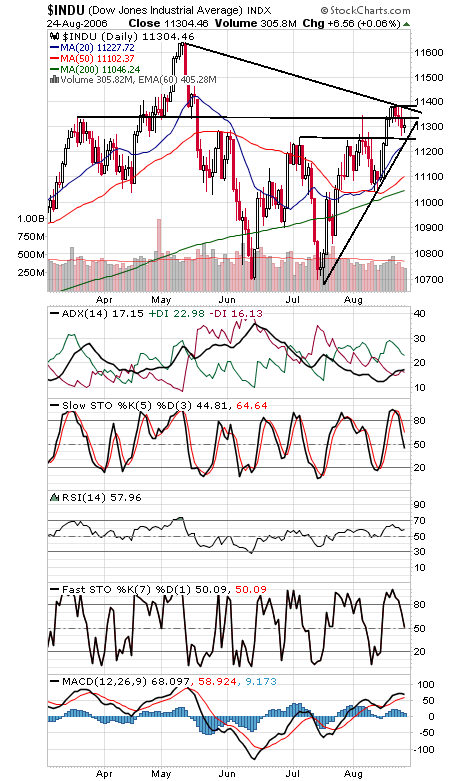

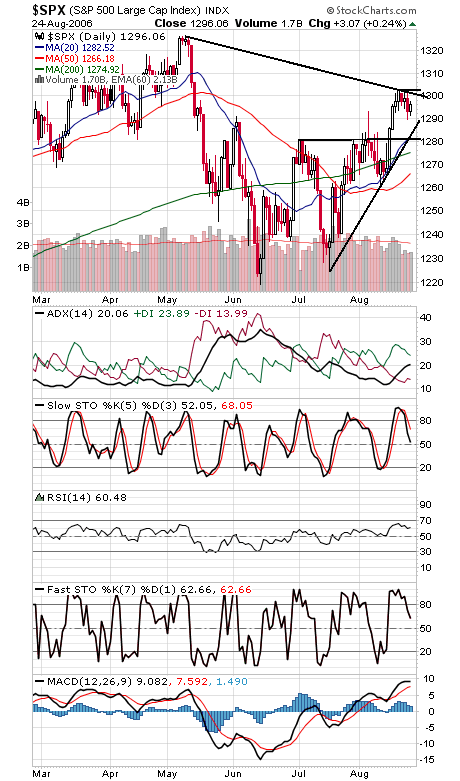

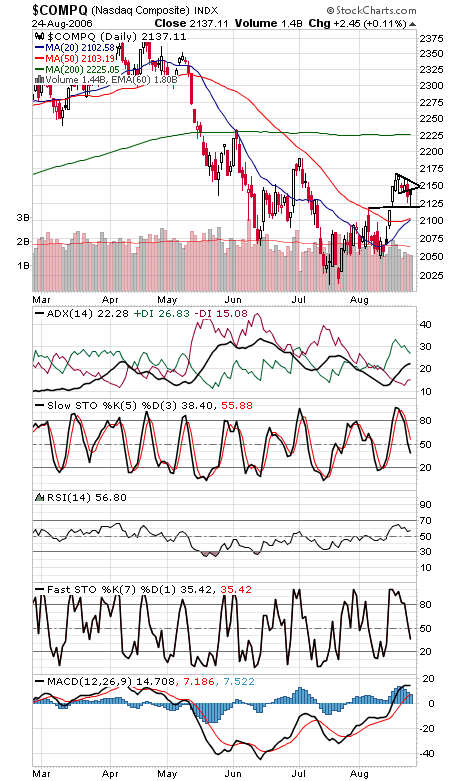

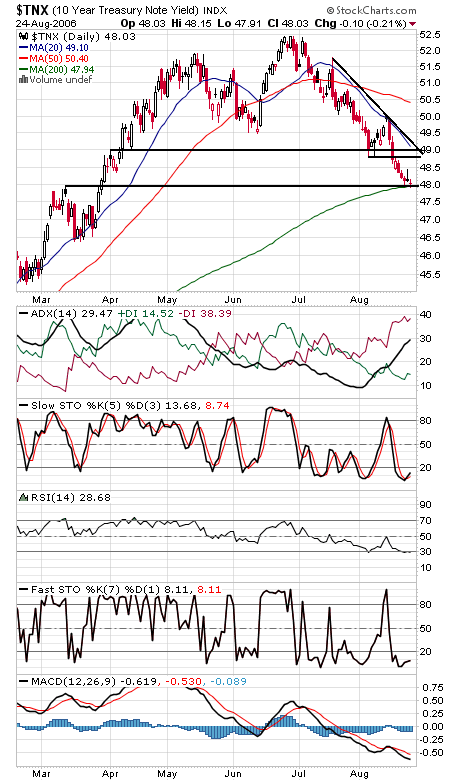

Friday’s tone will likely be set by Fed Chairman Ben Bernanke, who is set to deliver a major speech on the U.S. economy. Given his recent market-friendly speeches, we’d be surprised if he made an about-face tomorrow, but other Fed officials have turned hawkish in recent days. Heading into the speech, the major indexes are in a short-term downtrend within a six-week uptrend. The Dow and S&P (first two charts below) are the best examples of the market’s current position; both cleared their early July highs last week and are now trying to hang on. That makes 11,250 and 1281 important support here. 1289 and 1285 are first support levels on the S&P, and 1300-1302.5 is resistance. For the Dow, 11,340-11,350 and 11,384 are the levels to beat to the upside. The Nasdaq (third chart) is so far holding important gap support at 2115-2125 (2120), while a move back through 2145-2155 could point the index back up. Bond yields (fourth chart) tend to lead more than follow the Fed, and they’ve been suggesting a slowdown for the last couple of months. Still, with yields at major support here, a pullback wouldn’t be surprising.