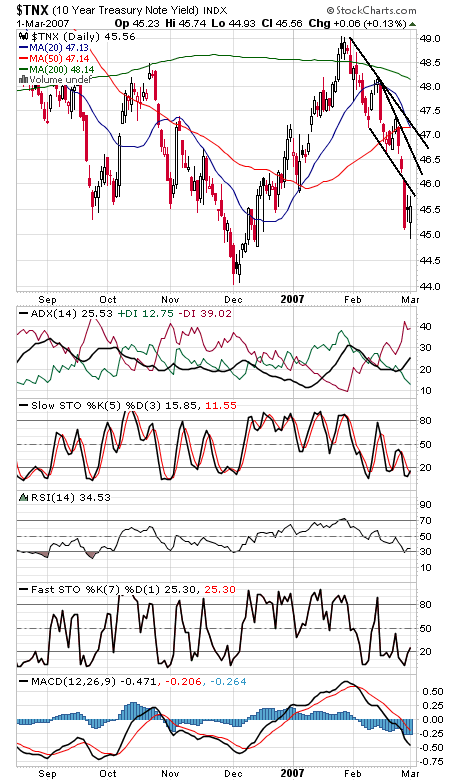

The Nasdaq (first two charts below) seems likely to give a sell signal tomorrow, for a nasty one-week loss of 4% or so, although monthly inflows could support the market into the middle of next week. About the only way to avoid the carnage was to sell on the intraday break of the S&P’s rising channel at about 1438 on Tuesday (third chart); if you waited for closing prices, it was too late to sell. Looking ahead, we’re not so sure the selling’s done yet; a bounce followed by a low-volume retest of the lows (or lower lows) is still a possibility, if not likely. The Nasdaq blew through a whole lot of support today before recovering. Support is 2390-2395, 2375 and 2350-2359. Resistance is 2419 and 2431. The S&P faces resistance at 1416-1420, and support is 1397-1400, 1390, 1380 and 1360. The Dow (fourth chart) is looking pretty oversold. Support is 12,200 and 12,059-12,100, with 12,000 below that, and resistance is 12,350 and 12,500. Bonds (fifth chart) continue to pause, which is about the story of the market here: plenty of pauses, but no reversals yet.