|

| Source: Reuters |

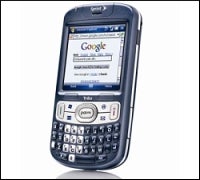

With this week’s debut of its latest Treo smartphone, Palm (NASDAQ: PALM) is clearly not sitting idle while Research In Motion (NASDAQ: RIMM) and Apple (NASDAQ: AAPL) continue to dominate the handset industry. The question is whether the No. 3 player can deliver necessary device innovations in time to avoid being left in the dust.

Despite less than stellar earnings reported in late June, Palm is on a steady track these days in terms of smartphone sales. It sold 968,000 units in the fourth quarter of fiscal year 2008, representing a 29 percent increase year over year.

For revenue, the outlook isn’t as shiny, however, as it reported a loss of $43.4 million for its fiscal fourth quarter.

The Treo 800w could change the revenue tide for the Sunnyvale, Calif.-based vendor, which held 13.16 percent marketshare as of the first quarter of 2008.

The primary reason? Palm has put some sleek and snazzy features in place as well as professional functionality by replacing its proprietary OS with Windows Mobile 6.1.

Yet it isn’t quite enough to slow iPhone mania or put any sort of dent in RIM’s BlackBerry spiraling growth, said IDC senior research analyst Ryan Reith. At least not yet.

According to Reith, until this new Treo, Palm’s phones have been boxy in design.

“People don’t want brick phones like Palm’s devices,” he told InternetNews.com.”Sex appeal sells,” Reith adds, noting slick user features such as the iPhone’s touch pad and the ‘curving’ of the once conservative-looking BlackBerry.

What Palm needs to do, and do fast, is come through on a long in-development Linux system, which will spur better mobile applications and lower device costs. At the same time Palm has to continue to focus on form-factor innovation, Reith said.

“Right now they’re not in competition with RIM and Apple, but down the road that could change,” he explained. “They just have to stop talking about what they’re doing and bring it to market.”

Heading to market is exactly what RIM and Apple have done consistently in the past year.

A little over a year after its initial iPhone launch, Apple now holds 18.91 percent market share as of the first quarter of 2008, according to IDC. Industry leader RIM has 43.76 percent for the same time frame.

Those numbers will definitely change by the end of the second quarter, Reith said, as Apple delivered its second iPhone and RIM has debuted several new devices including the Pearl and the Curve product lines.

RIM also rolled out its latest handset called the Bold, and the BlackBerry Thunder is due out by the fall. The Thunder is reportedly RIM’s touch-screen answer to the iPhone.

RIM’s momentum is reflected in its recent earnings report. Revenue of $2.24 billion for the first quarter of the fiscal year was up 107 percent compared with the same quarter last year. It shipped approximately 5.4 million units and will mark its 40 millionth BlackBerry sale sometime this summer.

Most telling, however, is RIM’s advances in the consumer segment. The company added 2.3 million new subscribers in the first quarter, bringing the total subscription list to more than 16 million as of the end of May; 40 percent are consumer users — a 29 percent spike over last year’s first-quarter subscribers.

Next page: Focus on market strategy

Page 2 of 2

Focus on market strategy

Both RIM and Apple have been busy adjusting user market strategies as this year.

Apple first aimed for the consumer base, but its second iPhone clearly is much more enterprise friendly. The iPhone provides Microsoft Exchange server support and a remote “kill” feature for wiping an iPhone clean once if reported lost or stolen. Morgan Stanley (NYSE: MS) has stated it expects iPhone unit sales to double in 2009. A million new iPhones shipped in the first weekend of its launch.

RIM, which holds 73 percent of corporate smartphone purchases, is charging after consumers with a newly announced marketing strategy called “BlackBerry for Life.” The program promotes the BlackBerry’s multi-media capabilities — a big departure from its mainstay workplace applications that make it so popular with businesses.

Such strident moves, Reith said, will get both vendors greater marketshare. How much of that growth will be drawn from Palm’s holdings is yet to be seen.

If Palm can move swiftly with getting its Linux system in place within the next year it will remain competitive, given emerging vertical smartphone markets within the health care, educational and agricultural segments. Such markets, Reith explained, will want specific applications for their respective work environments. A Palm Linux system could spur such applications. It would eliminate current licensing fees Palm pays for the Windows OS and lower device cost.

“They have some work to do, but the Linux system could be its salvation,” said Reith.