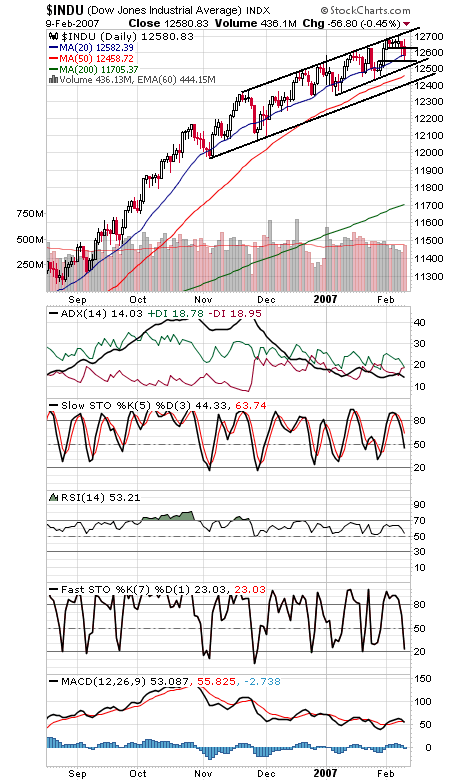

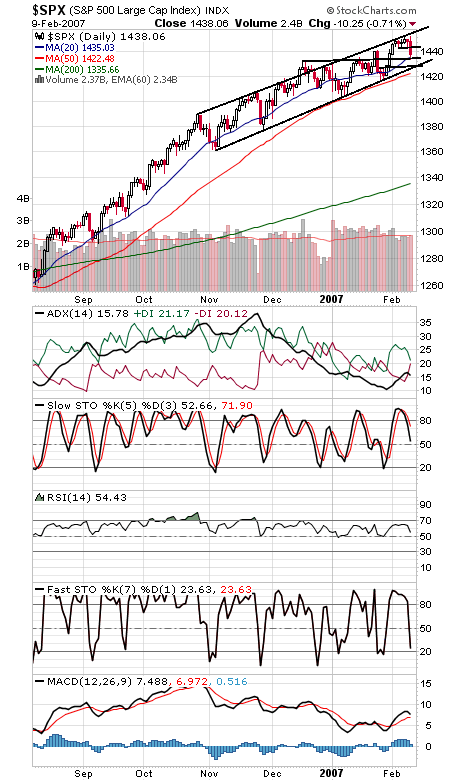

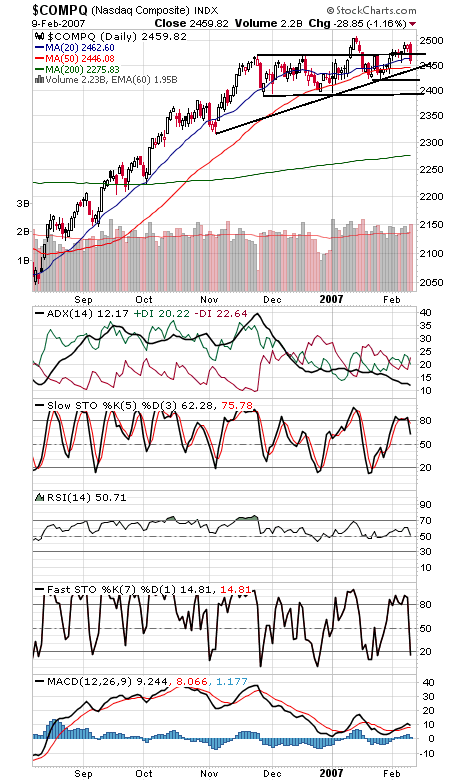

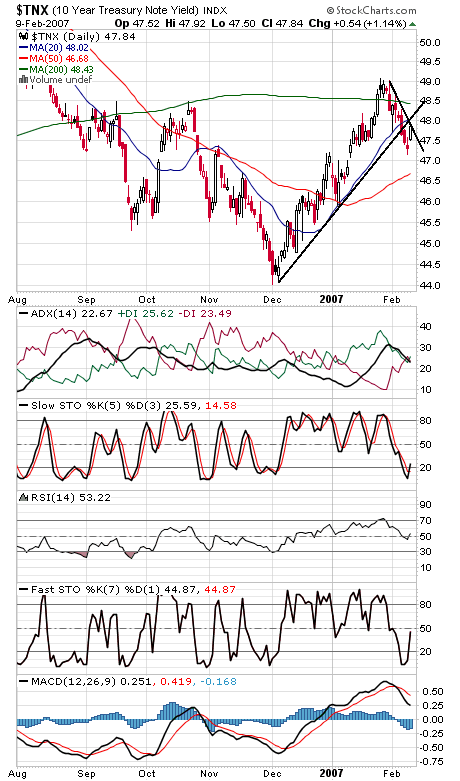

Today’s pullback is very much in keeping with market’s pattern of the last few months: a bump up against the upper channel lines on the Dow and S&P (first two charts below) followed by a pullback. This pullback may last a few more days, but unless those rising channels break to the downside, we’ll continue to give the benefit of the doubt to the bulls. The Dow stopped today just above 12,543 support, the start of the most recent move to new highs. Below that, 12,510 is a significant level. To the upside, 12,614-12,630 is first resistance. The S&P pushed a little below 1435 support before recovering; we’ll leave first support at 1433-1435, and 1427 is critical. To the upside, first resistance is 1443-1444. The Nasdaq (third chart) just can’t seem to leave 2471 behind for good, which makes it first resistance again. 2440-2450 looks like a good first support zone. 10-year yields (fourth chart) are trying to put in a bottom here, but it will take some more Fed jawboning to get them past some tough resistance between here and 4.85%.