Much depends on Fed Chairman Ben Bernanke striking just the right tone Friday morning, but at least the market will have monthly inflows and a pre-holiday positive bias on its side, plus a whole lot of panic selling in the last month that suggests sellers may be running out of steam. With the market entering its weakest month historically, we can but hope.

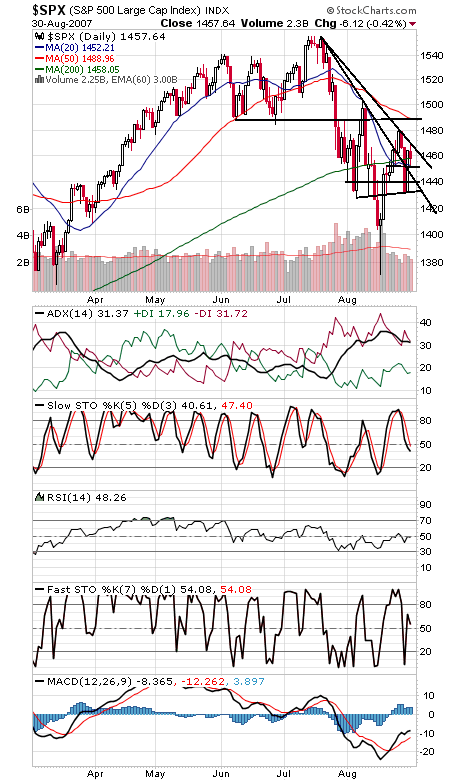

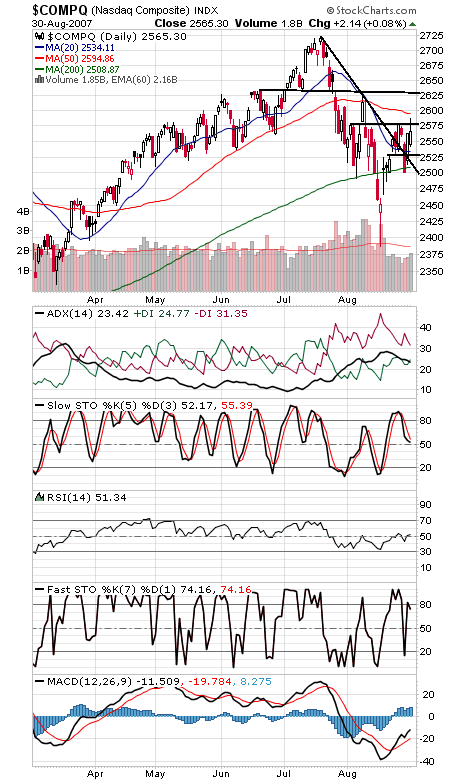

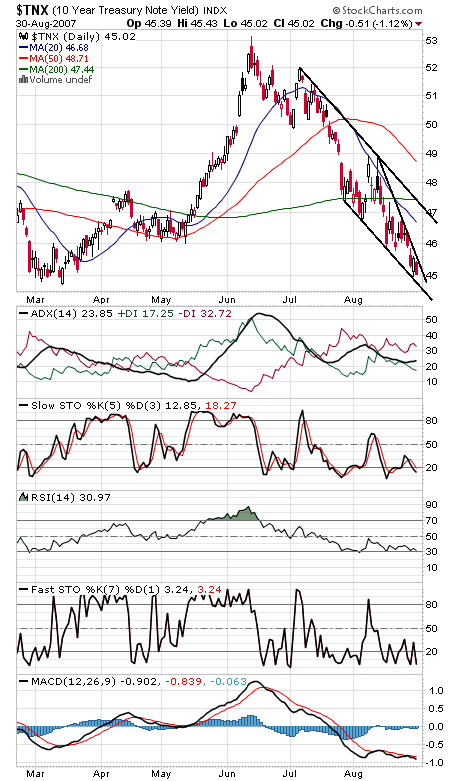

The S&P (first chart below) got stopped at its downtrend line today, making 1467 an important first level for tomorrow, with 1480 and 1488 above that. 1450, 1440 and 1433 are support. 2576 and 2595-2600 are first resistance levels for the Nasdaq (second chart), and support is 2555, 2542 and 2531. The Dow (third chart) faces important resistance — perhaps the biggest test for the market here — at 13,280, with 13,400 and 13,445 above that. 13,184-13,200 is support. Bond bulls (fourth chart) remain in control.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association